Liu Li at the Wall Street Journal reports that the OECD has upped its forecast of Chinese GDP growth in 2009 to 7.7% from its 6.3% projection made in March.

"The OECD said it now expects China's economy, the world's third largest, to grow 9.3% in 2010, up from its previous projection of 8.5%. Still, it cautioned that 'the outlook for 2010 is more uncertain and depends on the extent to which private consumption and business investment react to the stronger economic situation, as both the fiscal and monetary stimulus will be easing.'"The OECD stood by its projection that the consumer price index in China would fall by 1% in 2009 versus the projections coming out of Beijing of an 4% increase.

2. CONSUMER SENTIMENT UPTICK IN JAPAN, BUT BOJ SEEMS TO BE DISCOURAGING TOO MUCH OPTIMISM

Edward Hugh at Fistful of Euros has a characteristically long and detailed post on the Japanese economy where he notes that consumer sentiment is upbeat, with the confidence index climbing to 35.7 from 32.4 in April, according to the Cabinet Office in Tokyo--but in the face of horrible export numbers. Hugh notes that the OECD's new forecast has Japan's GDP still on course to contract by 6.8% in 2009 and has revised its forecast for 2010 down to 0.7% growth in 2010. Hugh remarks:

"In its Monthly Report of Recent Economic and Financial Developments the BOJ revised its basic view of the economy upwards for the second consecutive month. In April, the Bank were saying that “Japan’s economic conditions have deteriorated significantly”, but this was revised in May to the view that 'Japan’s economic conditions have been deteriorating, but exports and production are beginning to level out', and in June to the view that 'Japan’s economic conditions, after deteriorating significantly, have begun to stop worsening'.Well worth reading in full.

This has been widely seen as an indication that the BOJ has revised its view on the economy upward, but the BOJ itself has been trying to discourage this interpretation. At the press conference, Governor Shirakawa said that the BOJ’s view on the current state of the economy was in line with the forecast made in the Outlook for Economic Activity and Prices report published on 30 April, namely that 'the pace of deterioration in economic conditions will likely moderate gradually and start to level out', thus emphasizing that the BOJ has not changed its view. To reinforce this point, using the analogy of a weather forecast, he said that if the weather forecast for the following day turns out to have been right, this does not mean that the forecast has been revised."

3. CHINA AND TURKMENISTAN INK DEAL FOR ADDITIONAL 30% SUPPLY OF NAT GAS, CHINA AGREES TO $4 BILLION LOAN ON PREFERENTIAL TERMS

Alexander Vershinin at the Associated Press reports that China has signed a 30 year deal to increase purchases of Turkmen natural gas by 30%.

"Chinese Vice Premier Li Keqiang met with his Turkmen counterpart Wednesday to sign the contract, which increases gas deliveries to 40 billion cubic meters (52 billion cubic yards) annually, the state-run newspaper Neutral Turkmenistan reported.4. JAPAN STRIKES DEAL WITH ADNOC TO INCREASE ITS STRATEGIC PETROLEUM RESERVE

Work on a 7,000-kilometer (4,300-mile) pipeline from Turkmenistan to China is expected to be finished by the end of the year.

'This agreement is very important for ensuring a stable, long-term and adequate supply of gas for this pipeline,' Li said at an official signing ceremony, according to the newspaper.

China has also committed to lending Turkmenistan's state gas company $4 billion on preferential terms, the newspaper reported."

Chikako Mogi at Reuters reports that the Japanese trade ministry has concluded a basic agreement with the UAE's ADNOC to store stocks of oil in Kagoshima, southern Japan.

"The ministry did not provide details of the volume that Japan was expected to receive from ADNOC.5. KOGAS AND GAZPROM AGREE TO FEASIBILITY STUDY ON NAT GAS PIPELINE EXTENSION TO SOUTH KOREA

The ministry said the project will help beef up Japan's energy security by tapping the supply from ADNOC in times of supply shortages."

Eric Watkins at the Oil & Gas Journal reports that Gazprom and Kogas have signed a memorandum of understanding to study the feasibility of supplying gas to South Korea via a pipeline extension from the Sakhalin-Khabarovsk-Vladivostok (SKV) gas pipeline.

"According to analyst Global Insight, two pipeline options between Russia and South Korea are currently being evaluated: an overland route via North Korea and a direct subsea line.In televised comments during his visit to Tokyo in May, Prime Minister Vladimir Putin said,

'The first option suffers from severe geopolitical risks while the second option presents partners with formidable technological and financial challenges,' GI said, adding, 'A drawn-out negotiation and planning process for the project…can be assured in either scenario.'

Underlining that point, Russian officials also have been courting Japanese investors into joining the SKV pipeline project."

