Platts reports that the CEO & Chairman of China National Offshore Oil Corporation, Fu Chengyu, reportedly said at the Boao Conference in Hainan China yesterday that the company would not pursue mergers or acquisitions during the downturn, though the government has urged companies to do so to take advantage of the current economic downturn.

"Fu said that due to the ever-intensifying protectionism and the lack of understanding about Chinese companies, CNOOC had to adjust its overseas expansion strategy."Fu said that the company will seek foreign partners for joint investments instead, thus obviating the nationalist concerns of the resources' hosts.

"In recent months, China has adopted a strategy of offering billions of dollars in loans to energy-rich nations such as Russia, Brazil, Venezuela and Kazakhstan in order to secure long-term oil supplies from them."Professor Michael Pettis at China Financial Markets notes that the speakers at the Boao conference were tripping over each other to declare the financial crisis over. He concludes:

What does this grab-bag of stories add up to? The point I want to make is that if the purpose of the stimulus package is temporarily to slow the rate of contraction, it will probably succeed. This may be an important result. On Tuesday when I as being interviewed on CCTV 9’s Dialogue, I suspect host Tian Wei was a little exasperated by my unrelenting pessimism about economic prospects and asked 'So should the government do nothing? Doesn’t it have to do something?' (I am paraphrasing).

Of course it does, and I am not criticizing it for making stupid moves. As I argued on the program, the government is faced with a tough choice between measures that boost employment and spending in the short term but may exacerbate China’s difficulties over the longer term and measures that speed up the pace and quality of China’s transition but may result in unacceptably high unemployment in the short term.

They seem to be doing the former, and I cannot complain or criticize since this is a political decision and not an economic one. The point, however, is that the paths facing China are not one leading to economic contraction versus another leading to economic recovery. The paths as I see it lead either to a very deep, short-term contraction followed by a healthy and balanced recovery, or to a slow contraction that may take many years and may result in much slower productivity growth over the next decade or so--perhaps we could call it a US-style crisis versus a Japanese-style crisis."

"It looks, however, like Beijing has at least for now decided clearly which path it will take, notwithstanding the brutal criticisms I have delicately referred to in the past from some of China’s more independent think-tankers. China is not likely to collapse economically, and we may see one or more “rebounds” over the next few years, but the glory days of growth are well and truly behind us until, I suspect, the financial system is sufficiently reformed that it leaves behind governance constraints that almost automatically assure systematic and massive capital misallocation. That will take many years. Meanwhile the transition to a healthier and more balanced economy--which was slated to be long and difficult in the best of cases--is likely to be longer and more difficult as a consequence of the fiscal and banking response to the crisis."A must read (h/t Yves Smith at naked capitalism.) Brad Setser at Follow the Money also takes aim at the "green shoots" being touted by finance ministers general all over the globe, noting that much of the Chinese stimulus is temporary in character and that, generally speaking,

"China exports a bit more than the US and imports a bit less, but they are basically comparable in size. And, well, the y/y change in a rolling 3m sum of China’s exports doesn’t look much different that the y/y change in US exports; and the y/y change in China’s imports doesn’t look much different than the y/y change in US imports."

However, Setser also points out that there is more than the stimulus package goosing the Chinese economy:

"But it is now pretty clear that the shift in the government’s formal budget wasn’t the only mechanism for providing stimulus to the economy.In the past robust lending growth inside China has resulted in large pickups in imports, and Setser sees this as a potential real "green shoot." Worth reading in full.

China’s banks are state owned. They were liquid, as lending had been curbed to try to keep China’s economy from overheating. And when told to lend more – whether to state firms looking to invest, state firms looking to stockpile commodities or local governments free to spend on ambitious infrastructure projects, they clearly did.

China’s state banks before the current crisis were a bit like the US Agencies before the August subprime crisis. At the peak of the housing boom, the Agencies’ ability to grow their portfolio was constrained (as a result of past accounting irregularities and the like). Their market share was falling. After the subprime crisis curbed private label securitization though, Washington lifted curbs on their activity, and they responded. Similarly, the state banks ability to lend was constrained by lending curbs and a rising reserve requirement at the peak of China’s boom. When the curbs on their lending were lifted, they responded, and in a big way.

