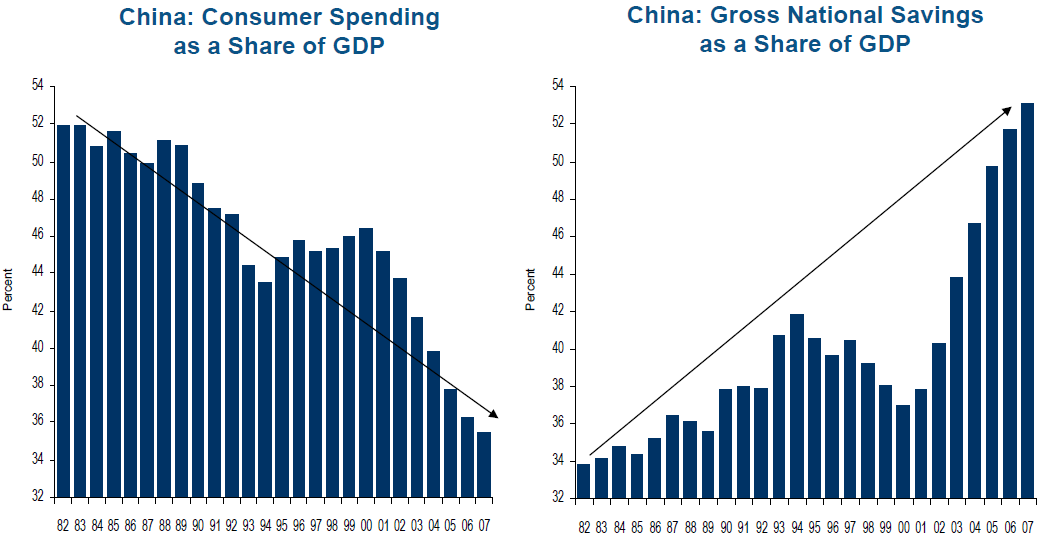

Barry Ritholtz at the Big Picture posts a fascinating graph which plots the trend of consumer spending as a share of GDP in China over time parallel to the trend of savings as a share of GDP:

The chart makes me think that culturally in China the consumer will only consume with abandon if the government pays him to. And the government is paying him to. Fang Yan and Michael Wei at Reuters report that passenger cars sales in China grew to 831,000 units in April, up from 604,900 units from a year earlier and 772,400 in March. Earnings did not particularly grow, however, as the Chinese stimulus targeted small vehicles, which do not yield the same margins as their larger cousins.

"'Beijing's stimulus policies are having a longer-lasting effect than expected,' said Qin Xuwen, an analyst with Orient Securities. 'As long as volume continues to grow, which is quite likely given the records in March and April, and there is no sudden spike in commodity prices, bottom lines of automakers will improve this year.'"Which is an issue, oil prices are perking up, to say the least.

2. AND MORE CARS = MORE OIL DEMAND, SO THE NDRC PUBLISHES MORE DETAILS ON ITS NEW FUEL PRICING POLICIES, WHICH ARE MORE RESPONSIVE TO GLOBAL PRICES

The state is trying to make transportation fuel costs in China more responsive to global prices and thus make oil demand more responsive to them. The National Reform and Development Commission introduced new rules for pricing domestic petroleum products at the beginning of the year, and Xinhua reports the agency detailed it method on its website today:

"China would adjust domestic fuel prices when global crude prices reported a daily fluctuation band of more than 4% for 22 working days in a row.On January 1 the NDRC introduced a new fuel consumption tax on importers and refiners of 0.8 yuan/liter (~$0.11745/liter or $0.445/gallon or ~$13.78/barrel) and suggested that it would reduce benchmark prices by 30-50%, though this more recent announcement appears to reflect a decision to let the price float to a certain extent--see Daily Sources 12/19 #1. In any case, close to a million new passenger vehicles a month, compact or not, translates into a considerable amount of oil demand. Dinakar Sethuraman at Bloomberg reports that the director of investor relations for China Petroleum & Chemical Corp., Zheng Baomin, indicated in a speech that Asia's largest refiner expects Chinese oil products demand to grow at 0.6 to 0.7 times that of GDP growth.

The commission said refiners would enjoy 'normal' profit when global crude prices are below US$80/b, but would face narrower profit margins when the crude prices rise above US$80/b.

