John Garnaut at the Sydney Morning Herald reports that Yu Dongming, the head of the metallurgical department of the National Development and Reform Commission, told the paper that "We don't anticipate that the country will continue to build its reserves." Zhang Bin, an economist at the Chinese Academy of Social Sciences, told the Herald that

"The commission is acting to reduce pressure on commodities prices and discourage over-production in heavy industry, including guiding steel production and reducing the building of excess capacity. Too much increase in inventories of commodities is not a good thing because the economy is still not that strong and cannot consume this level of imports of iron ore and coal."(h/t Yves Smith at naked capitalism.) In a related piece, Steve Ladurantaye at the Toronto Globe and Mail reports that Bank of Nova Scotia commodity market specialist Patricia Mohr noted in its monthly report yesterday that the share of oil consumed by China coming from external sources surpassed the dependence on foreign oil of the US in May.

"China relied on imports for 57% of its petroleum production in May while the US imported 55% of its needs. ... China imported 4.3 mb/d, while consuming 7.6 mb/d. The US imported 9.9 mb/d, and consumed 18.2 mb/d."May may well have been an extraordinary month, given that Chinese consumption rose by nearly 6% and oil imports grew by 3.5% from a year previous--a strong deviation from trend. And given noise from the government that the current bate of commodity stockpiling has come to a close, the June 1 announcement by the head of the National Energy Administration which seemed to say that Chinese storage was full, and the raise in prices for gasoline and diesel of 11% this weekend, Chinese demand may be about to take a big dive. We'll see. (h/t Leanan's Drum Beat at the Oil Drum.)

2. GERMAN HIGH COURT OKS LISBON TREATY PROVIDED LAW STRENGTHENING PARLIAMENT'S ABILITY TO IMPLEMENT EUROPEAN LAWS IS PASSED

Der Spiegel reports that the German high court--the Federal Constitutional Court--has ruled that the Lisbon Treaty is not fundamentally at odds with the Constitution, but that the Parliament must pass legislation strengthening its own involvement in the implementation of European law in order for the ratification process to proceed.

"Although the German parliament voted in favor of the treaty last year, a number of members from across the political spectrum petitioned the Constitutional Court to reject the treaty. While most are from the far-left Left Party, Peter Gauweiler, a member of Bavaria's Christian Social Union--the sister party to Chancellor Angela Merkel's Christian Democratic Party--led the challenge. He argued that the Lisbon Treaty would enable the EU to circumvent national parliaments and thus undermine Germany sovereignty.3. UK GDP FALLS 2.4% IN Q1, MORE THAN PREVIOUSLY ESTIMATED

President Horst Köhler had refused to sign the treaty until after the Karlsruhe court had made its ruling. The parliament will now be under pressure to rapidly bring in new legislation so that the ratification process can continue. The Lisbon Treaty is supposed to be implemented by the beginning of 2010 at the latest. [Andreas] Vosskuhle [the court's presiding judge] said on Tuesday that he was sure that the 'last hurdles' would soon be overcome. The German parliament is to gather for a special sitting on August 26 for a first reading of the new law, a spokesperson for the Social Democrats parliamentary party announced on Tuesday. The vote in the lower house would then take place on Sept. 8, just weeks before Germany's national election."

Svenja O’Donnell at Bloomberg reports that revised figures show UK GDP fell by 2.4% in the first quarter from the fourth quarter of 2008. The Office for National Statistics' prior estimate had been of a 1.9% decline.

"The UK’s GDP will probably fall 4.3% this year, the Organization for Economic Cooperation and Development said in a June 24 report. That compares with a 4.8% drop in the euro area and a 2.8% decline in the US."4. TURKISH GDP FELL 13.8% IN Q1

Steve Bryant at Bloomberg reports that the Turkish state statistics office published data today showing first quarter GDP falling by 13.8% from a year previous. First quarter GDP fell by 6.2% from the fourth quarter. Exports fell 26% in the first quarter from a year previous. Industrial production fell by 22% in the first quarter from Q1 2008. Unemployment rose to 16.1%.

