The AFP reports that on Friday the Bank of Japan [BoJ] decided to maintain its benchmark interest rate at 0.1%.

"The BoJ also expanded the types of debt it will accept from banks in return for emergency funds to include bonds issued by the governments of the United States, Britain, Germany, and France."2. E.U. PARLIAMENT PRESIDENT INDICATES THAT BERLIN IS UNLIKELY TO OK TURKEY ACCESSION TO E.U. ANY TIME IN THE NEAR OR MEDIUM TERM

Der Spiegel reports that the President of the European Parliament, Hans-Gert Pöttering, said in alive chat:

"It is my deep belief that--politically, culturally, financially and geographically--it would be too much to have Turkey as a member of the European Union."Spiegel's backgrounder:

"With his statements, Pöttering underscored one of the central demands being made during the European election campaign in Germany by the Christian Democrats and their sister party in the state of Bavaria, the Christian Social Union (CSU). Both parties are calling for a 'consolidation phase' in the European Union and for Turkey not to be given full membership. 'The European Union cannot be borderless,' German Chancellor Angela Merkel said during the presentation of the party's European election manifesto in Berlin on Monday. The position puts the CDU on a direct confrontation course with its coalition partners in the German government, the center-left Social Democrats (SPD). For years, the SPD has pushed for full membership for Turkey in the EU, arguing it would be prudent for security policy and that the country serves as an important bridge to the Islamic world."3. RUSSIA IN NEW ENRICHED URANIUM DEAL WITH THE U.S.

Steve Gutterman at the Associated Press reports that Russian uranium export company, Tekhsnabexport aka Tenex, signed a $1 billion package of contracts to supply three US utilities with enriched uranium.

"Tenex will supply fuel to the US utilities from 2014 through 2020 under the contracts, which provide the option for renewal, [Sergei] Novikov [, spokesman for the state nuclear agency Rosatom,] told the AP."Russia is already the largest supplier of enriched uranium to the US nuclear sector under the Megatons for Megawatts agreement which exports uranium from dismantled Russian nuclear warheads which has been modified for commercial use. The Megatons for Megawatts deal is set to expire in 2013 and up until now US corporations had not contracted for the supply of uranium enriched from the raw ore.

4. CHINA AND RUSSIA JOIN U.S. IN CONDEMNATION OF NORTH KOREAN NUCLEAR TEST

Evan Ramstad, Jay Solomon and Peter Spiegel at the Wall Street Journal report that North Korea's nuclear weapons test Monday was met with near-universal condemnation internationally.

"The United Nations Security Council, holding an emergency meeting in New York Monday afternoon, 'voiced their strong opposition to and condemnation of the nuclear test,' said the current council president, Russian Ambassador Vitaly Churkin.Beijing released a statement saying it was "resolutely opposed to the test."

Mr. Churkin said in a statement that council members 'demand that [North Korea] comply fully with its obligations' not to conduct tests, under a Security Council resolution passed after Pyongyang announced its first test blast in October 2006."

5. CHINA STATISTICS AGENCY RESPONDS TO ENERGY COMMUNITY'S SKEPTICISM REGARDING ITS INDUSTRIAL PRODUCTION/GDP NUMBERS

Andrew Batson reports that China's National Bureau of Statistics [NBS] is fighting back against the criticism leveled at it by the Paris-based IEA that its official 6.1% GDP growth rate for the first quarter doesn't add up with the fact that electric production fell by 3% for the same time period. (The IEA's report with its criticism was released on May 14--see Daily Sources 5/14 #2. That the criticism was fairly broadly held by the analytical community, see my comment on Daily Sources 5/13 #2 that it was "difficult to reconcile" the notion that industrial production was growing at 7% or more while electrical generation was dropping by as much as 4%.) The NBS pointed out on its website that comparing electricity consumption and GDP can be like comparing apples to oranges as electricity is measured in volumetric terms and GDP in yuan and,

"The bureau said that such gaps have appeared in other countries before without prompting notable comment. In 2001, it said, electricity consumption in the US dropped 3.6%, while GDP grew by 0.8%. In 2003. Japan’s electricity consumption declined 1.3%, while GDP grew 1.8%."The NBS said that total energy consumption rose by 3% in the first quarter, which it argues is in line with its figure of 6.1% GDP growth for the period.

"But in a new report Monday, Standard Chartered economists Stephen Green and Li Wei argue that, properly measured, energy-intensive industries are not declining any faster than other industries. And the historical relationships between other statistical indicators have also broken down in recent months. So they conclude that the gap between falling electricity output and rising measures of value-added still looks 'problematic.'"6. PETROCHINA TO TAKE 50% STAKE IN SINGAPORE'S JURONG ISLAND REFINERY

Jamil Anderlini at the Financial Times reports that PetroChina will pay $1 billion for the 45.5% stake in the Singapore Petroleum Company [SPC] held by Keppel Corporation. SPC operates one of the three major refining projects in Singapore, which is a major trading and shipping hub for petroleum products in the Asia Pacific. The city state's total refining capacity is about 1.3 mb/d. SPC owns 50% of Singapore Refining Company Private Limited which has a 50% stake in the 273.6 kb/d refinery joint venture with Chevron on Jurong Island. The other two refineries are held by ExxonMobil (605 kb/d) and Royal Dutch Shell (458 kb/d).