However, fuel prices would not go further up, or only be raised by a small margin, when crude prices rise above US$130/b, and fiscal and tax tools would be used to ensure supplies, the NDRC said."

"The government has forecast GDP to expand 8% in 2009, Zheng said at a conference today in Singapore. This equates to China’s oil-product demand growing between 4.8% and 5.6% this year, according to Bloomberg calculations based on Zheng’s speech."And China's National Bureau of Statistics data does suggest that apparent products demand was up slightly year on year in March. And Eadie Chen and Tom Miles at Reuters report that the petroleum products stocks held by Sinopec and CNPC fell by 15%--I infer from the month earlier. Sales rose by 5%.

3. WHILE COMMODITIES PRICES APPEAR TO BE SPIKING (ON CHINESE STIMULUS) CAUSING CORPORATIONS TO HEDGE, CAUSING MORE PRICE RISES LIKELY TO UNDERMINE STIMULUS GIVEN WEAK OVERALL DEMAND

And the entire commodities complex appears to be spiking, with the the spot S&P GSCI commodity index, a basket of raw materials, recently moving above 400, 32% higher than in late December, per Javier Blas at the Financial Times. Blas says that the price spikes, combined with rumors of "green shoots," have unnerved corporate consumers who are rushing to hedge their raw material requirements:

"The head of metals trading at a bank in London said: 'Consumers are being dragged to hedge, even if their demand is not strong, because they are afraid of the rapid price increase in some markets.'And Grant Smith at Bloomberg reports on the latest prediction, by PVM Oil Associates Ltd., that oil is set to move to $62.65/b shortly, and from there to $78/b within six months.The problem remains that oil at those levels seems to precipitate demand destruction. I updated my VMT vs front month WTI prices (nominal) chart last night and $70-$80/b appears to the point at which people drive less in the US ... I would imagine that the effect would be more pronounced in China:

Bankers pointed to hedge examples such as Delta, the world's largest airline, which has boosted its fuel hedge to 75% of this year's needs, from less than a third late last year.

Cargill and Louis Dreyfus, two of the world's largest agricultural trading houses, last week secured a hefty position in the sugar market, pushing prices higher, to supply India, the world's largest consumer."

The bright spot, from the perspective of oil bulls, seems to be localized in China, as even the stimulus program there does not appear to have especially heartened representatives of the steel sector there. Reuters reports that Mr Shan Shanghua, secretary general of the China Iron and Steel Association said,

"'We are still aiming at a yearly production of 460 million tonnes. Whether we can make it or not depends on exports and domestic demand. But I am sure that if we remain at that high production rate and do not cut output, it will be a disaster.'(h/t Yves Smith at naked capitalism.) The Baltic Dry Index, though off its lows, isn't recovering at a rate that would make me all that optimistic:

Mr. Shan said the Chinese, led in the negotiations by Baosteel, should be able to get a price below the spot market, which would mean a cut of more than 30%. He said that 'There is a common sense that wholesale prices should always be lower than those for retail.'"

4. GERMAN EXPORTS DOWN 16 Y-O-Y IN MARCH, OWEN HUMPAGE SAYS EURO MORE LIKELY ALTERNATIVE TO DOLLAR THAN SDRS

Der Spiegel reports that the value of German exports in March fell by 16% from a year earlier according to the Statistics Office. (They rose slightly from February--by 0.7%--but February is 10% shorter than March.)

"German industrial production remained flat in March, following a year long decline, data released by the Economics Ministry also showed on Friday.Owen F. Humpage at Vox EU writes that the notion of trading the dollar for SDRs is faced with the same problem as deciding, say, to stop your business communications in English and talk in Klingon instead. Though some central banks may be diversifying their reserves into metals, the dollar is by far the largest held foreign reserve internationally.

'Recent positive impulses came from the car industry that has benefited from economic stimulus measures at home and abroad,' the ministry said in a statement, referring in part to the German 'scrapping bonus' scheme which pays a bonus to drivers junking an old car and buying a new one.

Meanwhile, German manufacturing orders released on Thursday, unexpectedly jumped just over 3% between February and March. The rise, its first in seven months, also fueled hopes that the worst of the recession may have passed."

