The IMF has released its Global Financial Stability Report, the first chapter of which can be found here. I have not had time to read it--it comes in at 72 pages--but from all accounts it is sobering reading. Bob Davis at Real Time Economics comments:

"By that definition [a decline in real per-capita world GDP, backed by industrial production, trade, capital flows, oil consumption and unemployment data], this is the fourth global recession since World War II, and deepest by a long shot. The earlier recessions were in 1975, 1982 and 1991. All were one-year recessions when measured by purchasing power parity, which the IMF favors for global comparisons. Those stats take into account the different cost of goods and services in different countries — for instance, a haircut costs a lot less in Beijing than Boston. Looking at global GDP by the more traditional method using exchange rates, the 1991 recession lasted until 1993.The post has a helpful (sortable) chart of the recessions of 1975, 1982, 1991, and the forecast for 2009 showing the percentage declines for the indicators of per capita output (PPP weighted), industrial production, total trade, capital flows, oil use, and the jobless rate. My own first impression of the oil use indicator is that it is an under-estimation, given the decline seen in 1982, though, as I've said, I haven't had time to investigate the IMF's analysis of that particular indicator.

In 2009, the IMF estimates per-capita GDP will decline 2.5%, using purchasing power parity, compared to a 0.4% contraction, on average, during the three previous recessions. Industrial production, trade, capital flows and oil consumption in the 2009 recession will fall much more sharply than in the previous global recessions, while unemployment will increase more."

In that vein, Vandana Hari at Platts reports that Indian total oil demand rose to 132.4 million tonnes (~ 2.648 mb/d) in the fiscal year ending March 31, or 3.9% from the fiscal year prior.

"The industry had projected a 7% rise in Indian oil consumption in fiscal 2008-09, but the economic downturn that set in during the latter half of 2008 put a damper on consumption, [a senior industry official said late Tuesday.] The 1.5% drop in the combined demand for furnace oil and low sulfur heavy stock to 11.7 million mt in the year ended March 31 was directly related to an industrial slowdown, he said. These heavy products are used as secondary fuel for thermal power plants, as fuel for industrial units and feedstock for fertilizer plants in India."Haris Zamir at Platts reports that Pakistani petroleum products imports were flat for the period from July 2008 to March 2009 over the same period a year earlier, and crude oil imports were down 11.5% for the same period from a year earlier. The story suggests that the fall in prices may support consumption levels from this point on. Winnie Lee at Platts reports that Chinese apparent oil demand is down about 4.5% in the first quarter from a year earlier. China and India are the two places where most incremental demand growth had been seen in recent years.

Platts also published the oil and production data for March over February and from March a year earlier, as per the official government data. I have changed the reporting to a daily basis, as the March over February data can be misleading given that February is about 10% shorter than March:

The 0.7% increase in crude throughput is the first increase seen since November of last year. Further, Eugene Tang and Dinakar Sethuraman at Bloomberg report that China has resumed spot LNG imports on lower prices for the first time in six months.

"China paid about $493 a metric ton, equivalent to about $9.4/MMBtu, on delivered terms for a spot cargo of 58,064 tons from Trinidad & Tobago last month, customs data released today showed.2. SACHS ASSESSES REPORTS ON WATER ECONOMICS

Spot supplies of conventional-sized LNG cargoes to China ceased in October after China National Offshore Oil Corp. paid $20.43.MMBtu, a record, in September for a cargo from Algeria. The emergence of China may prop up spot prices that have fallen 70% from last year’s peak because of the global recession, and divert tankers from the US and Europe.

China imported at least three spot cargoes in April and paid less than $5 per million Btu on a free-on-board basis for a shipment from Russia, according to AIS Live ship-tracking data compiled by Bloomberg and an official. That’s a drop of at least 75 percent from the September record high.

Spot LNG sells for $4.60/MMBtu, a 47% discount to crude oil, JPMorgan Chase & Co. said in a note on April 3. LNG sold for a premium to oil in 2008."

