Wall Street Journal Asia has an editorial reporting that the Chinese State Council passed a new Postal Law, complaining that the new legislation which raises barriers on entry into the carrier market, and points out that that may violate its WTO commitments.

"Although China Post has always had a monopoly on 'universal mail,' like the US Postal Service does in America, some parts of the courier system are lightly regulated and open to entrepreneurs. Not surprisingly, these sectors now provide some of the best services. For instance, local express couriers, known as 'kuaidi,' pepper Chinese cities and can deliver almost anything within the city for a dollar or two. Under the new law, intra-city express couriers like these face a minimum capital requirement of 500,000 yuan--which will likely wipe many of them off the map."2. PARIS REJECTS PROPOSED EC HEDGE FUND REGULATIONS AS TOO LAX

Peggy Hollinger, Nikki Tait, and Martin Arnold in the Financial Times reports that Christine Lagarde, the French finance minister, has attacked the most recent proposed legislation being proposed at the European Commission which would regulate the hedge fund industry.

"'The Commission wants to create a system of mutual recognition,' Ms Lagarde said in an interview with the French daily Le Figaro. 'This is the kind of system that will open the door to a fund from the Cayman Islands that has never been regulated by Europe. The danger is that this could become the Trojan Horse of offshore funds.'3. DEMAND FOR TREASURIES MOSTLY COMING FROM THE PRIVATE SECTOR

France and Germany have been the standard bearers in Europe of stricter financial regulation of hedge funds. Nicolas Sarkozy, French president, has repeatedly attacked 'speculative funds' and summoned French banking leaders to the Elysée this month, where he sought undertakings on the transparency of their dealings."

Brad Setser's latest post at Follow the Money demonstrates that the majority of treasuries issued over the last twelve months were purchased by private investors as opposed to sovereign entities.

"Over the last 12 months of data, China bought about $250b of Treasuries, and other central banks bought just about as many. But, by our calculations, the outstanding stock of Treasuries not held at the Fed increased by $1.7 trillion."Setser notes that reserve managers are likely to purchase even fewer treasuries in the next 12 month period than they did in the last. The Fed will purchase more.

4. PFC ENERGY SAYS DEEP WATER EXPLORATION TO SLOW

Dinakar Sethuraman and Ann Koh at Bloomberg report that PFC Energy partner Michael Waters forecast in an interview that deep water oil production is likely to stay flat on relatively low oil prices.

"'The pace of growth will slow and then become flat for the next few years,' Michael Rodgers, a partner at PFC Energy, said in an interview at the Offshore Vessels conference in Singapore yesterday. 'There were not a whole lot of large commercial discoveries in the last couple of years.'5. HOME PRICES CONTINUE TO DECLINE ACROSS THE US

Production from deep water blocks grew 67% a year between 2005 and 2008 following discoveries off Angola and Nigeria. That beat a growth of 1.3% in total crude oil output during the same period.

Global deep water oil production may peak at 7.5 million barrels a day in 2013, Rodgers said."

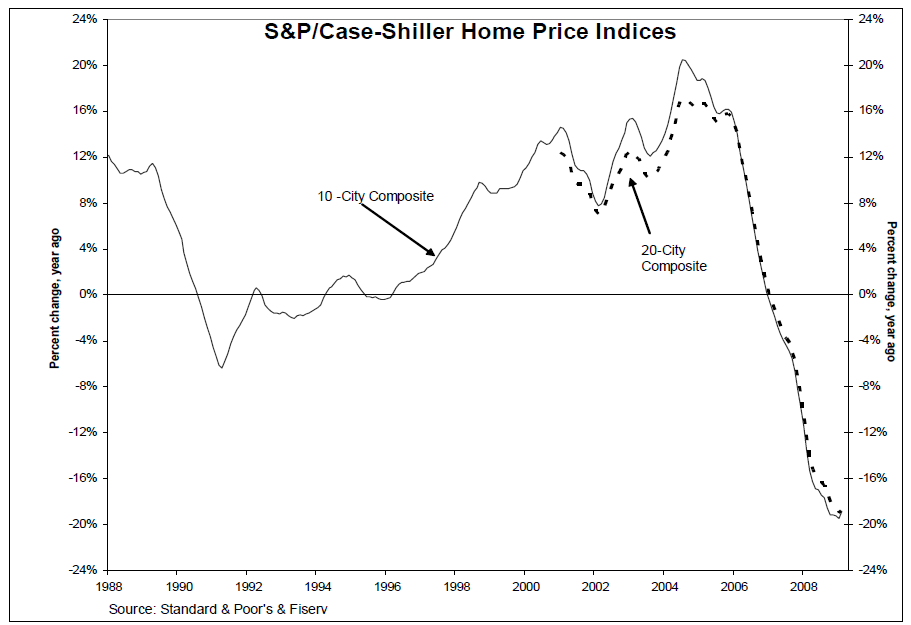

The Case-Shiller home price index continued to post declines in February, according to Phil Izzo at Real Time Economics.

"Phoenix, Las Vegas and San Francisco continued to lead year-over-year decliners, with drops over 30%. Cleveland posted a large month-to-month drop, as the rate of decline accelerated there. The rates of decline also accelerated in Charlotte, New York and Washington."The post includes a sortable chart of the index's readings for all twenty cities and declines from January and from February last year. Barry Ritholtz at the Big Picture posts a chart of the 20 and 10 city indexes from 1988:

No comments:

Post a Comment