Jess Smee at Der Spiegel reports that the Czech Senate yesterday approved the Lisbon Treaty, with 54 of 79 voting to ratify. President Vaclav Klaus is a euroskeptic and will ensure that the treaty is reviewed by the Czech Republic's high court, but most expect much of that to be a formality.

"The international treaty--which replaces the ill-fated European Constitution rejected by French and Dutch voters with a slightly altered version of the same document, this time written in legalese, filled with caveats for different member states and sans some of the features of a United Europe such as a flag and an anthem--can only be adopted when it is approved by all members. In addition to Ireland, the Czech Republic, Poland and Germany must all still sign the treaty before it can be officially ratified."Now attention will turn to Ireland, which rejected the treaty last year. In the meantime, Anatoly Medetsky at the Moscow Times reports that the European Union will offer today at a conference better trade ties and visa rules as well as €350 million ($466 million) in aid over four years for six countries neighboring Russia as part of an initiative known as the "Eastern Partnership."

"The EU names as a flagship project to pursue with the eastern partners the development of the 'southern energy corridor'--a term that describes all pipelines needed to bring Caspian Sea and Central Asian gas to the EU. The main part of the corridor is Nabucco, said Ferran Espuny, an EU energy spokesman.The Eastern Partnership specifically refers to Armenia, Azerbaijan, Georgia, Moldova, Ukraine, and Belarus--with Belarus being the most surprising choice of all. In the meantime, the European Central Bank cut its benchmark interest rate by a quarter percent to 1% today, per a Bloomberg story by Jana Randow and Simone Meier. The bank also indicated it would purchase as much as €60 billion (~$80.5 billion) in bonds.

Talks to secure commitments to supply gas and build pipelines for Nabucco are progressing well, Espuny said Wednesday."

"ECB officials have spent the past months bickering over whether to fight a recession by purchasing assets, with Bundesbank President Axel Weber leading resistance to such a move. The US Federal Reserve, the Bank of England and Bank of Japan have lowered rates close to zero and are already buying bonds, effectively printing money to reflate their economies in a policy known as quantitative easing."(h/t reader Charles.) Lukanyo Mnyanda at Bloomberg reports that Bank of England decided today to maintain its benchmark interest rate at 0.5%, but that it also announced it will spend an additional £50 billion (~ $75 billion) "of newly printed money to spur economic growth." Rebecca Wilder's weekly summary of global economic data seems to show that the aggressive stimulus measures are having some effect. She concludes that Chinese manufacturing probably has passed a cyclical low and that the same is true of the US, that export declines have slowed in South Korea, but are falling more steeply in India,

and that lagging indicators unemployment and prices are surging and falling on energy, respectively. I always find her analysis helpful and worth checking out. I would only point out, however, that if inflation is falling mostly on energy prices, then recent events in the oil market, counter intuitive as they might be, could translate into a considerable obstacle to global recovery, with the price of WTI having climbed $6/b over the course of the last week and some predicting a spike to $71/b on the back of cash-strapped traders trying to exit short positions--see Daily Sources 5/6 #7. As I've noted before, $70/b looks more or less to be the price after which demand starts to contract, as you can see in this chart of vehicle miles driven over the price of oil:

2. BEIJING ALLEGEDLY TO INCREASE GOLD HOLDINGS, PERHAPS EVEN FROM ITS PURPORTED NEMESIS THE IMF, AND IN THE FACE OF 10 YEAR EUROPEAN MONETARY AUTHORITIES POLICIES OF SELLING THE RESERVE METAL, CHINESE STATE BANKS MET 92% OF LENDING TARGET SET BY STIMULUS IN FIRST QUARTER, BUT WHERE DID THE MONEY GO? AND CAN BEIJING SECURE THE TRUST OF THE INTERNATIONAL FINANCIAL COMMUNITY (AND DOES THAT MATTER?), WELL MIDDLE EASTERN ARAB NATIONS ARE STICKING TO DOLLAR PEG FOR NOW, THANK YOU VERY MUCH--BUT WHAT WOULD THAT MEAN FOR THE COMMON CURRENCY SET FOR 2010?, ARAB FOREIGN MINISTERS IN CAIRO TO COORDINATE POLICY ON ISRAEL/PALESTINE

Patti Waldmeir at the Financial Times reported yesterday that analysts believe that Beijing has embarked upon a policy of increasing its holdings of gold bullion in order to diversify its foreign reserves.

