Kate Mackenzie at FT Energy Source reports that in the annual meeting of the EU and OPEC today the EU's energy commissioner, Andris Piebalgs, suggested that the EU would be comfortable with an oil price of $70/b. She quotes from a Reuters story:

"For the fragile world economy, $80 could be alarming, but representing the European Union, Energy Commissioner Andris Piebalgs said a price approaching $70 was not damaging. 'What we also discussed in our meeting is that $70 per barrel, the current price, definitely does not impede the recovery of the economy,' he said. 'We really believe the current situation has some good stability. If it continues it will be a chance for (economic) recovery and also guarantee that upstream investments will continue.'"Piebalgs indicated that the EU was in agreement with OPEC insofar as it thought that "speculation" in the oil markets needed to be curbed. Alessandro Torello and Flemming Emil Hansen at Dow Jones Newswires reports that OPEC President Jose Maria Botelho de Vasconcelos told journalists in a press conference following the meeting that OPEC "would like to reach the $80 per barrel, so that investment could be met."

"He said the current level of between $60 a barrel and $70 a barrel is comfortable as it allows some investment, but a higher price would be better."Eurointelligence notes that a report by the Bundesbank suggests that the oil shock was a contributing cause of the current economic crisis:

"FT Deutschland quotes from a Bundesbank study that apart from the financial crisis, the sharp rise in oil prices was an important contributing factor for the recession. For Germany, the costs of energy imports to from 1.8% of GDP in 2004 to 3.4% in 2008. The shock would have been much harder had it not been for the appreciation of the euro and the increase in energy saving and efficiency. The Bundesbank report also explained that the auto crisis in the US was caused in part by an oil-price induce switch to smaller and medium sized cars, which are mostly produced outside the US."Tom Liodice at the Platts blog The Barrel reports that Philip Verleger in his Notes at the Margin forecast that oil will fall to as low as $20/b by December 20.

"The $20/b claim is one not just to 'stand out and be different,' but Verleger believes that continuously rising inventories might have something to do with it and points to data released last week by the Energy Information Group.Other bears include Fereidun Fesharaki, who in the beginning of June suggested that there would be a $20/b drop in price in the middle of Summer due to the inventory build-up--see Daily Sources 6/1 #2--and Takayuki Nogami, a senior economist at Japan Oil, Gas and Metals National Corporation, who suggested that oil was likely to fall to $45/b by the end of July after economic optimism evaporates in the face of large inventories--see Daily Sources 5/28 #6.

'[G]lobal supply has been running ahead of global demand since March 2007,' Verleger said. 'Over the first five months of 2009, supply exceeded demand by 1.7 mb/d. The 14-month build in inventories has caused the stock accumulation to approach the peak last record by EIG in 1997.'

Verleger believes that the monthly inventory builds have to stop soon because global consumption will increase or global supply will decline.

'My guess is it will be production, not consumption that falls,' Vergler notes. 'Oil producers will find themselves in the same predicament as natural gas producers today. In the case of gas, output is shut in because there are no buyers.'"

2. EUROZONE STILL CONTRACTING, BUT AT SLOWER RATE; GERMANY DOING WORSE, FRANCE DOING RELATIVELY BETTER; SARKOZY REJECTS AUSTERITY; HOUSEHOLD SAVINGS RATES IN DEVELOPED WORLD SPIKING; ECB INDICATES IT WILL NOT LOWER RATES FURTHER; FALL IN PRIVATE FINANCIAL FLOWS TO AND FROM THE US FROM 2007 SHARPER THAN FALLS IN TRADE FLOWS

Edward Hugh has a useful post at Fistful of Euros where he notes that the eurozone economy is still contracting, but the rate of contraction has stabilized.

"[T]he flash reading on the composite purchasing managers index (which covers both industry and services) for the 16 nation euro area [rose] to 44.4, fractionally above the 44 registered in May."(Readings below 50 indicate contraction; above 50 indicates expansion.) He notes that the German private sector contracted slightly in May,

"The flash estimate for the manufacturing PMI index rose to 40.5 from 39.6 in May, but the flash services PMI reading fell to 44.3 from 45.2 last month. And in the manufacturing sector the ratio of new orders to stocks of finished goods fell back to 1.12 after rising to 1.18 in May. Which effectively means inventories started to rise again."