The increase in their lending in the first quarter is staggering. The state banks are a far larger part of China’s financial system than the Agencies are in the US, so the expansion of their lending seems to have had a macro impact."

2. JAPAN TO CONSIDER DEVELOPING NUCLEAR WEAPONS? SEOUL TAKES UP PYONGYANG'S OFFER OF TALKS

Greg Scoblete at the Compass notes that in a speech today former Japanese finance minister Shoichi Nakagawa suggested that Tokyo should acquire nuclear weapons. Scoblete notes that:

"kick-starting a debate about whether Japan should acquire a nuclear deterrent would be useful for the US as well as Japan."Were it a government official who made the remarks, I would regard it more as a shot over the bow of Kim Jung Il's hermit kingdom. That said, CNN reports Seoul will send officials to Pyongyang tomorrow to directly negotiate with the country for the first time in a year. The talks were proposed by the north, which gives as the reason for them the resolution of "issues related to the Kaesong industrial complex."

3. THE DEBATE INSIDE PAKISTAN RE: SWAT BURNS ON AS THE STATE BANK OF PAKISTAN CUTS THEIR BENCHMARK INTEREST RATE, 6 MONTHS AFTER HAVING RAISED IT FOR IMF LOAN

Pamela Constable at the Washington Post wrote a fascinating summary of the how the Swat agreement is being received within Pakistan itself. Key excerpts:

"'The government made a big mistake to give these guys legal cover for their agenda. Now they are going to be battle-ready to struggle for the soul of Pakistan,' said Rifaat Hussain, a professor of security studies at Quaid-i-Azam university here. He predicted a further surge in the suicide bombings that have recently become an almost daily occurrence across the country. Two recent bombings at security checkpoints in the northwest killed more than 40 people."

"'We really had no other choice. We had no power to crush the militants, and people were desperate for peace,' said Jafar Shah, a Swati legislator. His Awami National Party, though historically secular, sponsored the sharia deal. 'Now people are calling us Taliban without beards,' he said ruefully, 'but it was the only option available.'"

"'The inescapable reality is that another domino has toppled and the Taliban are a step closer to Islamabad,' the Pakistan-based News International newspaper warned last week after the Buner takeover [which the Taliban occupied for several days, shutting a religious shrine, burning DVDs in the street, and touring the area in a truck convoy]. The paper compared Pakistan to Vietnam: a weak and corrupt state being 'nibbled away' by determined insurgents: 'The Taliban have the upper hand, and they know it.'"

"'In Swat they got their system imposed at gunpoint, and now they are ready to Taliban-ize the whole country,' Altaf Hussain, the exiled head of the Muttahida Qaumi Majlis political party, said at a teleconference of Muslim clerics in Karachi on Sunday. Denouncing the insurgents' abusive and autocratic methods, he said, 'We have to decide between our country and the Taliban.'"

"'Things are confused and unclear. People have suffered a lot, and they are desperate for peace, but they don't know if it will last,' said Afzal Khan Lala, a provincial legislator, reached by phone in Mingora. 'If the Taliban are sincere, then peace should prevail. But if they have ulterior aims and seek supremacy over the state, I doubt peace will come to Swat.'"The piece is the best I've seen on the discussion inside Pakistan regarding their dilemma in a long time--worth reading in full. In the meantime, Farhan Sharif and Khalid Qayum at Bloomberg report that the State Bank of Pakistan today lowered its benchmark interest rate by a full 1% from 15 to 14%. The move follows the 2% raise in the benchmark interest rate imposed on November 12, 2008, the fourth raise that year, in order to meet the requirements for a $7.6 billion bailout from the IMF.

