Kate Mackenzie at FT Energy Source reports that UK Prime Minister Gordon Brown asked top ministers at the Treasury and the Department of Business to draw up plans for responding to high oil prices. Apparently the administration is also considering proposals by which the IMF would take a role in monitoring oil prices--and influencing price. (The IEA mostly acts as a data collector and canary.)

"Brown believes that the G20 meeting in London in the spring missed an opportunity to put in place measures to stabilize the oil price, after it fell from a peak of $147 a barrel to less than $35 early this year."The idea currently being mulled could reportedly form a key element of the UK proposal at the G20 meeting to be held in Pittsburgh in October. In the meantime, Platts reports that the Centre for Global Energy Studies, based in London and led by former Saudi Arabian oil minister Ahmed Zaki Yamani,

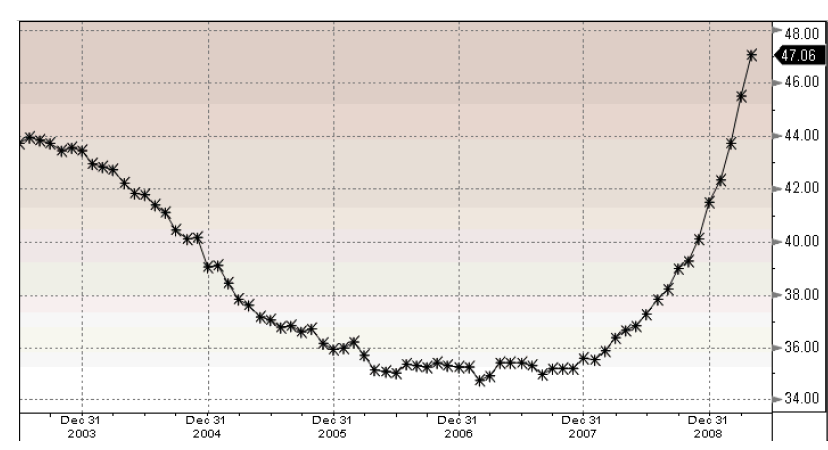

"is forecasting that oil prices will rise steadily through the rest of this year, reaching $80/b in the fourth quarter, as OPEC continues to maintain its current levels of quota compliance."The CGES argues that OPEC should raise production in order to moderate price and gird a potential economic recovery, but is choosing not to do so. James Hamilton at Econobrowser plots the correlation between gasoline price and US consumer sentiment (with the dashed line [RH] being the miles per dollar spent on gasoline and the solid line [LH] representing the Reuters/Michigan index of consumer sentiment):

He comments:

"So how should we assess the likely consequences of the fact that gas prices have now come back up significantly from their lows of December? The Edelstein-Kilian regressions employed in my paper from a recent conference at the Brookings Institution imply that a 20% increase in energy prices would historically be followed within 2 months by a 15-point drop in consumer sentiment and a 1.4% decline (relative to trend) in real consumption spending. From that perspective, the 46% (logarithmic) increase in (seasonally unadjusted) gasoline prices since December is quite worrisome.A bit wonky, but nonetheless the must read of the day. And Kyle Peterson at Reuters reports that the Airline Transport Association sent a letter dated June 11 to President Obama, complaining of the role of speculators in the oil market:

On the other hand, since those December prices were 88% (logarithmically) below the July 2008 peak, consumers should have been giddy in December and still be significantly more sanguine now than they had been last summer, if the only thing on their mind was the price of gasoline.

Only problem is, consumers were anything but giddy in December. Credit and employment challenges have weighed far more heavily than gas prices over the last 9 months, and are presumably far more important than gas prices for determining what happens over the next few months as well."

"A repeat of last summer's astronomical crude-oil prices will bring the nation's economic recovery to a painful halt. ... Businesses that spend billions of dollars on fuel each year, already dealing with the impacts of decreased consumer spending, are especially vulnerable."(h/t Kate Mackenzie at FT Energy Source.) In the meantime, Andy Xie on Friday had an opinion piece at Caijin Magazine where he argued that the lending inside mandated by the stimulus program has not been spent on "tangible projects" but in asset markets.

"There's little doubt that China's bank lending since last December has driven speculative inventory demand for commodities. Chinese banks lend for commodity purchases, allowing the underlying commodities to be used as collateral. These loans are structured like mortgages.The other must read of the day.

Banks usually have to be extremely cautious about such lending, as commodity prices fluctuate far more than property prices. But Chinese banks are relatively lenient. As an industrializing economy, China's support for industrial activities such as raw material purchases for production is understandable. However, when commodities are bought on speculation, lenders face high risks without benefiting the economy.

...