The French economy, on the other hand is recovering, though Hugh notes that the recovery is especially fragile at this stage. Well worth reading in full. Eurointelligence reports that in his speech to the parliament at Versailles yesterday, President Sarkozy rejected austerity measures:

"Sarkozy focused mostly on cushioning the effects of the recession rather than presenting a reinvigorated reform agenda. No tax rise and no austerity policies ('since these have always failed,') but more investment into the future: Reindustrialisation, support for the young and unemployed, universities and schools, etc., as the way out of the crisis.Rebecca Wilder notes that household savings rates are rising in the US, Canada, the UK, and Germany. She plots a graph of personal savings rates for those countries from the first quarter of 1997:

In his speech Sarkozy distinguished between 'good' (cyclical and 'bad' (structural) deficits and a third type of deficit that would be 'reabsorbed by allocating the proceeds of growth'

He announced a new public bond to raise money for 'priority investments'. In the next three months the government will hold vast consultations with different stakeholders to identify priority investments (Les Echos has more details) Jean Francis Percresse writes that such a public bond could reunite the nation behind a growth strategy while at the same time accepting reforms such as the rise in the pensions age. But this was not a new strategy for France. The old policies had led to the present accumulation of debt."

She comments:

"The wealth effects have been smaller in Germany and Canada ... but the impact on household saving has been very similar. This suggests that the wealth effect is (likely) a dominant determinant of saving patterns. Deleveraging may only be secondary, suggesting that renewed economic growth and a stabilization of asset values may cap the US saving rate below a German-style saving rate, 10%-12%."Well worth reading in full. Peter Boockvar at the Big Picture notes that European Central Bank [ECB] member Weber today said, in effect, that the ECB would not lower the benchmark rate any further. He also sniped at the Fed's policy, saying

"the past has shown that an overly generous provision of liquidity in global financial markets in connection with a very low level of interest rates promotes the formation of asset price bubbles."And Brad Setser, at Follow the Money, notes that the fall in private financial flows--both to and from the US--was sharper than even trade flows.

"One thing though is sure: the scale of the collapse in private financial flows the experienced during this crisis is entirely unprecedented. There were a few instances in the past when private flows (excluding flows into Treasuries) were slightly negative. But outflows of 5% of GDP in a quarter are entirely unprecedented. And now that the US data has been revised to reflect the survey, adding private purchases of Treasuries back in doesn’t change all that much …"Well worth reading in full.

3. PETTIS ARGUES THAT CHINESE GDP GROWTH WILL BE CAPPED BY CONSUMPTION GROWTH AS US SAVINGS RATE GROWS

Michael Pettis at China Financial Markets has an interesting analysis of the effect of the growing US household savings rate on the Chinese economy:

"Now that the US is raising its saving rate, this means among other things that the growth in US consumption will be lower than the growth in US GDP. If the US GDP grows slowly, consumption will be flat. If it contracts, consumption will contract sharply. In either case the US trade deficit should continue declining except in the very unlikely event that US investment grows by more than the increase in savings.Really should be read in full. (h/t Yves Smith at naked capitalism, whose comments on the piece are also worth reading.)

Since the balance of payments must balance, if US GDP growth exceeds US consumption growth, China’s consumption growth must exceed China’s GDP growth, and Chinese savings must decline. Chinese savings can decline because consumption rises, or they can decline because GDP declines, but they must decline.

That implies that Chinese GDP growth, rather than be constrained on the bottom by consumption growth (i.e. GDP must grow faster than consumption), will now be constrained on the top by consumption growth. China’s growth in GDP, in other words, will be less than its growth in consumption unless there is a surge in investment. There has, of course, been a fiscally induced surge in investment, but with rising debt and collapsing corporate profitability, I think this can at best continue for a year or two, and probably much less.