Humpage comments:

"These currencies’ official reserve rankings parallel their status in international commerce more generally. This correlation should be of no surprise. Why hold a currency that no one uses? According to a 2007 BIS survey, roughly 88% of daily foreign exchange trades involve dollars. Again, the euro is a distant second, with the British pound and Japanese yen trailing."He concludes that at its core the SDR notion is based on inflation concerns, which would be more easily met by switching to the euro than SDRs. Worth reading in full.

5. PAKISTANI PM TELLS COUNTRY ALL BETS ARE OFF IN SWAT, CHINESE AMBASSADOR TO ISLAMABAD COMPLAINS OF US PRESENCE IN REGION

Pamela Constable at the Washington Post reports that Pakistan's Prime Minister, Yousuf Raza Gillani, made a late night televised address last night which told the country that the armed forces are being "called in to eliminate the militants and terrorists," effectively ending negotiations with the Taliban for now. The announcement:

"signaled the final collapse of a fragile peace accord between the government and Taliban forces in the Swat region. It also represented the civilian government's formal green light for a full-fledged offensive by the military, which until now has been fighting sporadically."Gillani has been regarded within the country as a hopeful figure having negotiated the end of the conflict with the lawyers' movement which ended in Chief Justice Chaudhry being restored to his seat and the governance of Punjab restored to the PML-N. Meanwhile, Kalbe Ali at the Karachi Dawn reports that the Chinese Ambassador to Islamabad, Lou Zhaohui, told reporters today that Beijing is "concerned over the increasing US influence' in the region.

"‘These are issues of serious concern for China,’ he said, adding that China was concerned over the US policies and the presence of a large number of foreign troops in the region.6. FMR ASST SECY OF DEFENSE ARGUES AFGHAN MILITARY SHOULD BE GIVEN LARGER GOVERNANCE ROLE

He said that US strategies needed some ‘corrective measures’ to contain terrorism. However, he added, terrorism was a serious issue and required cooperation between countries in the region to counter it."

Former Assistant Secretary of Defense Bing West argues in the Wall Street Journal that the most important step to take in order to establish relatively amicable security in Afghanistan is to give the Afghan Army a larger role in governing the country.

"But as long as Pakistan is a sanctuary, US forces here will be on the strategic defensive, no matter how skillful their military tactics. We can't stay forever. The basic question is: How to consolidate the battlefield gains? That depends upon how the mission is defined. President Barack Obama has avoided promising to build a vibrant democratic nation. 'The achievable goal,' he said recently, 'is to make sure it [Afghanistan] is not a safe haven for terrorists.' Such a minimalist policy can be achieved in one of two ways.Worth reading in full.

The first is to apply the classic counterinsurgency model: After the military push the enemy from a populated area, the police take over, while government appointees provide honest governance and basic services. This approach pursues the expensive nation-building that Mr. Obama has not endorsed. It requires thousands of additional police trainers and hundreds of civilian advisers in the districts. These advisers also serve as watchdogs against corruption, acting as a shadow government to restrain officials prone to skimming and payoffs. It's a sound approach that is slow and expensive.

The second option is to expand the role of the Afghan army to act as the facilitators and watchdogs of governance. Today, American commanders like Capt. Howell routinely participate in shuras or councils. They can gradually hand off such governance-related tasks to Afghan officers."