The international media has been following reports of record commodity imports by China. The surge is being portrayed as reflecting China's recovering economy. Indeed, the international financial market is portraying China's perceived recovery as a harbinger for global recovery. It is a major factor pushing up stock prices around the world.

But China's imports are mostly for speculative inventories. Bank loans were so cheap and easy to get that many commodity distributors used financing for speculation. The first wave of purchases was to arbitrage the difference between spot and futures prices. That was smart. But now that price curves have flattened for most commodities, these imports are based on speculation that prices will increase. Demand from China's army of speculators is driving up prices, making their expectations self-fulfilling in the short term."

2. GLOBAL RETAIL SALES NUMBERS DOWN

Rebecca Wilder at News N Economics notes that retail sales are taking a serious hit globally. Here is her graph of retail numbers for Asia:

She observes:

"Out of the 27 countries listed below, 18 posted a positive average annual growth rate in 2008, while just 5 saw the same in 2009 ytd."Worth reading in full.

3. WORLD BANK SAYS GLOBAL ECONOMY TO CONTRACT BY 2.9% IN 2009, TRADE TO FALL BY 9.7%

Timothy R Homan at Bloomberg reports that the World Bank released a report today forecasting that the global economy will contract by 2.9% in 2009, a rougher contraction than the bank previously forecast of 1.7%. Global trade is expected to fall by 9.7% versus the fall of 6.1% forecast in March.

"'Unemployment is on the rise, and poverty is set to increase in developing economies, bringing with it a substantial deterioration in conditions for the world’s poor,' the World Bank said. While the world is set to return to growth in the second half of 2009, a recovery will be subdued, the report said.4. SARKOZY TO GIVE "STATE OF THE UNION ADDRESS" IN VERSAILLES, OVERTURN CENTURY OF PRECEDENT

Reduced capital inflows from exports, remittances and foreign direct investment means 'increasingly grave economic prospects' for developing nations, the lender said. After peaking at $1.2 trillion in 2007, inflows this year may fall to $363 billion, it said."

Emmanuel Georges-Picot at the Associated Press reports that French President Nicolas Sarkozy has decided to overturn 136 years of precedent and directly address both houses of the French parliament today at the Chateau of Versailles. Sarkozy means to use the event to establish a platform by which to address the country on big issues along the lines of the American "State of the Nation" address.

"The last presidential speech to France's parliament was in 1873, before lawmakers banned the practice to protect the separation of powers and keep the president in check."5. MALAYSIA'S CENTRAL BANK TAKES KEY STEP IN DIRECTION OF PURCHASING YUAN-DENOMINATED DEBT AS RESERVE

Denis McMahon at the Wall Street Journal reports that the China Securities Regulatory Commission said on June 12 that it had approved the Malaysian central bank--Bank Negara Malaysia--as a qualified foreign institutional investor [QFII].

"That status allows the Malaysian central bank to invest in China's exchange-traded equities and debt, including Ministry of Finance bonds."Potentially, therefore, Bank Negara Malaysia could act as the first central bank to buy Chinese debt as a reserve. However, Bank Negara Malaysia has yet to be approved by China's currency regulator to purchase renminbi. In February, China and Malaysia signed a currency swap agreement.

6. RUSSIA INVOLVED IN TAIWANESE JET FIGHTER UPGRADE, BELARUS & RUSSIA ANNOUNCE JOINT MILITARY EXERCISES

Yevgeny Bendersky at the Compass notes the recent report that Russia was involved in the development of the third generation fighter planes for the Republic of Taiwan.

"According to The China Times, Taiwan has begun work on a new military aircraft after appeals to the US with a request for the sale of 66 fighter aircraft F-16C/D. Washington, as previously reported, denied this request, not wanting to spoil relations with Beijing. Chinese journalists also point out that the plane, developed by a public company Taiwan Aerospace Industrial Development Corporation (AIDC), has two engines and has a short take-off capability. Its development, according to The China Times, was completed only after Russia sent its experts to Taiwan--the source did not specify what Russian organization or company they represented.Bendersky also notes that Belarus and Russia announced their joint military exercises for 2009, on the back of the recent refusal of Minsk to join the Moscow-led Collective Security Treaty--see Daily Sources 6/15 #3.

This is certainly a new turn for the Russian defense industry and presents a dilemma for the United States. Washington and Taipei have a very close defense relationship, even if certain military hardware is not sold to the ROC from time to time. Taiwan is one of the high-tech sources for a great deal of technology that powers high-tech American industry, as well as American military developments. Russians were always keen on seeing first hand how far Western--and US in particular--military development has advanced, since at this time, Moscow can only watch on the sidelines as America and her allies implement next-generation high-tech military gear. Did the Russians get a chance to see first hand the advanced technology that Washington sold to Taipei, and did they take good notes to take back with them? An even larger question is what this news may do to the Moscow-Beijing military cooperation. Russia has sold a wide variety of advanced high-tech aircraft to mainland China recently, including Su-27 multi-role fighter bomber. China, making sure it was able to level the playing field, quickly reverse-engineered the Russian plane and began its indigenous production under J-11 designation.