Jeffrey Sachs has an opinion piece in Today's Zaman which argues takes stock of a series of recent studies of the water economies of various countries--The UN World Water Development Report 2009, The World Bank's India's Water Economy: Bracing for a Turbulent Future and Pakistan's Water Economy: Running Dry, and the Asia Society's Asia's Next Challenge: Securing the Region's Water Future--and concludes that the leaders from those societies likely to be most affected need to brainstorm in concert on how best to address the coming problems. Key excerpt:

"[T]he precise nature of the water crisis will vary, with different pressure points in different regions. For example, Pakistan, an already arid country, will suffer under the pressures of a rapidly rising population, which has grown from 42 million in 1950 to 184 million in 2010, and may increase further to 335 million in 2050, according to the UN's 'medium' scenario. Even worse, farmers are now relying on groundwater that is being depleted by over-pumping. Moreover, the Himalayan glaciers that feed Pakistan's rivers may melt by 2050, owing to global warming.Worth reading in full.

Solutions will have to be found at all 'scales,' meaning that we will need water solutions within individual communities (as in the piped-water project in Senegal), along the length of a river (even as it crosses national boundaries), and globally, for example, to head off the worst effects of global climate change. Lasting solutions will require partnerships between government, business and civil society, which can be hard to negotiate and manage, since these different sectors of society often have little or no experience in dealing with each other and may mistrust each other considerably."

3. FRANCE TO INVITE CHINESE PRESIDENT TO VISIT

Carlos Tejada at China Journal links to a China Daily story stating that Paris intends to invite Chinese President Hu Jintao for a state visit, though the link appears broken. The move is part of a thawing of relations between Paris and Beijing after the two released a joint statement stating that "France refuses to support any kind of 'Tibet independence'"--see Daily Sources 4/1 #5.

4. UK DEBT AT HIGHEST LEVEL SEEN SINCE WWII

Julia Werdigier at the New York Times reports that British sovereign debt is slated to reach £175 billion (~$255 billion) in 2009, the highest level since World War II.

"Britain’s net borrowing is expected to reach 11.9% of gross domestic product in 2010 and finances would only balance by 2016. The dismal outlook and rising debt pushed the pound lower against all major currencies on Wednesday and government bonds dropped."5. RUSSIA FURTHER INTEGRATES INTO ITALIAN ENERGY SECTOR

Svetlana Kovalyova at Reuters reports that Gazprom announced that it will purchase downstream assets in Italy from Chevron.

"Gazprom Neft will buy a plant in Bari, southern Italy, which produces 36,000 tonnes of lubricants a year for cars, trucks and other industrial uses, and fuel marketing and sales operations in Rome, the companies said."The move does seem to represent an especial affinity for integration with the Italian energy infrastructure.

6. EGYPT'S FEUD WITH HIZBULLAH WIDENS

Michael Collins Dunn at the MEI Editor's blog reports that Egypt's feud with Hizbullah has now expanded to include official protests to the head of Iran's interests section in Cairo as well as allegations that Lebanon was involved in the plot. In the meantime, Nazila Fathi at the New York Times reports that Tehran made an official announcement via the IRNA news agency that it welcomed talks over its nuclear program, and that it had a proposal ready to resolve the dispute over it.

"The statement also said that Iran would continue its ongoing nuclear work in 'active collaboration' with the United Nations nuclear agency and in the framework of the main international treaty that aims to halt the spread of nuclear weapons and promote peaceful uses of nuclear power.7. CHÁVEZ FURTHER CONSOLIDATES POWER

'The Islamic Republic of Iran will continue its nuclear activities in an active collaboration with the International Atomic Energy Agency in the framework of the NPT, along with other member nations,' it said ... ."

Fausta Wertz at The Compass reports that Hugo Chávez is now moving to oust those governors that have opposed his move to federalize national ports. Manuel Rosales, mayor of Maracaibo, has fled the country and is seeking political asylum in Peru.