"The slump in output is adding to pressure on Prime Minister Recep Tayyip Erdogan to accept assistance from the International Monetary Fund, just as Turkey did during the last crisis in 2001. To date, Erdogan has resisted a loan accord with the IMF, opting instead to expand the budget deficit to fund tax cuts and incentives designed to preserve jobs."4. US TROOPS LEAVE IRAQI CITIES

Ernesto Londoño at the Washington Post reports that US troops left the major metropolitan areas in Iraq, returning responsibility for security to Iraqi forces. More than 130,000 troops remain in the country, but the US has closed or returned to local control 120 bases and facilities, with plans to formally transfer control for another 30 today.

"The government staged a military parade to mark 'National Sovereignty Day,' and Prime Minister Nouri al-Maliki made a triumphant, nationally televised address.Iraqi Interior Minister Jawad al Bolani has an opinion piece in the Washington Post in which he enumerates the problems the country will face going forward, in "the beginning of a highly uncertain chapter in Iraqi democracy and self-governance." Key excerpt:

"This day, which we consider a national celebration, is an achievement made by all Iraqis," said Maliki, speaking before the explosion at a market in Kirkuk, which damaged at least 30 shops."

"Looking beyond the policing and anti-corruption efforts, ordinary Iraqis will perhaps have the strongest say yet in how their future takes hold. We are already looking well past June 30 to Jan. 30, 2010, the date of our next national elections. Many parties, including my own, will field candidates. But this democratic process is not an end in itself. The mere act of voting does not secure our democracy, for it can easily fall into the hands of separatist or foreign-controlled parties. Each successive election here has been a tug of war for our national survival; perhaps none will be more momentous than 2010."5. IRAQI OIL AUCTION HITS SOME SNAGS--CHINA NOT FROZEN OUT YET

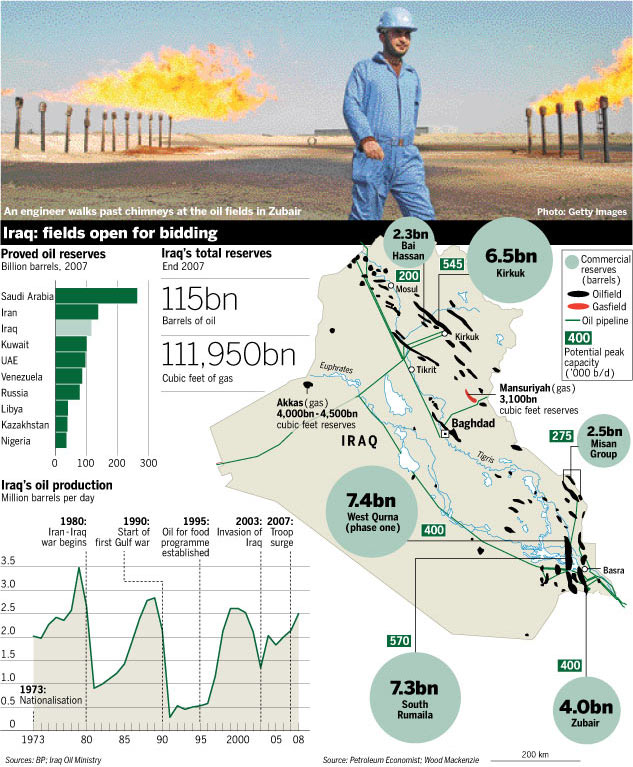

Carola Hoyos at FT Energy Source reports on the outcome of the auction of rights to develop Iraqi oil and gas fields today.

"BP and CNPC have won the right to help Iraq develop the Rumaila field. The UK and Chinese companies beat ExxonMobil, the US oil company, which had partnered with Petronas, the Malaysian oil company. BP clinched the contract when it agreed to reduce its fee per barrel from $3.99 to $2.The report yesterday at Platts that winners will not be "announced" may mean that the ratification process leaves room for those who have lost bids to lobby. So far the decision by Sinopec to make an offer on Addax does not appear to have affected the ability of Chinese companies to secure concessions with Baghdad.