7. KRG LETTER SUGGESTS THAT A DEAL HAS BEEN STRUCK WITH BAGHDAD ON STATUS OF KURDISH CONTRACTS WITH OIL COMPANIES

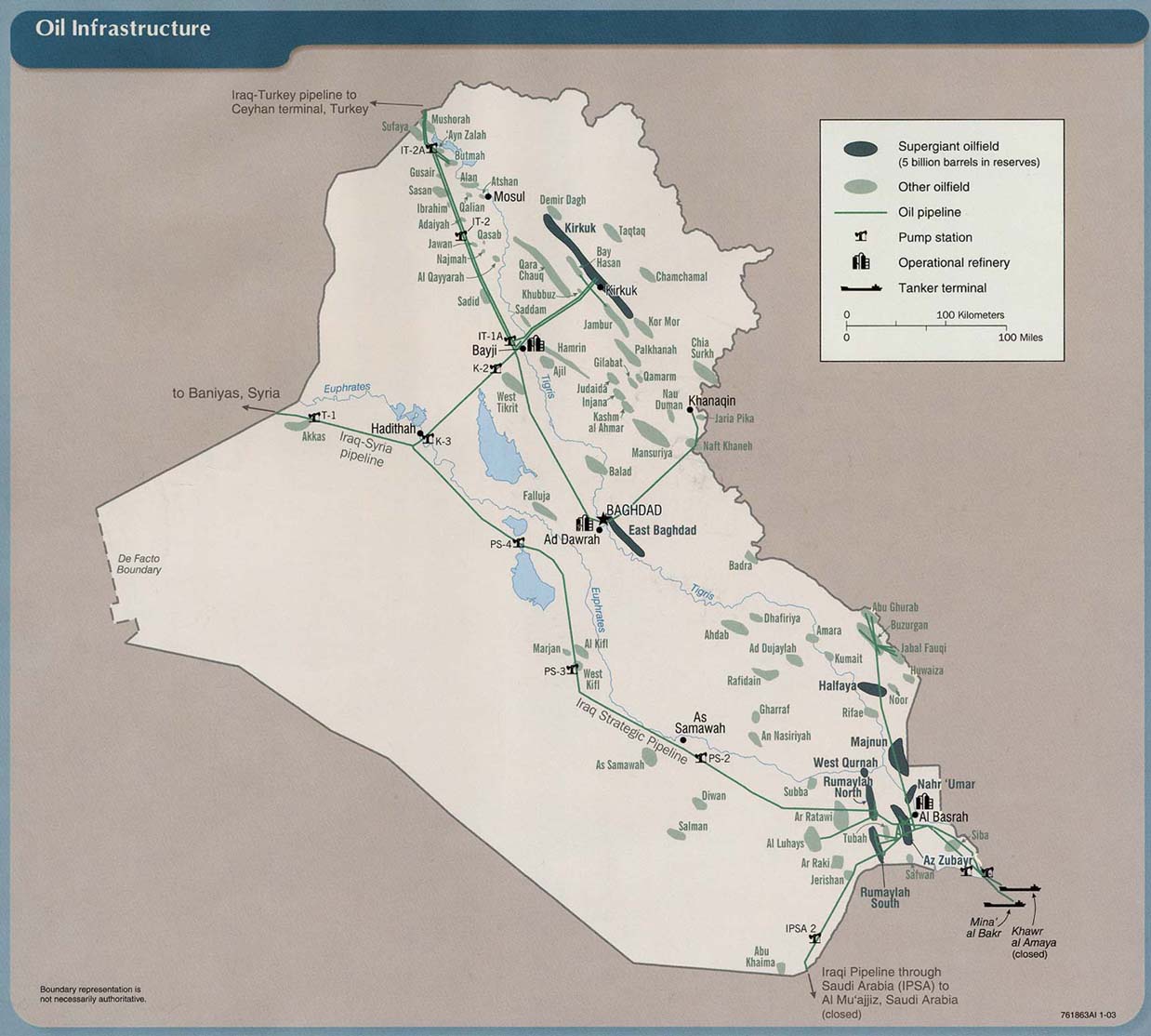

William MacNamara at FT Energy Source reports that the Minister of Natural Resources of the Kurdistan Regional Government, Dr. Ashti Hawrami, released a statement today which stated that crude exports from the Tawke field of 60 kb/d and the Taq-Taq field of 40 kb/d will officially begin being exported through the Iraq-Turkey pipeline come June.

Key excerpt from the letter which Energy Source reproduces in full:

"The exported crude oil from both fields will be marketed by SOMO [Iraq's State Oil Marketing Organization] and the revenue will be deposited to the federal Iraq account for the benefit of all Iraqi people. The average API gravity of the crude oil mix at a combined rate of 100,000 barrels per day will be around 35 degrees. Once the Taq-Taq pipeline is laid and further upgrades are made to the Tawke pipeline, the combined exports from these two fields will reach 250,000 barrels per day, with the average API gravity of around 39 degrees. These higher API gravity oil mixes will improve on the overall quality of the present Kirkuk oil mix which is only around 31 degrees API."Though the letter clearly implies that a deal has been struck with the central government regarding the validity of the licenses the Kurdish Regional Government has granted various E&P firms in the region, the Iraqi Oil Ministry denied to reporters at Reuters that any such deal had been struck. The companies involved also indicated surprise when approached by reporters. McNamara adds:

"While no expected the power struggle between Iraq’s central and regional governments to end any time soon, many many players involved in the Kurdistan oil industry said in recent weeks that the two sides were closer than ever to an agreement over Kurdish oil exports and were hammering out the final details of revenue-sharing."8. POPE VISITS HOLY LAND, BRZEZINSKI URGES LARGER, MORE PROACTIVE--AND MORE BALANCED--APPROACH BY OBAMA ADMINISTRATION IN PALESTINE PEACE PROCESS

Rachel Donadio at the New York Times reports that Benedict XVI arrived in Jordan today as part of a visit to the Middle East that will take him to Israel and the Palestinian territories.