"Beijing and Shanghai-based gold industry analysts said the country had almost doubled its bullion holdings. But they said China was likely to make as many purchases as possible within its borders, rather than turn to international markets where it could push up gold prices."If it is state policy, turning to domestic markets for gold may be complicated by private household demand for gold, as evidenced by the 19.6% spike in gold and jewelry sales over the May Day Holiday of May 1 - 3 as reported by the Commerce Ministry--see Daily Sources 5/4 #2.

"China’s current gold reserves represent only about 1.6% of total foreign reserves, a vastly smaller percentage than the world’s average of 10.5%. Nevertheless, its percentage is similar to the 2.2% in Japan, the world’s seventh-largest holder. The challenge for Beijing is to attain a similar diversification, requiring large amounts of gold, without disturbing the market."Ms. Waldmeir indicates that analysts speculate that Beijing may try and increase its holdings via the expected IMF sale of 400 metric tonnes of gold bullion, perhaps in an "off-market agreement." That would be interesting in the context of the speculation that the Chiang Mai Initiative is in effect an attempt to decouple from the IMF and the Western-led international financial system. That said, Javier Blas at the Financial Times also reports that the paper conducted an analysis showing that had several central banks of Europe not embarked upon a policy of selling gold ten years ago, they would be $40 billion richer than they are now. That, in and of itself, is not an astonishingly large number in the context of central banking--or so it seems to me--but the story also notes:

"The proportion of European reserves held as gold remains extremely large even after years of sales, at an average of about 60%, compared with the world average of 10.5%."Several of the central banks that embarked upon the policy of gold sales had held as much as 90% of their reserves in gold. The move out of gold and into bonds was justified by the notion that bonds are less volatile, and, indeed, it is the case that the so-called "Great Moderation" did not affect commodities, which is why the notion of "core inflation" was invented--or so I surmise.

The FT includes a fascinating and especially informative graphic illustrating global central bank gold holdings and with commentary here. Terence Poon at the Wall Street Journal reports that the People's Bank of China said today that the country had yet to establish a solid economic footing in the crisis, and sounded a note of caution with respect to new lending.

"The central bank reiterated that it will maintain its moderately loose monetary policy and ensure sufficient liquidity in the banking system, but it added that loan quality needs to improve to 'prevent risks of amplifying volatility in the economy and of rebounding nonperforming loans.'Meaning, I take it, that further strong measures to stimulate domestic demand will be required. Andrew Batson at the China Journal reports that the most recent central bank quarterly monetary policy release gives some hints as to where the loans are coming from and going to:

Despite its concerns about the sharp loan growth, the PBOC promised to ensure credit levels will accommodate economic growth. 'If the international financial crisis deepens in the future, credit will need to continue growing at a certain pace,' it said.

China extended 4.58 trillion yuan ($670 billion) of new loans in the first quarter, already 92% of the minimum five trillion yuan target the government set for the full year."

"China’s state-controlled banks are clearly leading the lending charge, accounting for 50.5% of the new credit extended during the quarter. Foreign banks are, however, behaving more like they are elsewhere, and are not following their Chinese colleagues into the lending surge. Loans by foreign financial institutions declined by 26.4 billion yuan in the first quarter.Andrew Batson, in the WSJ, reports that Beijing is responding to concerns about the veracity of the statistics it releases on the economy, by conducting an overhaul of the economic data collection system in the country.

The central bank’s breakdown of new medium- and long-term borrowing, the kind most likely to be used to pay for investment, shows that 50.1% went to infrastructure in the first quarter. That clearly reflects how banks are being pressed to give priority to government stimulus projects. But such lending has its own risks. 'Recent bank lending has been concentrated in government projects which, while helping drive rapid investment, also requires evaluation of local governments’ ability to repay the debts,' the central bank said.

Outside of stimulus projects, demand for credit is not as strong. Only 7.9% of new medium- and long-term lending went to manufacturing, and 11.2% to real estate development."

"During the current downturn, China's National Bureau of Statistics has tried to provide more and better information. It is publishing data on food prices more frequently, and promises more detailed figures on output, jobs and wages. New penalties for falsifying statistical reports are also now in force.This bit causes just a bit of cognitive dissonance given Beijing's recent decision to allow financial news organizations to operate in the country, but prohibit them from engaging in news gathering operations--see Daily Sources 5/1 #1. Meanwhile, Shanthy Nambiar and Camilla Hall at Bloomberg report that Saudi Arabia, Qatar and Bahrain monetary officials indicated today that they saw no need to move away from the dollar pegs for their currencies.