Russians recently expressed concern that China is making plans to produce its own version of an even more advanced plane that Russia sold to Beijing about 8 years ago--Su-30 Flanker multirole fighter, a more advanced version of Su-27. Since all of Taiwan's military aircraft are designed and fielded against mainland China, Russian know-how now is part of ROC's high-tech air force pointed at the mainland. One has to wonder what Beijing thinks about all this, and whether Moscow's action was a pay back of sorts for China deciding to copy Russian technology."

7. TALIBAN OPERATIONS IN AFGHANISTAN AND PAKISTAN RE-CENTRALIZING

Matthew Rosenberg, Yochi J. Dreazen and Siobhan Gorman at the Wall Street Journal report that Mullah Omar, the head of the Taliban, has been reasserting direct control over the militants in their struggle with NATO in Afghanistan.

"'This is Quetta's answer to Obama's surge,' said a senior member of a militant network led by Gulbuddin Hekmatyar, an independent Afghan warlord who fights alongside the Taliban. He was referring to plans by the administration of President Barack Obama to send an additional 21,000 troops to Afghanistan over the next few months. The Quetta 'are not ready to lay down their weapons,' he said in an interview in the Pakistani city of Peshawar."Omar is thought to lead the Taliban leadership council from the city of Quetta in south Pakistan. There are some indications that the effort to re-centralize decision-making for the Taliban is upsetting some lieutenants which may make them more amenable to US outreach efforts. Insofar as Omar is directing attacks at Islamic institutions in Pakistan, I suspect he is setting fire to his own bed.

8. ZADARI SAYS US TOO COZY WITH DICTATORS, ASKS FOR MORE MONEY

Pakistan's President, Asif Ali Zardari, has an op ed in today's Washington Post, which sounds more than a little like a rebuke. To wit:

"The West, most notably the United States, has been all too willing to dance with dictators in pursuit of perceived short-term goals. The litany of these policies and their consequences clutter the earth, from the Marcos regime in the Philippines, to the Shah in Iran, to Mohammed Zia ul-Haq and Pervez Musharraf in Pakistan. Invariably, each case has proved that myopic strategies that sacrifice principle lead to unanticipated long-term consequences."His ask sounds more like a threat than a plea:

"We need immediate assistance. The Obama administration recognizes that only an economically viable Pakistan can contain the terrorist menace. The United States has committed $1.5 billion a year for five years to help stabilize our economy, and the House of Representatives and the Senate Foreign Relations Committee have acted decisively to reorient the Pakistani-American relationship toward not just a military alliance but a sustained economic partnership.I suspect that someone's PR advisers weren't thinking when they composed this. It is not exactly a secret that Zadari is known to his countrymen as Mr. 5% nor that he recently moved to try and bar his main opponent for the office of President from running for office and his brother from running the province he had been elected to govern. Insofar as he backed down in the face of the lawyers' movement, I feel that he is "committed" to rule of law and democracy, but the rhetoric of the piece is rather closer to that of Evita Peron than to Nelson Mandela. Should be read in full, of course.

Now, the rest of the world must step up and match the US effort. Pakistan needs a robust assistance package so that we can deliver for the people and defeat the militants. And the rest of the world should again follow the American lead in helping us deal with the millions of internally displaced people who are the most recent victims of terrorism in our nation.

But aid is not enough. In the long term, Pakistan needs trade to allow us to become economically independent. Only such an economically robust Pakistan will be able to contain the fanatics and demonstrate to the 1.5 billion Muslims worldwide that democracy and economic development go hand in hand. Notably, the United States is moving forward with regional opportunity zones in Afghanistan and the Federally Administered Tribal Areas region of Pakistan that will remove trade barriers and provide economic incentives to build factories, start industries, employ workers -- and give hope to the people. This opportunity zone concept should be a model to Europe, as well. Europe must realize that it is in its own self-interest, as the United States has realized, to do everything possible to grow the Pakistani economy and to provide incentives for Pakistani exports to the continent."

9. CONTINUED US JOBLESS CLAIMS FALLING MOST LIKELY DUE TO INSURANCE EXPIRING

Barry Ritholtz at the Big Picture observes that the decline reported in continuing claims is not due to the unemployed finding work, but rather to their unemployment insurance expiring. He plots the "exhaustion rate" for jobless benefits:

and notes, "They are now unemployed AND broke. That is hardly a green shoot ..."

No comments:

Post a Comment