"On Monday, Benedict lands in Tel Aviv for four intense days in Israel that will include visits to the Western Wall, holy to Jews; and, sacred to Catholics, the Church of the Holy Sepulcher and the hall where Jesus is believed to have had the Last Supper. In Jerusalem he will visit the religious compound in the Old City known to Muslims as the Noble Sanctuary and to Jews as the Temple Mount.In Jordan the Pope will meet with Muslim clerics and scholars as part of his outreach. In a review of Richard Haas's most recent book in Foreign Affairs, former Secretary of State Zbigniew Brzezinski makes the argument that the Obama Administration will need to abandon the passive approach to the Israeli-Palestine issue going forward as things are coming to a head:

The Vatican’s Jewish interlocutors say they hope the trip will mend fences, while Israeli officials hope it will boost Christian tourism to the region.

The trip is an important opportunity for the pope 'to demonstrate visually,' that the relationship between Jews and Catholics 'has continued to flourish since the visit of John Paul II,' said Rabbi David Rosen, chairman of International Jewish Committee on Interreligious Consultations."

"If the new president is to avoid in the Middle East not only the gross errors of his immediate predecessor but also the much too long-lasting passivity of the Clinton years, he truly has to lead. Admittedly, making matters more difficult for him is the legacy of the last 16 years, when a subtle shift took place in the US approach to the Israeli-Palestinian conflict: the United States moved from being a genuine mediator seeking to nudge both sides toward peace to holding a posture of thinly veiled partiality in favor of one of the parties to the conflict. The result has been detrimental to the prospects for peace--for without engaged and genuinely forthright US mediation, the two parties to the conflict have shown themselves to be unable to reach a genuine compromise.9. SUDAN TO ALLOW NEW HUMANITARIAN GROUPS INTO DARFUR

To make matters worse, Islamist extremism is gaining ground among a growing number of Palestinians, and Israeli politics are currently moving in an increasingly intransigent direction. In the months to come, the next Israeli prime minister may try to prod the United States to go to war with Iran, while arguing disingenuously that the Palestinians must first become economically more developed before an Israeli-Palestinian peace can be seriously considered. The argument regarding the Palestinian issue, in effect, will be for leaving things as they are, notwithstanding the danger that the prolonged stalemate (with its periodic violence and the relentless expansion of the settlements that it allows) is already poisoning the prospects for a two-state solution."

The BBC reports that Sudan's Minister of Humanitarian Assistance, Haroun Lual Ruun, told reporters that the country would allow new humanitarian organizations into Darfur. He also indicated that Khartoum would allow those UN and NGO organizations remaining in the region to expand their operations.

"'I think what we're hearing... is that new NGOs with new names, new logos, if necessary, can come in,' [UN humanitarian chief John Holmes] was quoted as saying by Reuters news agency.Sudan's President Omar al-Bashir expelled most aid agencies from Sudan and the Darfur region following his indictment in the International Criminal Court in March--see Daily Sources 3/6 #5. Bashir also responded to the decision by releasing from prison a prominent critic of his regime, Hassan al-Turabi, the foremost Islamist in Sudan who had ties to Osama bin Laden--see Daily Sources 3/10 #15. Turabi was originally imprisoned by Bashir in part because Turabi had come out in favor of the ICC's indictment of the President, which makes more sense, I suppose, in light of recent conjecture that it might indict former US officials for their actions in prosecuting the second Gulf War. Foreign Affairs hosted a Q&A session on Sudan with Andrew Natsios, Professor of Diplomacy at Georgetown University, where he was asked what "are the United States' key national interests with regard to the Sudan crisis?" His response:

'That means there's an opportunity to exploit some of that expertise and experience that is there and I think that is a welcome degree of flexibility about how it might happen in the future.'"