But the real test will be whether higher authorities permit the numbers to show politically inconvenient fluctuations in China's economy.

'I think the check is less technical ability and resources, and more whether they are allowed to announce bad news, instead of only good news and okay news,' said Derek Scissors, a fellow at the Heritage Foundation in Washington."

"A decision on the date for a single currency shared by Saudi Arabia, the UAE, Kuwait, Qatar and Bahrain hasn’t been taken yet, according to [Saudi central bank Governor Mohammed] al-Jasser.Meanwhile, the BBC reports that Arab foreign ministers are meeting in Cairo to formulate a common approach to the Middle East process.

Qatar’s central bank Governor al-Thani said today he still thinks meeting the 2010 target for the currency between Saudi Arabia, the UAE, Kuwait, Qatar and Bahrain is possible.

'We will still continue with 2010 and we’ll be working hard on the schedule to achieve our goals and objectives,' he said."

"The Arab foreign ministers will also decide whether to send their report on alleged Israeli crimes in Gaza to the International Criminal Court."3. TEPCO TO RESTART 1.356 GW NO 7 NUCLEAR REACTOR IN THE NEXT COUPLE MONTHS, SHOULD REDUCE DEMAND FOR LNG/CRUDE

Takeo Kumagai and Jonty Rushforth at Platts reports that Tokyo Electric Power Co. is ready to restart the 1.356 GW No. 7 nuclear reactor at the Kashiwazaki-Kariwa nuclear power plant, after receiving approval from the local authorities today.

"All of Tepco's nuclear reactors at the Kashiwazaki-Kariwa nuclear power plant, with a combined capacity of 8.212 GW over seven units, have been offline since they were shut July 16, 2007, following an earthquake.It can take from two to three months to bring the reactor back on line following the approval of the local authorities. In the absence of the operating plant, Tepco is being forced to directly burn crude, low sulfur fuel oil, LNG, and coal as feedstock replacements.

The earthquake did relatively little damage to units No. 6 and No. 7, which have been repaired, but there is no timeframe for bringing the remaining five units back online. The No. 6 and No. 7 reactors each have a capacity of 1.356 GW."