"Japanese partners could take part in projects to develop pipelines and other transport infrastructure. I mean from Sakhalin Island to Khabarovsk to Vladivostok." (see Daily Sources 5/12 #4.6. IRAQI MINISTRY CONSIDERING HOW TO RESPOND TO SINOPEC'S BID FOR ADDAX

Anthony DiPaola at Bloomberg reports that the Iraqi Oil Ministry is considering whether to exclude Sinopec from bidding on developing oil fields, following the news that the company had made an offer on Addax Petroleum, which operates fields in Kurdish Iraq. (See Daily Sources 6/24 #7.)

"The Oil Minister hasn’t yet decided, a ministry spokesman said by telephone today. The Chinese company, also known as Sinopec Group, is among more than 30 oil producers short-listed by Iraq to bid for development rights on June 29 and 30.7. OPEC SAYS WORLD OIL MARKET IN "DELICATE AND PRECARIOUS" STATE

The government hasn’t received official notification of the agreement between Sinopec and Addax, said Abdul Mahdy al-Ameedi, deputy director general of the Oil Ministry department running the bid rounds.

'They can participate so far,' he said of Sinopec. 'There are some days until the bidding process,' he said, adding the government would be reviewing the deal."

Margaret McQuaile at Platts reports that in its latest bulletin, OPEC said that the world oil market is in a "delicate and precarious state."

"A commentary in the latest issue of the OPEC Bulletin said oil prices were now 'closer to levels that could support sound investment plans for future production' but were not justified by fundamentals of supply and demand.8. RUMORS OF SAUDI-SYRIAN-LEBANESE 'GRAND BARGAIN'

It noted that OPEC's own crude basket, which had stood at $44/barrel at the start of the March 15 ministerial meeting, had climbed above $70/b since the most recent conference on May 28 despite supply continuing to be greater than demand and OECD commercial stocks remaining well above five-year average levels."

Michael Collins Dunn at the MEI's Editor's Blog reports that there are rumors of a grand bargain being arranged between the Saudis, Damascus, and Lebanon.

"To sum it all up before I start linking: Syria is going to accept the idea of Sa‘d Hariri as Prime Minister in Lebanon. In turn, Saudi Arabia is going to patch up its relations with Syria. King ‘Abdullah will then visit Damascus. And if the Lebanese can smooth out the outlines of a unity government of some sort, Syria won't stand in the way."Worth reading in full.

9. US DELIVERS WEAPONS TO SOMALIA'S TFG

Stephanie McCrummen at the Washington Post reports that the US has sent a shipment of weapons and ammunition in aid for the transitional federal government in Somalia.

"To cut off the rebels' weapons and supplies, the United States has stepped up pressure on Eritrea, and foreign warships patrolling Somali waters to combat piracy have begun blocking cargo ships heading to the rebel-held port of Kismaayo in southern Somalia.10. MEND ATTACKS IN NIGERIA FORCE CLOSING OF TWO REFINERIES, GAZPROM AGREES TO JV WITH THE NIGERIAN NATIONAL OIL COMPANY, GAZPROM TO BEGIN CONSTRUCTION ON TRANS-SAHARAN PIPELINE NEXT YEAR, TOTAL OFFERS TO COOPERATE WITH GAZPROM--ESPECIALLY IN AFRICA

African diplomats have also proposed a no-fly zone over Somalia to prevent weapons from being flown in from Eritrea to the rebels, but it is unclear whether that idea will gather necessary support at the United Nations."

Jacinta Moran at Platts reports that Nigeria shut down the 125 kb/d Warri and the 150 kb/d Port Harcourt after attacks by MEND on pipelines and other oil facilities have cut the flow of crude, making operations impossible. Warri has reportedly been shut down for over a month.

"Nigeria's main militant group earlier Thursday said it sabotaged a Shell oil pipeline in the Delta today, the latest in a slew of attacks against facilities in Africa's biggest oil producing country.Susan Njanji at AFP reports that Shell confirmed that the Billie-Krakama pipeline had been attacked and stated that it had been shut down.

The Movement for the Emancipation of the Niger Delta (MEND) said in an emailed statement it had attacked the Billie-Krakama pipeline in Rivers state in the Niger Delta.

'Cawthorne Channel 1, 2 and 3 flow stations feeding the Bonny export terminal have been effectively put out of service,' it said."

"President Umaru Yar'Adua on Wednesday expressed hope he could resolve the Niger Delta crisis this year.BBC reported last week that one militant leader took advantage of the amnesty offer--see Daily Sources 6/17 #9. Meanwhile, Medvedev's visit evidently bore fruit as Gazprom announced that they have started a 50-50 JV in oil, gas, gas processing and transportation. Gazprom also announced it plans to begin construction of the Trans-Saharan pipeline next year.

'I am hopeful and confident that by the end of this year, we will have a secure and stable environment in the Niger Delta,' he told a news conference with [Russian President] Medvedev [who was in Nigeria yesterday to pursue energy cooperation initiatives.]