"The central US national interest in Sudan is humanitarian. The cooperation between the Sudanese and US government on counterterrorism has been exaggerated and overemphasized as a motivating force in US policy--it is useful but not central to the relationship."This is code. It is in the interests of US elected officials and other American political associations to address Sudan primarily in terms of Darfur, because the US is primarily a Christian country and to openly address it in a hard-headed fashion would be bad for the political future of either. If I were to take a stab at what the US national interest is in Sudan, it would be:

A) The establishment of a stable government, capable of policing its constituents, and thus with which meaningful negotiation can take place;

B) So that a policy within Sudan which actively discourages militant Islamists from setting up base there;

C) Which probably could only take place when the civil war is brought to an end, which leaks instability into neighboring countries, most significantly via panicked migration flows, all of which are unable to provide basic services to their own citizens or subjects, much less to foreign migrants, one of which, at least, is a key US ally;

D) Meaning that the consolidation of rebel movements into a single coalition with which the central government can come to an agreement with; and10. VENEZUELAN TROOPS SEIZE FOREIGN OIL SERVICES COMPANIES' ASSETS

E) Additional supply of oil and gas to the global market, not only from Sudan, but also from Chad, which has been drawn into the conflict, as the additional crude theoretically mitigates price on the global market, and thus the share gasoline and diesel takes from the average American's pocket book.

Manuel Hernandez at Reuters reports that Venezuela sent troops to seize control of boatyards and other assets belonging to oil services companies late yesterday after the National Assembly gave final approval to a law which would empower the government to nationalize their operations first and consider the legality and terms of compensation later. Yesterday Chávez told the media:

"'Tomorrow, we will start to recuperate assets and goods that will now belong to the state, as social property, as they should always have been,' Chavez said, adding that thousands of workers would be taken on by state oil company PdVSA.Companies potentially affected by the deal include Baker & Hughes, Halliburton, and Williams, among others. Carlos Camacho at Platts reports that Venezuelan Energy and Oil Minister Rafael Ramirez indicated on Wednesday that:

But members of a Zulia business group that represents local oil firms told Reuters soldiers seized the installations of 20 companies on the eastern side of [Lake Maracaibo] late on Thursday."

"companies re-injecting natural gas and or water to sustain oil production--a means that sustains one-sixth of all Venezuelan production--are the main intended targets of the new law, as well as companies providing E&P barge services."Reports began surfacing in March that Caracas was having a tough time meeting its obligations to foreign contractors in the country--see Daily Sources 3/19 #5.

11. SWINE FLU CASES RISE, BUT REMEMBER THAT TB KILLS TENS OF THOUSANDS MORE DAILY

Donald G. McNeil Jr. at the New York Times reports that the World Health Organization announced today that 2,384 people in 24 countries have confirmed cases of swine flu. The disease does not, at this stage, appear to be more lethal than regular flu, though it is clearly highly contagious and the historical fear with respect to diseases that jump between species is that the new species has no resistance to the disease which could, under the, um, wrong circumstances create a true global disaster. So, while being in favor of the reporting and the actions taken by the authorities, here is the curative for the media hysteria over the matter, by Hans Rosling, h/t Parke Wilde at US Food Policy:

12. US HEADLINE UNEMPLOYMENT NOW 8.9%, U-6 IS 15.8%, FAR WORSE DECLINE THAN LAST 5 RECESSIONS, BUT STILL RATE OF UNEMPLOYMENT RANKS GROWING SLOWER

The Bureau of Labor Statistics released the unemployment data today, showing that U-3, or headline unemployment, grew by 0.4% in April from March to 8.9% nationally (without adjusting for seasonality). U-6, or "total unemployed, plus all marginally attached workers, plus total employed part time for economic reasons" crept up 0.2% to 15.8%. The number of unemployed persons, or U-3, rose by 563,000 to 13.7 million in April, well below analyst expectations which were of at least 600,000. Justin Fox at the Curious Capitalist put together a graph which plots the current decline in employment against five prior recessions, noting that the employment situation is clearly much worse than what was seen in 1982 and 1974:

Fox comments:

"Basically, the report offers a little bit of backing for the 'job market is turning' story that some other more timely but less reliable indicators have been hinting at, but not much. These numbers will be revised over the next couple of months as more data come in, and by then they may tell a somewhat different story. One thing that the revisions won't change: This employment downturn is now clearly much, much worse than those of 1981-1982 and 1973-1974."

No comments:

Post a Comment