...

The Mansuriyah gas field got no bids.

There were four bids from different consortia for the Zubair oilfield. But in the end the winning bidder rejected the terms on which Iraq was insisting and the field went unawarded. The groups that had initially bid were BP , together with CNPC; India’s ONGC with Gazprom Russia and Turkish Petroleum Corp. The third was headed by Italy’s ENI, with China’s Sinopec, Occidental and Korean Gas; and the fourth was led by Exxon Mobil, with Royal Dutch Shell and Petronas.

The Maysan field failed to find a developer as Iraq and the single consortium that bid (Cnooc and Sinochem) could not agree the terms.

The Kirkuk field got one bid by a group led by Royal Dutch Shell and including Sinopec and the Turkish Petroleum Corp.

The Bai Hassan failed to find a developer as Iraq and the ConocoPhillips-led consortium that bid on it failed to agree terms.

The West Qurna field got five bids, but its future hangs in the balance after ExxonMobil and CNPC both rejected Iraq’s tougher terms.

The Akkas gas field got one bid from a group led by Edison.

The the group led by Cnooc, the Chinese oil company, that bid on the Missan oil field, ended up rejecting Iraq’s tougher terms."

6. CHINA EXTENDS $950 M TO ZIMBABWE

The BBC reports that Prime Minister Morgan Tsvangirai told the media that "The government through the minister of finance, secured credit lines of almost $950m from China."

"'We will encourage and facilitate more Chinese companies to seek development in Zimbabwe,' Chinese official Zhou Yongkang told state news agency Xinhua."I am increasingly becoming convinced that Chinese international loan agreements are mostly headlines, with the actual flow of finances tending to be much smaller.

7. US SUPREME CT SAYS ECUADOR IS NOT REQUIRED TO SUBMIT DISPUTE TO ARBITRATION

Gerald Karey at Platts reports that the US Supreme Court has declined to overrule a lower court ruling which rejected Chevron's claim that the joint operating agreement under which they operated in Ecuador required any dispute to be resolved via arbitration before the American Arbitration Association. In the meantime, Chevron

"is awaiting a ruling by a judge in Ecuador in a lawsuit seeking damages for Amazon residents for what could be upward of $27 billion. A judgment is expected later this year.8. FAO SAYS 1 BILLION GLOBALLY UNDERNOURISHED

The Ecuador suit alleges that Texaco (later acquired by Chevron) dumped billions of gallons of toxic waste in the Ecuadorean rain forest from 1964 to 1990. Chevron has argued that Petroecuador should pay a share of any damages award. Petroecuador partnered with Texaco from 1974 to 1992, when the state-owned company took over sole operations."

On June 19, the AFP reported that the FAO released figures showing that one billion people globally are undernourished.

"[Jacques] Diouf [FAO chief] said in a statement earlier: 'A dangerous mix of the global economic slowdown combined with stubbornly high food prices in many countries has pushed some 100 million more people than last year into chronic hunger and poverty.'(h/t Charles Kenny at Fistful of Euros.)

An FAO statement said 1.02 billion people do not get enough to eat and predicted an 11 percent increase for all of 2009.

An estimated 642 million of the total are in the Asia-Pacific region, the agency said in a statement. Some 265 million are in sub-Saharan Africa, 53 million in Latin America and the Caribbean and 52 million in the Middle East and north Africa.

Some 15 million are hungry in developed countries, the FAO said."

9. BIS CALLS FOR SWEEPING REFORMS TO FINANCIAL REGULATION

Chris Giles at the Financial Times yesterday reported that the Bank for International Settlements [BIS]--an international organization of 55 central banks--published its annual report calling for sweeping financial regulation reforms.