Yar'Adua is Thursday expected to unveil details of an amnesty package for militants who cease hostilities as part of efforts to end the unrest and save the crucial oil and gas industry."

Meanwhile, Simon Shuster at Reuters reports that the general director of Total E&P Russie told reporters today, "We are very open to discussing with a company like Gazprom to have developments abroad including, of course, in Africa."Douglas Muir at Fistful of Euros observes:

"If you’re a human being who speaks French, you’re more likely to be African than European. La Francophonie’s demographic center of gravity is now somewhere around Bamako, Mali.

...

Demographic growth plus the slow-but-steady rise of literacy rates in most of Africa means that by the next decade, most literate Francophones will be African too.

...

[T]he Academie Francaise has always allowed non-French citizens to be members; by 2050, I’d expect these members to be approaching a majority.

...

If you’re a human being who speaks French, and is also a practicing Catholic, you’re almost certainly African--like, ten-to-one odds. Plenty of people have already pointed out that Catholicism, slowly retreating in Europe, is growing like crazy in Africa, so I won’t go into that here.

But: French is now one of the major languages of Islam. "

11. VENEZUELA AND US TO EXCHANGE AMBASSADORS

Ian James at the Associated Press reports that Venezuela and the United States will exchange ambassadors, after each expelled them nine months ago.

12. CREDIT CARD CHARGEOFFS RISE WITH UNEMPLOYMENT INSURANCE EXHAUSTION RATES, INITIAL UNEMPLOYMENT CLAIMS UP

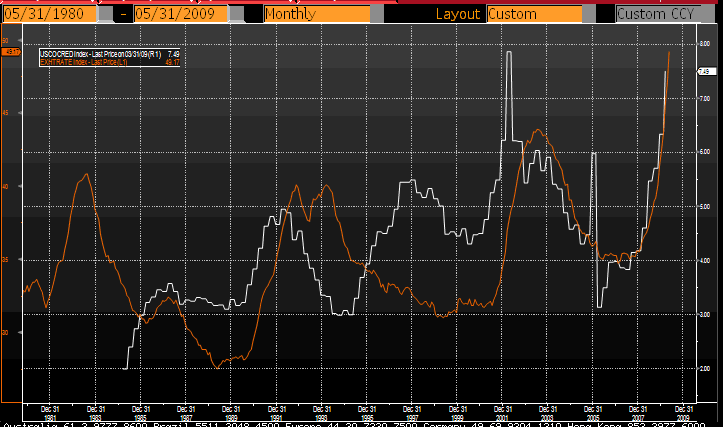

Barry Ritholtz at the Big Picture compares credit card charge off rates to the rate of people who have exhausted their unemployment insurance.

Meanwhile, Glenn Somerville at Reuters reports that initial unemployment claims rose by 15,000 to a seasonally-adjusted total of 627,000.

"Continued claims, which gauge how many Americans were still on jobless rolls after an initial week of claims, rose 29,000 to 6.738 million in the week ended June 13, the latest period for which the data was available."12. ANOTHER STUDY LINKING US RECESSIONS TO PRICE OF OIL

Sheila McNulty at FT Energy Source reports that Steven Kopits of Douglas Westwood Energy research has released a study which notes that in the last 37 years the US has experienced seven recessions, and that oil has played an important role in each. "In every case when oil consumption breached 4% of GDP, he notes, the US has suffered a recession." Koptis also remarks that every time there has been a sustained rise of more than 50% or more in the price of oil, the US enters a recession. McNulty writes:

"From his research, then, it seems there are three rules by which to avoid recession caused by oil prices:Kotis' piece graphs nominal and inflation-adjusted crude prices from 1970-2009, shading the periods of US recession.

- Crude oil expenditures should not exceed 4% of GDP.

- Oil prices should not increase by more than 50% year-on-year.

- Oil price increases should not be so great that a potential demand adjustment should have to reach 0.8% of GDP on an annual basis, as shedding demand at this rate has generally been associated with recession."

His work can be found here--well worth reading in full. Meanwhile, Grant Smith at Bloomberg reports that Barclay's Capital technical analysis that crude will fall to below $66/b after having broken through a "Ichimoku cloud" at $70.35/b.

"The so-called Ichimoku cloud is an area bound by two predictive lines on a general-overview chart, the investment banking arm of Barclays Plc said. Crude breached the lower boundary of this cloud at around $70.35 a barrel in New York on June 19, and oil may consequently be dragged towards a support layer around $66 and fall below that, the bank said.This analysis comes from a different team, if I understand aright, than the one led by Paul Horsnell in London, which correctly predicted in May that prices were set to breach $70/b--see Daily Sources 5/14 #9.

'You still want to be looking to sell,' Barclays analyst MacNeil Curry said in a telephone interview from New York. 'In the sessions ahead, we look for a break of trend-line support at $66.83 to reignite the downtrend,' the bank said in a report."

No comments:

Post a Comment