So what does that mean for future Chinese growth? When China was growing at 11-13% a year, Chinese consumption was growing by 9% a year. The rapid reversal in the earlier decline in US savings might cause Chinese GDP growth to grow by at least 1-2% below consumption. So if we assume that Chinese consumption continues growing at 9%, this initially suggests GDP growth rates of 7-8%.

But hold on. If GDP growth rates of 11-13% translate into 9% consumption growth rates, is it reasonable to assume that GDP growth rates of 7-8% will still result in 9% growth rates in consumption? I doubt it. My guess is that the growth in Chinese consumption will also slow. This suggests that while the US is adjusting, China’s annual growth rate must be significantly below 7-8%, perhaps 5-6%, or even lower. The key is the rate of Chinese and US fiscal expansion, in the former case to permit the rise in Chinese savings rates not to constrain domestic growth, and in the latter case to slow down the contraction of the US trade deficit."

4. JAPAN BANK FOR INTERNATIONAL COOPERATION TO REVIEW LOANS TO VENEZUELA FOR REFINERY EXPANSIONS, NIPPON EXPORT AND INVESTMENT INSURANCE CONSIDERING ENDING COVERAGE FOR PROJECTS IN VENEZUELA ALTOGETHER

Steven Bodzin and Shigeru Sato at Bloomberg report that the Japan Bank for International Cooperation [JBIC] is reviewing agreements to provide Venezuela $1.5 billion in financing for the expansion of the El Palito and Puerto La Cruz refineries after the Chávez administration has moved to nationalize plants owned by Japanese companies and delayed payments to oil services companies. Further, Nippon Export and Investment Insurance is considering ending coverage for projects in Venezuela altogether.

"Planned Japanese investments in Venezuela include $10 billion in liquefied natural gas projects, $8 billion in petrochemicals and $1.5 billion for the refineries, Chávez said while visiting Japanese Prime Minister Taro Aso in April."Chávez signed the loan agreement with JBIC in Toyko in April--see Daily Sources 4/1 #8. Last week the the Lloyd’s and London company insurance markets’ Joint War Committee has reacted to Chávez's renewed nationalization drive by placing the country on its list of most risky places for shipping--see Daily Sources 6/15 #10.

5. KURDISH GOV SAYS SCHEDULED BAGHDAD OIL CONCESSIONS UNCONSTITUTIONAL

The AFP reports that the Kurdish government today released a statement labeling the oil and gas contracts Baghdad is set to award this month "unconstitutional." The statement said Baghdad's policy was

"unconstitutional and against the economic interests of the Iraqi people. ... The regional government of Kurdistan has made clear progress in increasing Iraq's oil exports and oil revenues in a short time. This progress has been made by focusing on exploration and not on existing fields, in line with the best practices of international markets, and in accordance with the principles of the Constitution of Iraq. The regional government regrets that it cannot say the same thing on the procedures taken the Federal Ministry of Oil of Iraq."(h/t Juan Cole at Informed Comment, who sees the conflict over oil concessions as an emerging constitutional crisis.)

6. PALESTINIAN PM CALLS FOR STATE WITHIN TWO YEARS, JUDT IN NY TIMES SAYS DISTINCTION BETWEEN SETTLEMENTS "SPECIOUS"

Howard Schneider at the Washington Post reports that in a speech yesterday, Palestinian Prime Minister Salam Fayyad called for the establishment of a Palestinian state within two years. He called upon Palestinians to accept the Palestinian Authority as the only institution responsible for security in the territories.

"There is no pluralism in security. The Palestinian Authority is solely responsible. We have to put a stop to this senseless argumentation. I call upon you all to line up on the project of state-building, good government and proper management so the Palestinian state can be a reality."He also promised peace with Israel, saying

"We hope to embody our state next to your state through a meaningful peace. We do not wish to build walls but bridges."Yesterday, Tony Judt, one of the more influential historians whose focus of study is the 20th century intellectual history, had a remarkable op ed in the New York Times, in which he argues that the distinction between "authorized" and "unauthorized" settlements made by the Israeli government is sophistic.Key excerpt:

