The Economist reports that the World Health Organization has raised the threat level for swine flu to "pandemic." The country with the most recorded cases--the United States.

2. JAPAN CUTS TARGET CONSUMPTION OF BIOFUELS

Takeo Kumagai at Platts reports that Japan has cut its target consumption of biofuels to 600k kl/year by 2020 from its previous goal of 2 million kl/y. 600 kl/year is about 3.77 mb/y or 10.3 kb/d--significant, but neither target was truly game-changing.

3. CHINA WILL NOT SET BINDING TARGETS ON EMISSIONS CUTS, AUTO SALES IN MAY UP 34% YOY

AFP reports that following talks with US climate envoy Todd Stern, Chinese foreign ministry spokesman Qin Gang told reporters that Beijing was unable to commit to a binding greenhouse emissions cuts target:

"China is still a developing country and the present task confronting China is to develop its economy and alleviate poverty, as well as raise the living standard of its people.Meanwhile, Patricia Jiayi Ho at the Wall Street Journal reports that the Chinese stimulus program has boosted auto sales in that country by 34% year over year.

Given that, it is natural for China to have some increase in its emissions, so it is not possible for China in that context to accept a binding or compulsory target."

"Auto sales last month totaled 1.12 million units, the China Association of Automobile Manufacturers said. In contrast, U.S. car sales fell 34% in May to 925,824 units."Of course, autos produce copious amounts of greenhouse gases.

4. CHINESE EXPORTS DOWN 26.4% IN MAY YOY, EXPORTS DOWN 25.2%; CONTINUES TO BUILD CAPACITY W/O CLEAR MARKET TO SELL PRODUCT TO; INTRODUCES REBATE ON STEEL LIKELY TO FUEL TRADE WARS

Andrew Batson at the Wall Street Journal reports that Chinese exports fell by 26.4% from the year previous. Despite a binge in commodities purchase, the total dollar value of Chinese imports fell by 25.2% from a year earlier.

"Other data issued Thursday showed stimulus money continuing to flow into the economy. Fixed-asset investment, China's main measure of capital spending, rose 38.7% in May from a year earlier and is up 32.9% so far in 2009. That is the fastest growth since the investment boom of 2004--but activity still remains concentrated in the areas benefiting from the government measures."Brad Setser at Follow the Money helpfully produces a graph of the year over year change in Chinese imports and exports in three month moving averages:

He comments (and as always, it is worth reading his entire post):

"The sharp fall is over. But there isn’t yet much sign of recovery. Not in Chinese demand for the world’s products. Or in Chinese exports to the world.Macroman follows up his especially interesting post yesterday by noting that Chinese PMI accurately foretold the collapse in exports, but the recovery in the PMI has yet to show up on the export side:

To me, though, the biggest puzzle is on the import side. A strong, growing economy driven by a surge in fixed investment would normally be expected to generate strong demand for the rest of the world’s goods, especially if China is growing far faster than the rest of the world."

He comments:

"While it's true that the PMI data may now be capturing more of the internally-driven investment dynamic within China, it's worth pointing out that the latest survey had export orders rising.Well worth reading in full. For more on US demand, see #11. In the meantime, Yves Smith notes the report from MetalMiner which notes that "China has just offered a new 9% VAT rebate for flat-rolled steel products and hot rolled ferro-alloy products starting June 1" and that that is sure to "fuel the trade wars."

This, of course, begs the question of who the Chinese plan on selling to. It's all well and good continuing to build factories and export capacity, but the real world isn't like Field of Dreams; just because you build it doesn't mean that customers will come. Yesterday's US trade figures were telling in that regard. Imports declined again in April; while an inveterate "second derivative" believer may find reasons for optimism in the slight lessening of the pace of import decline in yesterday's data, Macro Man is rather more skeptical. And the fact that US exports declined as well suggests that domestic demand in the rest of the world remains flaccid at best."