"Retired General Raúl Baduel, who brought Chávez to power following the 2002 attempted coup and later was instrumental in defeating Chávez's constitutional referendum in 2007, was arrested at gunpoint on April 7, pending corruption charges. He issued from prison a plea for Venezuelans 'to save democracy,' which was recorded by his son, Raúl Emilio Baduel, with his cell phone. You can watch the video (in Spanish) here."The governor of the state of Miranda, Henrique Capriles Radonski, is being investigated for corruption; Henrique Salas Feo, governor of the state of Carabobo, is being investigated for "promoting secession;" and César Pérez Vivas, governor of the state of Táchira, is having his election challenged. Further, the mayor of Caracas, Antonio Ledezma, has been forced out of his offices by squatters and Chávez has appointed a vice mayor in his place. Well worth reading in full.

8. MEXICAN CRUDE PRODUCTION CONTINUES TO DECLINE

Robert Campbell at Reuters reports that Mexican oil production declined by 7.8% in the first quarter of 2009 from the first quarter of 2008 to 2.667 mb/d.

9. ZIMBABWE STOCKS REBOUND ON RE-DENOMINATION IN DOLLARS, IS THAT, COMBINED WITH RECORD DOLLAR DENOMINATED DEBT ISSUES, A COUNTERPOINT TO THE ALTERNATIVE TO THE DOLLAR MOVEMENT?

In an interesting story vis-a-vis the global movement for an alternative to the dollar on top of record debt issues denominated in dollars, Janice Kew at Bloomberg reports that Zimbabwean stocks have doubled after shares were re-denominated in dollars and the new coalition government took office two months ago.

"'In an economy which continues to be devoid of dollar liquidity the rise has come as a surprise,' Harare-based Danha wrote in the note. 'Interestingly there is still no evidence of significant foreign portfolio inflows, and much of the trade can be attributable to locals.'10. GEITHNER'S SPEECH BEFORE THE ECONOMIC CLUB FAIRLY GLOOMY

The central bank shut down the exchange in November as inflation estimated at 89.7 sextillion percent, a plunge in the Zimbabwe dollar to 12.6 trillion per US dollar and international sanctions against President Robert Mugabe’s regime caused the economy to collapse. A new coalition government was sworn in on Feb. 11 in a power-sharing agreement between Mugabe and opposition leader Morgan Tsvangirai.

Gains have been led by Innscor Africa Ltd., producer of crocodile skin for Gucci Group NV and Prada SpA, Delta Corp., Zimbabwe’s largest beer and beverages maker, and Econet Wireless Holdings Ltd., the country’s biggest mobile-phone operator, according to Renaissance, a Moscow-based brokerage with offices in Africa."

The full text of Secretary of Treasury Tim Geithner's remarks today before The Economic Club of Washington can be found here. Key excerpt:

"The International Monetary Fund now expects the world economy to decline this year for the first time in more than six decades. The 1.3% decline forecast by the IMF represents a sharp deterioration from the roughly 4% annual rate at which the world economy normally would be expected to grow. The lost output could be as high as three to four trillion dollars this year alone.(h/t David Wessel at Real Time Economics.) Worth reading in full.

And those numbers mask grave damage to economies around the world.

Only 17 of the 182 economies followed by the IMF are expected to grow faster this year than they did last year. Some 71--including 30 of the world's 34 advanced economies--are expected to shrink. The collapse of world trade is will likely be the worst since the end of World War II.

Several crucial lessons flow from the simultaneous nature of this crisis.

The rest of the world needs the US economy and financial system to recover in order for it to revive. We remain at the center of global economic activity with financial and trade ties to every region of the globe.

Just as importantly, we need the rest of the world to recover if we are to prosper again here at home. Before the crisis, US exports were among our economy's fastest-growing sectors, accounting for more than 6 million American jobs, or about 5% of total private sector employment in the US. Now, they are one of its fastest-shrinking."