"'The assessment that inflation is slowing means we can afford to lower interest rates,' Governor Syed Salim Raza told reporters in Karachi while announcing the bank’s quarterly monetary policy for the next three months. The lower benchmark rate will be effective tomorrow, he added."4. AHMADINEJAD INSISTS ON ACCUSED SPY'S RIGHTS, DEEMS ISREAL 'PARAGON OF RACISM'

With one hand he giveth; with the other he taketh away. Thomas Erdbrink at the Washington Post reports that Iranian President Mahmoud Ahmadinejad wrote to the prosecutor handling the case to persuade him to ensure that Roxana Saberi's rights under the Iranian legal system are upheld.

"As per the president's request, please see to it that the legal proceedings are not diverted away from the path of justice. Personally see to it that the defendants are able to assert their legal rights in defending themselves."Of course, this is, to a large extent Kabuki, because it is not the President who is in charge of the Iranian legal system, but the Leader of the Revolution.

"Saberi's lawyer has 20 days to appeal the prison sentence. Legal experts have said that Saberi has a good chance of being acquitted by an appeals court. Other observers say that this case could follow a similar track as one from two years ago: After holding 15 British naval and marine personnel for nearly two weeks in 2007, Ahmadinejad unexpectedly announced their release, sending them home with gifts during a ceremony attended by the international news media."Ahmadinejad immediately erased whatever good will he might have engendered by the move, by arguing today at the UN Conference on Racism that Isreal is a paragon of it, per Edward Cody at the Washington Post. Ahmadinejad said:

"So long as Zionist domination continues, many countries, governments and nations will never be able to enjoy freedom, independence and security. "As long as they are at the helm of power, justice will never prevail in the world and human dignity will continue to be offended and trampled upon. It is time the ideal of Zionism, which is the paragon of racism, be broken."As I have noted before, Tehran seems to be making it politically as difficult as possible for any rapprochement with the US. In the meantime, Anna Shiryaevskaya at Platts reports that Russian President Medvedev is set to present today a new proposal for an energy security agreement with Europe.

"'We would like to start talks with our partners as soon as possible. I hope for constructive reception of our ideas,' he said.5. RAÚL CASTRO ADMITS HE'S HUMAN, SOMETHING FIDEL COULD NEVER QUITE DO

The document will consist of three sections: principles of international energy cooperation, a transit agreement targeting resolution of transit conflicts, and a list of energy products, which will include oil, gas, nuclear fuel, coal and electricity, Medvedev's aide Arkady Dvorkovich said, according to a Prime-Tass report."

Paul Richter and Peter Nicholas report that Obama Administration officials have admitted that they have been caught a bit off guard by Raúl Castro's statement Thursday that,

"We are willing to discuss everything--human rights, freedom of press, political prisoners, everything, everything, everything they want to talk about. We could be wrong, we admit it. We're human."Although the Obama Administration was not ready to give particulars on how it wants to move forward on talks with Havana, President Obama said at the Americas Summit in Trinidad & Tobago:

"I think it's important to recognize, given historic suspicions, that the United States policy should not be interference in other countries. But that also means we can't blame the United States for every problem that arises in the hemisphere. That's part of the bargain. That's part of the change that has to take place."In the meantime, CNN reports that Hugo Chávez said in a statement Saturday that:

"It is possible we will begin evaluating the designation of an ambassador in the United States. We want to move in that direction."A US State Department official confirmed for the press that Venezuela and the US were discussing re-opening normal diplomatic relations by re-exchanging Ambassadors.

"'This is a positive development that will help advance US interests,' the official said. 'And, the State Department will now work to further this shared goal.'"6. FED LIKELY TO TARGET COMMERCIAL REAL ESTATE SECTOR FOR REMEDIAL MEASURES

Emily Barrett at Real Time Economics reports that Dennis Lockhart, president of the Atlanta Federal Reserve Bank, indicated at a conference this weekend that commercial real estate was a top concern of the Federal Reserve Bank going forward:

"'On our watch list this year as a risk to the [economic] outlook is continuing worsening in the commercial real estate sector,' Mr. Lockhart said.7. HISTORICAL RECESSIONS VS MARTIN FELDSTEIN

...