7. U.S. ASKS CHINA TO GET MORE INVOLVED IN PAKISTAN

Paul Richter at the Los Angeles Times reports that the US has asked China to provide Pakistan with training and military equipment to help counter the growing militant threat in the country.

"Richard C. Holbrooke, the administration's special representative for Pakistan and Afghanistan, has visited China and Saudi Arabia, another key ally, in recent weeks as part of the effort."An interesting development to be sure, especially in light of the statement by the Chinese Ambassador to Pakistan's statement in early May that the US presence in the region was a "serious concern"--see Daily Sources 5/8 #5.

8. FRANCE INAUGURATES "PEACE CAMP" IN U.A.E.

BBC reports that President Nicolas Sarkozy formally opened a French air base in the UAE today. The base can house as many as 500 troops and includes a naval and air base as well as training facilities.

"'Be assured that France is on your side in the event your security is at risk,' Mr. Sarkozy said in an interview with the UAE's official news agency.In a standard issue Newspeak cogitation, the base has been named "Peace Camp." Mr. Sarkozy is also in the UAE to discuss their potential purchase of 60 new Rafale multipurpose jets, in a deal worth about €8 billion (~ $11 billion).

'Through this base--the first in the Middle East--France is ready to shoulder its responsibilities to ensure stability in this strategic region.'

An aide to Mr. Sarkozy is quoted by AFP news agency linking the base to an alleged Iranian threat: 'We are deliberately taking a deterrent stance. If Iran were to attack, we would effectively be attacked also.'"

(h/t Joshua Keating at Morning Brief.)

9. VENEZUELA MAY WITHDRAW FROM THE O.A.S., START NEW HEMISPHERICAL ORGANIZATION WITH CUBA; MEANWHILE LEAKED ISREALI REPORT CLAIMS VENEZUELA IS SUPPLYING URANIUM TO IRAN'S NUCLEAR PROGRAM

The AP reports that Chávez has indicated that he would like to withdraw Venezuela from the Organization of American States [OAS] and work with Cuba--expelled from the OAS in 1962 primarily at the behest of the US--to develop an alternative organization to coordinate the interests of the Western Hemisphere. Meanwhile, Mark Lavie at the Associated Press reports that an Israeli government report was leaked to the media which claims that Venezuela and Bolivia supply Iran with uranium for its nuclear program.

"Bolivia has uranium deposits. Venezuela is not currently mining its own estimated 50,000 tons of untapped uranium reserves, according to an analysis published in December by the Carnegie Endowment for International Peace. The Carnegie report said, however, that recent collaboration with Iran in strategic minerals has generated speculation that Venezuela could mine uranium for Iran."10. ECUADOR PROPOSES KEEPING OIL IN GROUND, SELLING CARBON CREDITS TO DEVELOPED WORLD

Joshua Partlow at the Washington Post reports that Ecuador--which rejoined OPEC 2007 after a 15 year hiatus--is trying to gauge interest in a plan whereby it would leave the oil reserves found under its Yasuni National Park untouched in return for cash from the developed world.

"Ecuador would sell certificates to governments or companies that would allow them to emit carbon dioxide in amounts corresponding to the carbon left underground in Yasuni."

"[Roque] Sevílla [, a prominent Ecuadoran environmentalist who is on the committee in charge of the Yasuni initiative,] said that focusing on carbon could save Yasuni. The 410 million tons of carbon dioxide that would avoid being emitted could raise $4 billion to $7 billion, Ecuador estimates."The EIA estimates that Ecuador exported about 327 kb/d in 2008 and that it has about 4.517 billion barrels in proved reserves. About one fifth of this, or 831 million barrels, is thought to be under the Yasuni National Park. In June, the German Parliament resolved to support the project and provided funds for a study on how to put it into practice.

11. SOMALI TRANSITIONAL GOVERNMENT ASKS FOR INTERNATIONAL AID VS INTERNATIONAL JIHADIST-BACKED AL-SHABAAB

CNN reports that the President of the Transitional Federal Government [TFG] of Somalia, Sheikh Sharif Sheikh Ahmed, yesterday asked for international assistance in combating al-Shabaab via the media:

"I am calling on the international community to help Somalia defend against foreign militants who have invaded the country."Al-Shabaab, which has splintered off from the Islamic Courts Union--the government ousted by Ethiopia with tacit US support after having been fingered as having ties to al-Qaeda--has become a cause celebre in the international jihadist community. (For example, Osama bin Laden issued an audio statement attacking the TFG, thus implicitly supporting al-Shabaab, in the middle of March, per Thomas Hegghammer at Jihadica.)