"But if I am right, and there is no realistic prospect of removing Israel’s settlements, then for the American government to agree that the mere nonexpansion of 'authorized' settlements is a genuine step toward peace would be the worst possible outcome of the present diplomatic dance. No one else in the world believes this fairy tale; why should we? Israel’s political elite would breathe an unmerited sigh of relief, having once again pulled the wool over the eyes of its paymaster. The United States would be humiliated in the eyes of its friends, not to speak of its foes. If America cannot stand up for its own interests in the region, at least let it not be played yet again for a patsy."7. MAY EXISTING HOME SALES DOWN 3.6%; MOODY'S SAYS US SOVEREIGN DEBT Aaa RATING SOLID

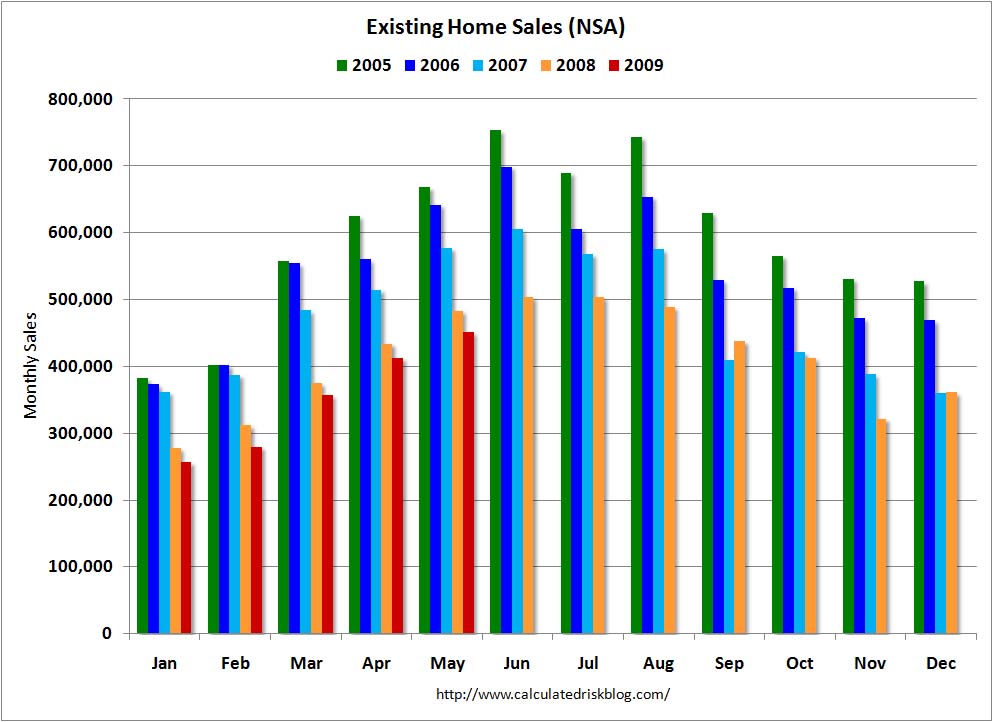

Barry Ritholtz at the Big Picture reports that in May existing home sales fell by 3.6% from May 2008.

"Sales in May 2009 rose 2.4% from April to 4.77 million. Note that these are apple and orange comparisons--revised to unrevised numbers. Once again, the prior monthly number was revised downwards (4.68 million down to 4.66 million)."He links to a chart plotting monthly existing home sales from 2005 from Calculated Risk:

Meanwhile, Keiko Ujikane and Jason Clenfield at Bloomberg report that Moody's Aaa rating of US sovereign debt 'remains solid."

"'Although the US is losing altitude in the Aaa range, it is starting from a very strong base,' Cailleteau, who is chief international economist at Moody’s, said in Tokyo today. The economy is resilient enough to recover and the government is committed to raising taxes and cutting spending, he said."8. BLOG COMPARING NEWS HEADLINES FROM GREAT DEPRESSION TO CURRENT CRISIS

An interesting new blog which gives headlines from the week 79 years ago in the Great Depression has been linked to general all over the economic blogosphere.

No comments:

Post a Comment