Fed policymakers are still considering whether to include sponsorship for

commercial property loans under its Term Asset-Backed Securities Loan Facility,

or TALF, Mr. Lockhart said, adding that there’s been no official decision.

'The details haven’t been fully worked out,' he said."

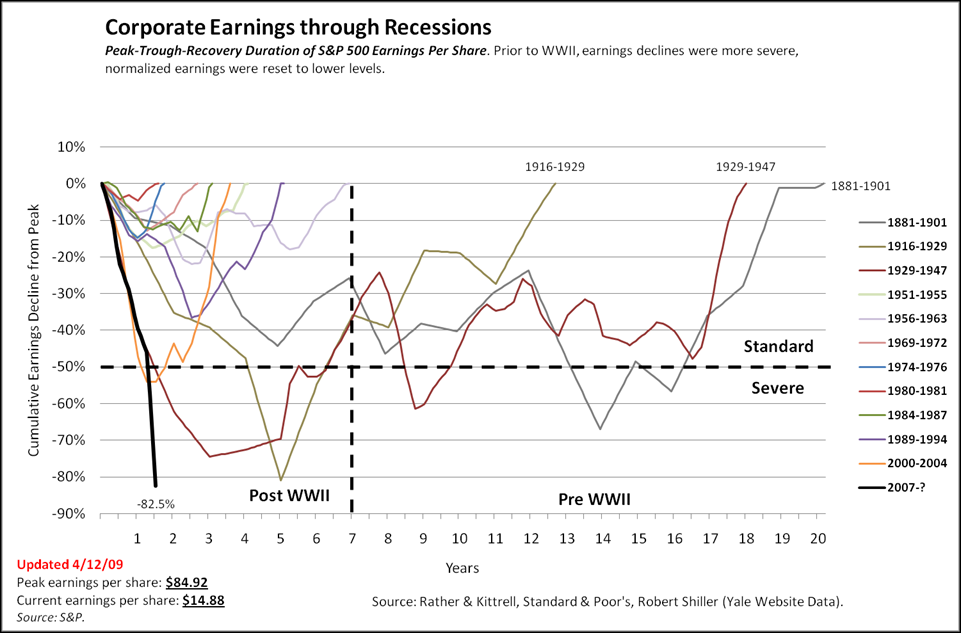

Barry Ritholtz at the Big Picture links to a chart plotting corporate earnings per share of the S&P 500 in recessions from 1881 on:

Martin Feldstein has an opinion piece at the Financial Times from which I infer that he sees economic recovery looming, titled Inflation is looming on America's horizon. He concludes:

"The deep recession means that there is no immediate risk of inflation. The aggregate demand for labour and goods and services is much less than the potential supply. But when the economy begins to recover, the Fed will have to reduce the excessive stock of money and, more critically, prevent the large volume of excess reserves in the banks from causing an inflationary explosion of money and credit.Worth reading in full.

This will not be an easy task since the commercial banks may not want to exchange their reserves for the mountain of private debt that the Fed is holding and the Fed lacks enough Treasury bonds with which to conduct ordinary open market operations. It is surprising that the long-term interest rates do not yet reflect the resulting risk of future inflation."

3 comments:

http://blog.usni.org/?p=2352 Fact or fiction?

CNOOC deja-vue?

Does this sound credible?

Fascinating.

I am not familiar enough with McDermott to say how this could plausibly take place ... maybe given that it is not a US company it would be possible to purchase it, but a considerable amount of its value comes from its contracts with the US government.

Either way, my guess is that there is basically no way that CNPC will be allowed by the Congress to take over a major part of the nuclear supply chain for the USN.

That said, the energy business is to a large extent about information, and I could see a lot of acquisition decisions in Beijing being made on the basis of getting a better sense of the global market.

Short answer ... I doubt it's real ... and if it is, I doubt it could go ahead in the way it is being reported.

China has such a large impact on the global economy now that so many nations are experiencing difficulty; I hope that the intentions are peaceful.

I'm not zenophile, simply not.

However I watch the actions more closely than the press releases~

Thanks for making that easier.

Post a Comment