"It advocated big reforms to markets to limit bilateral trading between banks and instead introduce central counter parties, with trading on regulated exchanges.10. CASE SHILLER APRIL INDEX HOME PRICES DOWN 18% YOY, INITIAL CLAIMS DATA MAY MEAN JOB LOSSES HAVE PEAKED--UNEMPLOYMENT INSURANCE EXHAUSTION'S EFFECT ON CONSUMPTION MAY HAVE BEEN OVERSTATED

It said institutions, particularly banks which posed a risk to the financial system, should also be subject to higher requirements to hold bigger buffers of capital against a future crisis. The authorities should strive to increase those buffers in good times.

It also recommended 'a scheme analogous to the hierarchy controlling the availability of pharmaceuticals', with a sliding scale topped by the safest products available for everyone to purchase, and tailed by financial instruments deemed illegal."

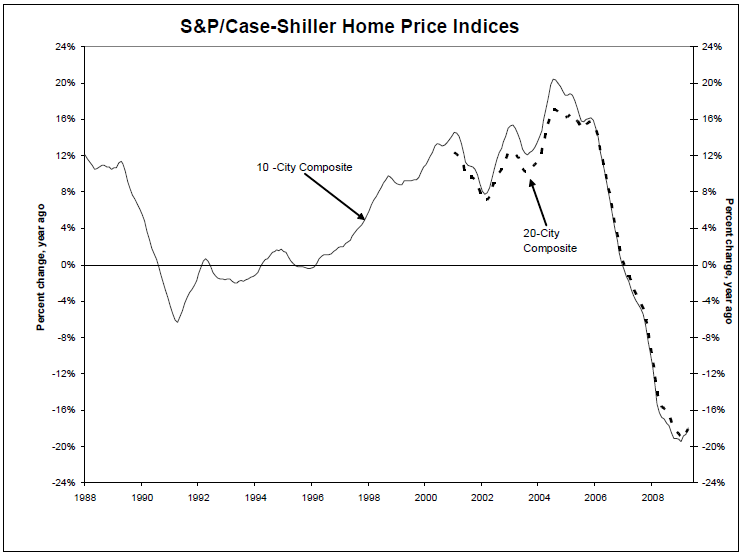

Barry Ritholtz at the Big Picture reports that the Case Shiller index showed home prices continuing to decline in April--18% year over year--but at a slower rate than in March.

Rebecca Wilder at News N Economics argues that if you take the four week moving average of initial unemployment claims, it looks likely that job losses are likely to slow from now on.

"Robert Gordon ([in an] Econbrowser post from April 2009) noticed a pattern that is quite evident in the chart [below]: for each recession, the 4-week moving average is a good predictor of the recession's end. We will see if that happens this time."

Wilder further notes that once unemployment claims peak, they tend to fall sharply. She also puts the kibosh on the notion that exhausted claims means that the fall in continuing claims is simply an indicator of people falling off unemployment losing all support for basic necessities. She notes that there are a number of additional unemployment programs not included in the basic state numbers--and

"By including the number of people that are collecting benefits under the [Emergency Benefits] EB and [Emergency Unemployment Compensation] EUC-2008 programs, the total stock of claimants tallies closer to 9 million rather than the 6.1 million (not seasonally adjusted) claiming under the regular program."Worth reading in full.

11. STATES ONLY ALLOT 0.9% OF STIMULUS FUNDS FOR TRANSPORTATION TO PUBLIC TRANSPORTATION AND OTHER GREEN TRANSPORTATION INFRASTRUCTURE--THE REST GOES TO ROADS

Ana Campoy at Environmental Capital reports that the American Recovery and Reinvestment Act of 2009, which appropriated stimulus money to jump start transportation projects, is being used almost exclusively to fund highway and road construction and repair, per a report released Monday by Smart Growth America--a green transportation advocacy organization.

"Instead of pouring the money into new, cleaner ways of getting around, such as street cars or bike paths, many states fell back on their old habits: more than 30% of the funds are going towards building new roads. Another 63% will be used to fix the nation’s decrepit transportation infrastructure. In contrast, states are only spending 0.9% of the stimulus money on public transportation projects."Worth reading in full.

No comments:

Post a Comment