Bloomberg reports that in the Ministry of Transport data released yesterday ships unloaded 35% more iron ore in July from July 2008. "Ships unloaded 56.5 million metric tonnes of iron ore in July at major ports." Meanwhile, China Daily reports that property sales across 30 Chinese cities fell by 4% in July from June. Property prices for 70 major Chinese cities rose by 0.8% in June.

"Property transactions in Guangzhou [formerly Canton, the capital of Guangdong province] fell 36% over June. The figure is only half of that of May, said Guangzhou's official property website.Meanwhile, Andrew Batson at the China Journal reports that worries regarding large numbers of unemployed migrant workers have proven overstated. The IMF China mission chief, who visited the country in late May early June, told reporters in a conference call:

'The fall has been triggered by high property prices and shrinking supplies in some cities,' said Qin Xiaomei, head of research, Jones Lang LaSalle Beijing. 'Property developers have slowed down the pace of new projects in the second half after robust sales in the first half,' she said."

"I think our sense is that while there is certainly some dislocation in the labor markets as export sectors in the coastal regions have declined, but in general that process of reallocation of labor has been relatively smooth. Part of it has been that labor has returned back to export sectors, perhaps with some reduction in real wages, and been reabsorbed into those areas.Meanwhile, Bloomberg News reports that the People's Bank of China yesterday in its quarterly monetary policy report warned that the quantitative easing policies of the developed nations threatens to spark sever inflation and currency volatility.

Part of it is that the interior of the country is doing quite well, and so some of that migrant labor has moved geographically across regions to where growth is stronger. And I think we’re seeing right now a dynamic where the historical pattern of very strong growth in the coastal regions and slower than average, national average growth in the interior is reversing, and you’re seeing much stronger growth in rural areas and in the interior provinces. And some of that labor has been reabsorbed into public infrastructure projects."

"Exiting too quickly from such policies, which the Chinese central bank said helped to prevent a repeat of the Great Depression, may undermine an economic recovery, the report said. Waiting for too long may trigger 'a new round of asset bubbles and severe inflation,' the central bank added.2. UK ENERGY SECURITY ENVOY TO RECOMMEND TRIPLING NUCLEAR ELECTRICITY GENERATION CAPACITY; JULY SERVICES INDEX SHOWS SIGNIFICANT IMPROVEMENT

'Central banks in major developed nations face a difficult choice between keeping government bond yields relatively low to promote economic recovery and maintaining currency stability' to protect national creditworthiness, it said."

Robin Pagnamenta at the Times reports that the UK's Prime Minister’s special envoy on energy security, Malcolm Wicks, will publish a report today arguing that Britain should triple the amount of energy it generates from nuclear power. A Times source familiar with the report said it would argue:

"The question is whether or not the same rigor [that is being devoted to cutting emissions] is being applied to energy security.Meanwhile, Vanessa Houlder at the Financial Times reports that the Markit Economics purchasing managers survey of the services sector rose to 53.2 in July from 51.6 in June, it's highest reading since February 2008. It is the third consecutive month with a reading above 50--above 50 indicates expansion and below indicates contraction.

The Government has not been good at asking serious questions about whether or not the UK is in the right place ... It’s a dangerous world and when we emerge from recession there will be a global grab for diminishing supplies of energy. Where is it all going to come from?"

"Analysts welcomed the latest figures as providing more evidence the recession was receding. Vicky Redwood, of Capital Economics, said: 'The latest UK data on both services and manufacturing suggest that a decent recovery is continuing across the economy.'3. TWO RUSSIAN SUBS PATROLLING OFF US COAST

Kevin Daly, of Goldman Sachs, said the 'very strong' services survey was consistent with annualized growth in gross domestic product of between 1.5% and 2%."

Mark Mazzetti and Thom Shanker at the New York Times yesterday reported that two nuclear-powered attack submarines have been patrolling off the eastern coast of the US recently.