12. MERRILL LYNCH JOINS THOSE ARGUING SPIKE IN OIL PRICES A MAJOR CONTRIBUTING CAUSE TO CURRENT CRISIS; SAUDI KING CALLS FOR $75-80/B OIL (JUST THE PRICE AT WHICH DEMAND STARTS TO FALL), SAUDI OIL MINISTER CALLS FOR OPEC MAINTAINING CURRENT QUOTAS, BUT EVERYONE APPEARS TO BE PREPARING TO PRODUCE MORE & CHINA LOOKS SET TO RAISE PRODUCT PRICES ON DAY OF OPEC MEETING

Kate Mackenzie at FT Energy Source reports that Merril Lynch’s London-based commodities team has released a paper arguing--in parallel to James Hamilton's recent work--that the oil shock of 2006-8 is responsible for sharply worsening the current financial crisis. She quotes from the note:

"In our opinion, the Great Recession of 2008-09 is the result of a simultaneous shock of surging energy prices and mounting credit problems (Chart 8). The crisis was precipitated by the collapse of Lehman Brothers, but it was the oil price spike that killed emerging market growth. We firmly believe that the world economy would not have contracted so sharply in 4Q08 without the tremendous oil price spike to $150/bbl that occurred in 3Q08 ...."

The Merrill Lynch team thinks that a jump in oil prices to $70-80/b could pose risks to growth in the OECD countries and that the emerging markets face problems between $90-100/b. (This jibes with my thoughts on the subject earlier. To wit, that $70-80/b is where you see demand destruction in the US in the past--see Daily Sources 5/8 #3--or about $2.50-$3.00/gallon average national gasoline and diesel prices--see VMT vs Real Gasoline and Diesel Prices 1980-Oct 2008. Insofar as emerging market economies are dependent upon exports to the OECD countries and that those exports tend to be production inputs or relatively unsophisticated manufactured goods, I am unclear as to why $90-100/b is acceptable to them, given that high petroleum products prices essentially act as a regressive tax, ie hurts the pocketbook of their target market.)

Meanwhile, Kate Dourian at Platts reports that in an interview with Kuwait's Al-Seyassah newspaper, King Abdullah of Saudi Arabia said,

"We still believe that $75 or maybe $80/b is a fair price for oil, particularly in current circumstances."And Tarek El-Tablawy at the Associated Press reports in an interview, Ali al-Naimi, the Saudi Oil Minister, told the Saudi daily Al-Hayat that OPEC was likely to maintain its current production quotas.

"Boosting production 'will not happen until we are sure that global inventories are reduced to their normal levels,' said al-Naimi, whose country is the world's largest exporter of crude. He said world crude inventories are currently at between 61 and 62 days of forward cover and the group wants to see them down to 52 or 54 days."But, Ayesha Daya at Bloomberg reports that the latest Joint Oil Data Initiative [JODI] data indicates that Saudi Arabian oil output jumped from 8.065 mb/d in February to 8.358 mb/d in March, well above the implied quota of 8.051 mb/d. And Platts reports that despite a week's worth of fighting in the Niger Delta, which has recently forced Chevron to shut in 100 kb/d of production, a Nigeria National Petroleum Corp [NNPC] official said crude exports, including condensates, will export 2.01 mb/d in June and 2.04 mb/d in July. Nigeria's implied OPEC quota has been reported from 1.74 mb/d to 1.67 mb/d. The NNPC official said that the country is currently at 1.66 mb/d. Meanwhile, Platts reports that Sinopec's Chairman Su Shulin was quoted by the People's Daily yesterday as saying that he expected the government to lift the guidance price of petroleum products by May 28, which is when OPEC is set to meet.

"Sinopec's refining business has been in the red recently as international crude prices have risen above $60/barrel, Su said.14. CHINA HOLDS SO MANY U.S. DOLLARS THAT IT MUST BUY MORE TO SUPPORT THEIR PRICE

'According to the information released on May 8--regarding the [new] oil pricing mechanism--prices of oil products sold in the domestic market will be revised when the moving average of international crude prices over 22 consecutive working days falls outside a 4% fluctuation range,' Su said, indicating that domestic oil prices should be adjusted following the recent uptick in global crude oil prices.

The 22-day moving average of the crude basket rose above the 4% fluctuation range from May 1, hovering around 5-10%, Platts data showed."

Jamil Anderlini at the Financial Times writes that China is stuck in a "dollar trap," meaning that it has no choice but to continue buying dollars with its growing reserves if it wants to conserve the value of its current holdings.