"The new rebate for steel ... will have the effect of two things. First, it will promote exports of steel products (vs. production for domestic consumption) as the 9% can only be claimed if goods are exported. It will further stimulate aggressive anti-dumping action on part of the US domestic steel industry (we have another anti-dumping case to report shortly)."5. ECB REPORTS THAT HOUSE PRICES ROSE SLIGHTLY IN EUROZONE 2H 2008; WILL LEND RIKSBANK €3BN TO AVERT CRISIS IN SWEDISH FINANCIAL SECTOR

Joellen Perry at Real Time Economics reports that according to the European Central Bank's [ECB] latest monthly bulletin, house prices rose in Austria and Portugal, but fell across the eurozone generally:

"Overall, euro-zone house prices still eked out a gain in the second half of last year, rising 0.6% compared to the same time period the year before. But that’s well down from a peak of 7.7% in the first half of 2005. And the ECB says it’s likely to get worse before it gets better."Meanwhile, Ralph Atkins, Joshua Chaffin, and Robert Anderson at the Financial Times yesterday reported that the ECB will lend the Riksbank (Swedish Central Bank) €3 billion (~ $4.2 billion) to boost the Swedish central bank’s foreign reserves as a measure to avert a collapse of the Swedish financial sector, which dominates the Baltic's financial sector.

"The ECB move signaled the Frankfurt institution’s willingness to shore up official European help for countries such as Latvia, which is fighting to avoid a potentially disastrous devaluation of its currency."Last Wednesday the Riksbank released it biannual financial stability report which estimated that Swedish banks faced 170 billion krona (~$22.8 billion) in losses, 40% of which would come from exposure to Eastern Europe. The report also argued that the banks were sufficiently capitalized to handle the crisis--see Daily Sources 6/3 #5.

6. BRAZIL CUTS BENCHMARK INTEREST RATE BY 1% TO 9.25%

Andre Soliani and Heloiza Canassa at Bloomberg report that the Brazilian central bank last night cut the benchmark interest rate by 1% to 9.25%. The cut was more than analyst expectations for a 0.75% cut.

"'The committee agreed that any additional monetary easing must be implemented in a more parsimonious way,' policy makers said in a statement accompanying their decision. The monetary policy committee 'will closely follow the evolution of the prospective scenario for inflation until its next meeting to then decide the next steps of the monetary policy strategy.'7. KHURAIS OIL FIELD PROJECT STARTS PRODUCTION

Brazil’s annual inflation slowed to 5.2% in May, the lowest rate in 12 months. Nobrega forecasts consumer-price increases will slow to 3.8% by year-end.

'The central bank may slow down the pace of cuts at the next meeting,' said Cristiano Souza, an economist at Grupo Santander Brasil. 'But the rate cuts haven’t come to an end yet.'"

Reuters published a factbox on the Khurais oilfield project, a Saudi field with Arab Light grade crude which has just begun production with a capacity of 1.2 mb/d--or about 1.5% of daily global demand.

8. NO MECHANISM YET FOR OIL FIELD OPERATORS IN IRAQ'S KURDISH REGION TO BE PAID

Ed Crooks at FT Energy Source notes that although exports from the Tawke and Taq Taq fields in Iraq's Kurdish region have begun, a mechanism by which the operators would be paid has yet to be arrived at.

"The problem for the KRG is that while the stand-off with Baghdad over oil revenues persists, paying DNO and their other companies for their oil sales would leave it out of pocket. Ashti Hawrami, the KRG oil minister, has promised that the companies will get paid. But to a cynic, his assurances sound suspiciously like 'the check is in the post'."9. SOUTH SUDAN BEGANS DEMOBILIZATION

BBC reports that demobilization has begun in southern Sudan. "[M]any fear renewed fighting ahead of a referendum on the south's potential full independence due in 2011."

10. RAIL FREIGHT VOLUMES CONTINUE TO DECLINE

Railfax's report is out. Their chart for total North American traffic in 13 week rolling averages:

For the week ended June 6th, coal volumes are down 9.2% from the comparable week a year ago, metals are down 53.8%, autos are down 51.1%.