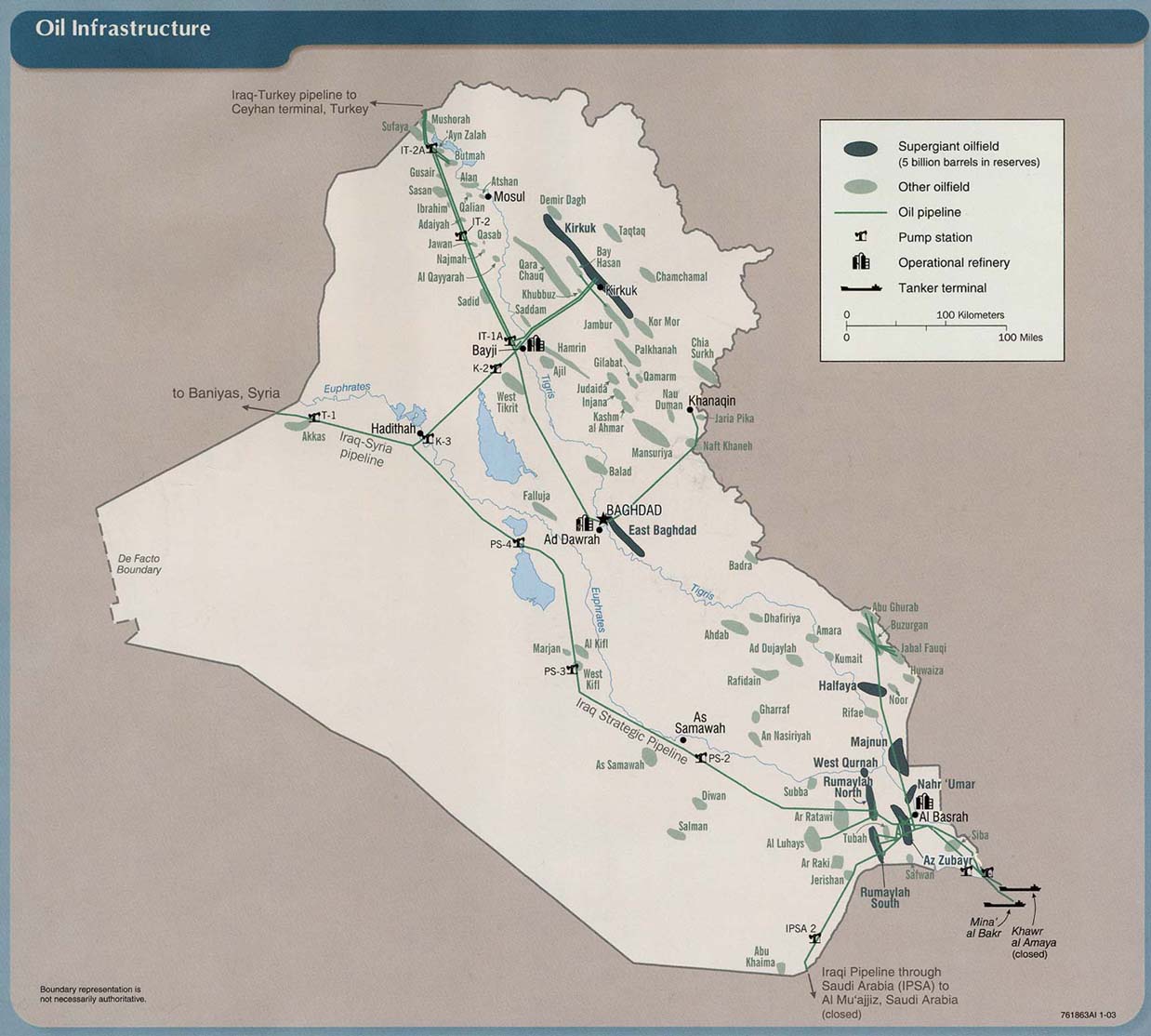

4. SECTION OF PIPELINE SERVING KURDISH AUTONOMOUS REGION BLOWN UP, JUST AFTER WORLD CLASS GIANT OIL FIELD FIND

Following the news yesterday that a world class giant oil field find was confirmed in the Kurdish Autonomous Region of Iraq, the AFP reports that a section of the oil pipeline running from the large Bai Hassan oilfield near Kirkuk was blown up.

"'We were forced to interrupt pumping in 15 wells' because of the blast, [a North Oil Company, or government,] official said, adding that repairs will take up to seven days.5. APPROX. 500,000 FLEE SWAT, BUNER, AND DIR; IS SHARIF PLAYING POLITICS WITH HIS COUNTRY'S SURVIVAL?

The North Oil Company produces 650,000-670,000 barrels of oil per day."

Alan Cowell at the New York Times reports that the International Red Cross published a statement today saying:

"[A]lthough figures remain unverifiable at this stage, reports indicated that up to 500,000 Pakistanis have been recently displaced by conflict in Dir, Buner and Swat."

It has been reported that PML-N's leader Nawaz Sharif has rejected an offer to rejoin the coalition government led by the PPP's Zardari, currently in talks with the Obama Administration in Washington, DC. An editorial in the Karachi Dawn suggests:

"Today, rising militancy is the main threat to national security, but the political class is divided on what is the best response. The PPP has shown itself willing to support military action, but the PML-N has baulked at supporting the option. Perhaps cleverly the PML-N has discerned that the electorate is not ready to support the military option because it causes unacceptable losses to local populations without seemingly being able to defeat the militants. And therefore, while sitting in the opposition, the PML-N can cleave to the populist line and not bear the burden of devising a credible and effective counter-insurgency and counter-terrorism policy which will inevitably involve a long-drawn-out and messy fight.6. EL PAÍS ACCUSES CARACAS OF SHELTERING FARC LEADERS

But what is good for the PML-N’s popularity is not necessarily what is best for the national interest. If the PPP and PML-N are nudged, or themselves agree, to join hands at the centre, they can form a formidable political alliance. The PML-N’s popularity in Punjab is unquestioned and Mr Sharif’s bona fides as the representative of the political right and conservative Pakistan are formidable. With the PML-N on board, the government will genuinely be able to claim its position on militancy represents the national will."