"Chinese and western officials in Beijing said China was caught in a 'dollar trap' and has little choice but to keep pouring the bulk of its growing reserves into the US Treasury, which remains the only market big enough and liquid enough to support its huge purchases.Rebecca Wilder at News N Economics notes that according to IMF data China is by far the world's largest capital exporter, just as the US is the largest capital importer.

In March alone, China’s direct holdings of US Treasury securities rose $23.7 billion to reach a new record of $768bn, according to preliminary US data, allowing China to retain its title as the biggest creditor of the US government."

Ms. Wilder comments:

"China's current account flows are likely to end up in US capital markets. This makes sense, as the US is expected to be one of the forces to pull the globe out of recession through renewed import demand for global exports in the wake of massive fiscal and monetary policy. Eventually, though, push will have to come to shove when it comes to the US-China current account imbalance. The only question is when!"Worth reading in full. Meanwhile, Ambrose Evans-Pritchard at the UK Telegraph reports that the yield on US 10 year treasuries has risen over 90 basis points since March, suggesting some resistance to the product in the market. (The People's Bank of China has rerouted its purchases of agencies and long term treasuries to treasury bills.)

"The US is not alone in facing a deficit crisis. Governments worldwide have to raise some $6 trillion in debt this year, with huge demands in Japan and Europe. Kyle Bass from the US fund Hayman Advisors said the markets were choking on debt.Olivier Accominotti pointed out that France was in much the same situation in terms of holdings of UK sterling in the years leading up to WWII--see Daily Sources 4/23 #1--the dispute over which, by the way, was one key reason that the UK and the US were late to heed Paris' warnings as events began to hint at maleficent intent from Berlin at the time.

'There isn't enough capital in the world to buy the new sovereign issuance required to finance the giant fiscal deficits that countries are so intent on running. There is simply not enough money out there,' he said. 'If the US loses control of long rates, they will not be able to arrest asset price declines. If they print too much money, they will debase the dollar and cause stagflation.'"

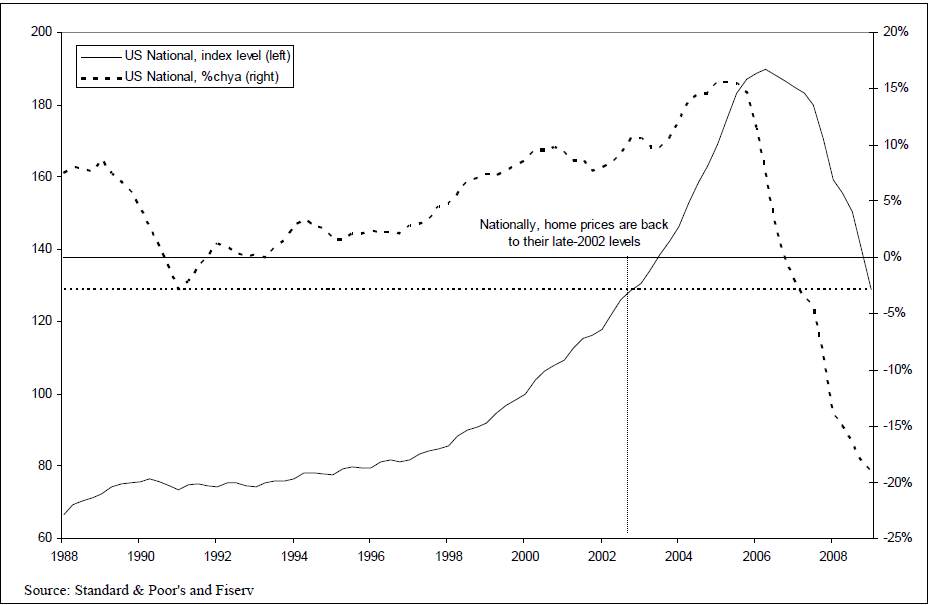

15. U.S. CONFIDENCE UP AS CASE-SHILLER PRICE INDEX DECLINES BY 19.1% IN THE FIRST QUARTER FROM A YEAR AGO!

The Associated Press reports that the Conference Board's Consumer Confidence Index in May rose to 54.9, from a revised 40.8 in April. The reading is the highest seen in eight months.

"'Looking ahead, consumers are considerably less pessimistic than they were earlier this year, and expectations are that business conditions, the labor market and incomes will improve in the coming months,' Lynn Franco, director of the Conference Board Consumer Research Center, said in a statement. 'While confidence is still weak by historic standards, as far as consumers are concerned, the worst is now behind us.'"Interestingly, the Case-Shiller Home Price Index declined 19.1% in the first quarter from a year ago, and 7.5% from the fourth quarter, per Barry Ritholtz at the Big Picture. Ritholtz notes that prices are now at their 2002 levels:

No comments:

Post a Comment