11. FORECLOSURES UP 19% IN MAY, RETAIL SALES UP 0.5% MOSTLY ON GASOLINE, BEIGE BOOK SEEMS TO WARN MORE OF DEFLATION THAN INFLATION, AMERICANS LIKELY TO SPEND A LOT LESS FOR A LONG TIME, VOLCKER SEES A LONG SLOG WITH HIGH UNEMPLOYMENT, SAYS NO CURRENT ALTERNATIVE TO THE DOLLAR

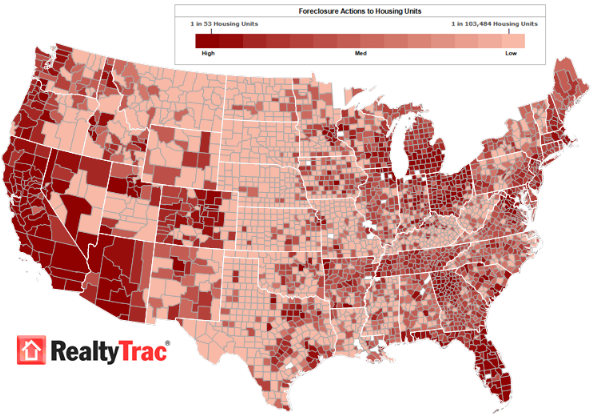

Barry Ritholtz reports that US foreclosure filings were up 19% and hosts the following graph from RealtyTrac:

Jeff Bater and Brian Blackstone at the Wall Street Journal report that the Commerce Department announced retail sales climbed by 0.5% in May from April. However, if you exclude gasoline sales, the increase is 0.2%. They also report that the Labor Department announced that initial jobless claims fell by 24,000 to 601,000 for the week ended June 6.

"Meanwhile, according to Thursday's report the tally of continuing claims--those drawn by workers for more than one week in the week ended May 30--jumped 59,000 to 6,816,000, the 19th-straight record high. The previous week, initially reported to have been a slight decline, was revised to show a small increase.Meanwhile, Izabella Kaminska at FT Alphaville reports that the Fed's Beige Book released yesterday was "more of a deflation alert than anything else," and includes the following excerpts from the book, which is used by the Federal Open Market Committee to decide on the federal funds rate:

Including extended benefit and other federal programs, the total number of people collecting jobless benefits was almost 8.5 million in the May 23 week. That number isn't adjusted for seasonal fluctuations."

"With few exceptions, Districts reported that prices at all stages of production were generally flat or falling. The notable exception to the downward pressure on prices was the widely-reported increase in oil prices."and

"For the most part, raw materials prices and product pricing were stable or declined, and little inflationary pressure is expected during the next 12 months."And Barbara Kiviat at the Curious Capitalist reports that some analysts think we have a long way to go before consumers begin spending again.

"One way to understand the Great Consumer Retrenchment is to look at the amount of debt the typical household carries as a percentage of its disposable income. The ratio of debt to income increased from about 35% in the early 1950s to about 65% by the mid-1960s, where it more or less stayed until the late 1980s. That's when debt started its epic rise, hitting 100% of income in 2001 and going all the way up to 133% in 2007. That figure is now starting to fall. At the end of 2008, the debt-to-income ratio was down to 130%."Kiviat notes that the new Fed data on household debt released today suggests that that ratio has fallen to 127.5% and notes that that's quite some distance for just three months.

"[Chief Economist & Strategist at Gluskin Sheff, Devid] Rosenberg, for one, thinks that to get back to a sustainable level, households have got another $3 to $5 trillion in debt to pay down—o-r default on."In that context, Real Time Economics reports that Paul Volcker, addressing a forum in Beijing, said

"that the US faces 'a long slog, with continuing high levels of unemployment.'Volcker also indicated that for the foreseeable future there is no alternative to the dollar, but that:

Volcker, known for successfully bringing inflation under control during his term at the Federal Reserve, said that the current economic situation 'is not an environment in which inflationary pressures are at all likely for some time to come.'"

"the ultimate logic of a globalized financial system is a world currency.

The theoretical premise that a system of floating exchange rates would promote swift and efficient adjustment has not been borne out in practice."

2 comments:

Reviewing this this afternoon, it has occurred to me that I have not read the paper in forever.

I find all this overproduction stuff hard to understand. It strikes me as the opposite of what I would imagine. Is there a moment of extreme over production before the dilemma of scarcity imposes itself? Or is this some sort of human madness where we can make so much but we cant figure out the best way to distribute it?

Hi Classic:

Not sure what you mean regarding extreme overproduction, unless you are referring to the Chinese binge purchases of commodities.

I guess they're buying cheap, with the notion of selling finished products expensive. Probably not doing the developed economies any good ... and insofar as that's the case undermining their export markets ... but, probably helping developing world economies that export commodities ... countries which have similar anti-colonial ideologies.

Post a Comment