11. MORE SHOES TO DROP IN HOUSING MARKET

The New York Times posts a very illustrative interactive graphic plotting homes prices versus median incomes for twenty cities from the first quarter of 1979 to the second quarter of 2009. In the accompanying article, David Leonhardt notes:

"The glut of foreclosed homes creates a self-reinforcing cycle. Falling prices lead to more foreclosures. Foreclosures lead to an excess supply of homes for sale. The excess supply then leads to further price declines. Jan Hatzius, the chief economist at Goldman Sachs, says that the 'massive amount of excess supply' means that home prices nationwide will probably fall an additional 15%.Barry Ritholtz at the Big Picture quotes from Bloomberg:

This estimate hides a lot of variation, too. In Miami, Goldman forecasts, prices could drop an additional 33%, which is pretty amazing since they’ve already fallen 50% from their 2006 peak."

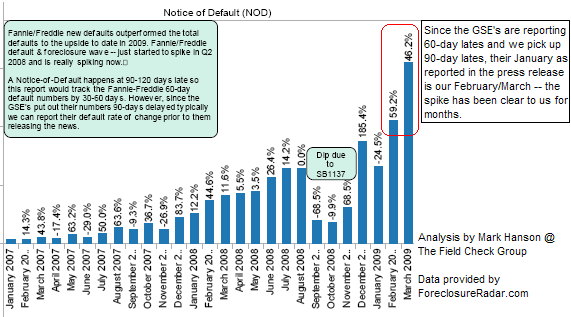

"Fannie Mae and Freddie Mac mortgage delinquencies among the most creditworthy homeowners rose 50 percent in a month as borrowers said drops in income or too much debt caused them to fall behind, according to data from federal regulators . . .Ritholtz links to a chart from the Field Check Group plotting the climb in default notices, remarking: "Note once again these are not Sub-prime or alt-A--they are Prime, the highest quality borrowers possible."

Of all borrowers who ended up in default, 34 percent told Fannie and Freddie they were earning less money, about 20 percent cited excessive debt as a reason for missing mortgage payments, and 8.1 percent blamed unemployment, FHFA said."

12. CARBON TO BE PRICES AT BETWEEN $13-26 A METRIC TON

Simon Lomax at Bloomberg reports that a proposed law to issue carbon emissions permits as a way to reduce greenhouse gas emissions would price carbon dioxide at about $13 to $26 a metric ton by 2015.

"The price range of $13 to $26 a permit was the result of five rounds of economic modeling that each used different assumptions. For 2020, the estimated permit price range is $17 to $33, the agency said. Each permit, also known as an allowance, would give the holder the right to emit the equivalent of one metric ton of carbon dioxide."13. COMMERCIAL CRUDE AND PRODUCTS STOCKS CONTINUE TO GROW

The EIA reports that for the week ended April 17 crude stocks grew by 3.9 million barrels to 370.6 million barrels, the largest stock holdings seen since September 1990. Gasoline stocks grew by 800 kb, and are well above the historical range for this time of year. Distillate stocks grew by 2.7 million barrels, and are behaving completely counter-cyclically. A story by Mark Shenk at Bloomberg quotes Tim Evans, an energy analyst with Citi Futures Perspective in New York:

"There are a large number of financial professionals trading oil who are paying more attention to the equity markets and the U.S. dollar, while ignoring the fundamentals of the oil market. There is nothing subtle about the numbers in today’s report."14. KISSINGER ARGUES THAT FINANCIAL CRISIS FAVORS CONCERT DIPLOMACY

Henry Kissinger has an opinion piece in the Washington Post which argues that the economic crisis favors "concert diplomacy," "in which groupings of great powers work together to enforce international norms." Key excerpt:

"Proliferation is perhaps the most immediate illustration of the relationship between world order and diplomacy. If North Korea and Iran succeed in establishing nuclear arsenals in the face of the stated opposition of all the major powers in the UN Security Council and outside of it, the prospects for a homogeneous international order will be severely damaged. In a world of multiplying nuclear weapons states, it would be unreasonable to expect that those arsenals will never be used or never fall into the hands of rogue organizations. A new, less universal approach to world order would be needed. The next (literally) few years will be the last opportunity to achieve an enforceable restraint. If the United States, China, Japan, South Korea and Russia cannot achieve this vis-à-vis a country with next to no impact on international trade and no resources needed by anyone, the phrase 'world community' will become empty."Whether you agree with him or not, he is always worth reading in full.

No comments:

Post a Comment