Fausta Wertz at the Compass reports that Spanish daily El País published an article yesterday which speculates that three top FARC leaders are hiding out in Venezuela.

"The article from El País came up after Colombian president Alvaro Uribe urged Chávez to help destroy the FARC. Chávez flat-out refused, saying that it's not his war."Ms. Wertz also notes that Chávez blamed the US for the recent crash of a helicopter, saying that the cost of patrolling the border with Colombia was beyond the financial resources of Caracas and that the conflict within Colombia itself is fueled to a great extent by the drug war. Fair points in my view, after all even the US with the largest federal government budget in the world finds cross-border traffic driven by the drug war impossible to police--and the precipitous decline in oil prices has put a serious crimp in Chávez's discretionary funds. (The proposed US budget includes $27 billion for "border and related security," an increase of 8% from last year. $27 billion is more than 8% of Venezuela's total GDP $331.8 billion and a little less than 27% of the 2008 budget in Caracas. It is 0.7% of the US proposed budget. Just sayin'.) However, it is also interesting in the context of Chávez's recent claim that Venezuela will not tolerate incursions by FARC into its territory--see Daily Sources 5/1 #2. Anyone who has been following my thinking on Chavez knows I don't think there's much chance of reconciliation, but in this particular instance I think that El País and Wertz are overstating the shock, just a bit.

7. OBAMA PROPOSES $3.4 TRILLION BUDGET PLAN

Lori Montgomery, Amy Goldstein and William Branigin at the Washington Post have the story on the Obama $3.4 trillion budget plan.

"The new budget documents, totaling more than 1,500 pages, fill in the details of a broad outline that Obama released in February. They include a massive appendix listing program-by-program information on the roughly 40% of the fiscal 2010 budget that constitutes discretionary spending, which will be set by Congress in what is expected to be a contentious appropriations process."Under the plan, spending on operations in Afghanistan would exceed spending for Iraq for the first time since the second Gulf War began.

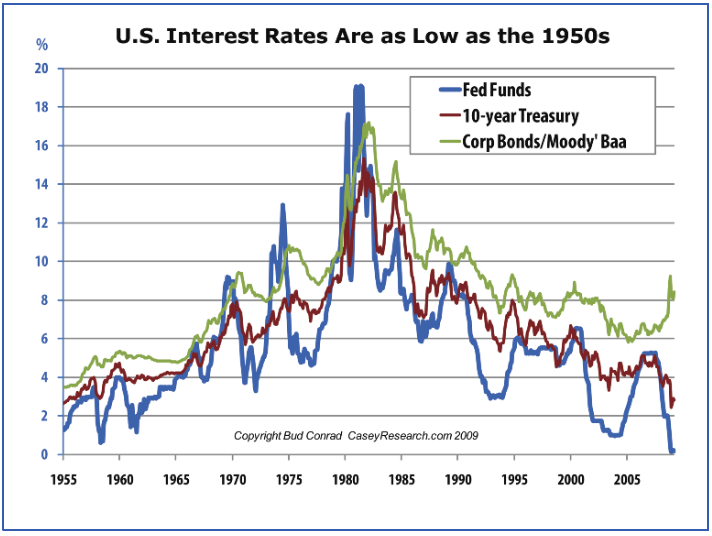

8. FED FUNDS RATE SINCE 1955

Barry Ritholtz at the Big Picture posts a graph plotting the Federal Funds Rate from 1955 on:

9. RETAIL DATA LOOKS BAD FOR ALL BUT APPAREL AND DISCOUNTERS--THE DATA TO BECOME EVEN MORE MURKY GOING FORWARD

Phil Izzo at Real Time Economics reports that a number of large retailers have released their sales data for April today, and RTE has posted a sortable table of the numbers on their site. Luxury retailers fared the worst. Discount and youth apparel firms seem, after a quick look, to have done relatively well. In a related story, Phil Izzo also reports that Wal Mart will no longer publish monthly sales data.

"The change also will remove an important piece for forecasters looking to get a handle on monthly retail sales. Wal-Mart is the nation’s largest retailer with $29.85 billion in sales just for April. An index for retail sales published by Thomson Reuters for April came in up 1.2% for the month, but excluding Wal-Mart’s results it posted a drop of 2.7%."An already murky picture is thus going to become murkier--almost certainly at the advice of the corporation's investor relations team.

No comments:

Post a Comment