"'I don’t think they’ve put two first-line nuclear subs off the US coast in about 15 years,' said Norman Polmar, a naval historian and submarine warfare expert.Galrahn at Information Dissemination notes that the report suggests that the submarines are staying out of the Economic Exclusion Zone--about 200 miles off the coast. He also asks why this information was leaked.

The submarines are of the Akula class, a counterpart to the Los Angeles class attack subs of the United States Navy, and not one of the larger submarines that can launch intercontinental nuclear missiles."

4. PAKISTAN TALIBAN SEES ITSELF AS PROVIDING GOOD GOVERNMENT

Qandeel Siddique at jihadica summarizes an Urdu-language interview of a Taliban commander in Pakistan. Key excerpt:

"The Swati Taliban claims to have the locals on their side: '… We are children of these people and they are our own. We live like brothers. We have a healthy relationship with them where they give us food and shelter, and we cooperate on matters. We are always in touch with the locals and share with them their burdens/grievances. We have built roads [for the Swati people] where in over 60 years the government could not. The locals are happy with us. They no longer need to pay tax to the government. We have build pipelines and provided water to people. [...] Also we resolved decade-long rivalries that had been going on and which the government failed to bring about peace. The Taliban have appointed ulema to solve these cases and bring peace.'5. RUSCORP SIGNS MOU WITH NIGERIAN STATE OIL COMPANY TO PROVIDE SECURITY, MAINTAIN PIPELINE NETWORK

The Swati Taliban assumes the role of a surrogate government by providing its citizen’s basic amenities--roads and water. And of course justice, which the locals feel deprived of, believing that the Pakistani government time and again ignores the developmental needs of this region. On top of this, the commander conjures a horrific picture of the Pakistani army; he pins the blame for collateral damage during warfare on the military--not only do they take innocent lives, they also steal from peoples’ homes."

Uchenna Izundu at the Oil & Gas Journal notes that a Russian security and maintenance company, Ruscorp, has signed a memorandum of understanding with the Nigerian National Petroleum Corp. to monitor the country's pipeline network, improve the existing pipelines as well as build new distribution lines.

6. CHÁVEZ ISSUES DECREE NATIONALIZING EQUIPMENT AND WAREHOUSING FACILITIES AT PORTS

Rainbow Nelson at Lloyd's List reports that Caracas has issued a decree effectively terminating all private concessions at the countries ports, with state-owned companies taking over all equipment and warehousing facilities. (Subscription only, but the headline is a decent datapoint.)

7. CREDIT CARD JUNK MAIL BOTTOMS

Barbara Kiviat at the Curious Capitalist notes that Synovate, a firm which tracks junk mail, has produced a chart--available at her blog--which shows that credit card offers going out underwent a sharp fall from the fourth quarter of 2007, but seem to have bottomed out in the second quarter of 2009.

8. CASH FOR CLUNKERS MOSTLY STIMULUS FOR AUTO INDUSTRY; AUTO INDUSTRY RESPONSIBLE FOR MOST OF MANUFACTURING REBOUND IN JULY; MINUS STIMULUS CONSUMER SPENDING MAY WELL HAVE SHRUNK BY 10% IN 2Q; PROBLEMATIC CONSTRUCTION LOANS LIKELY TO UNDERMINE BANK BALANCES GOING FORWARD

To answer what aim was intended by the cash for clunkers program, see Robert Rapier's R-Squared blog, which notes that the US will consume approximately 72 million gallons less gasoline annually because of the program.

"In the context of the amount of gasoline we use--140 billion or so gallons per year (a bit less now because of the recession)--this amounts to only 0.05% of our annual gas usage. Experts have suggested that making sure tires are properly inflated could save 3% on gas usage, or 60 times the amount saved by "Cash for Clunkers" if the majority of people are driving around on under-inflated tires.Which nicely dovetails with James Hamilton's post on whether there be an economic recovery in the offing, writing:

So, for $1 billion invested in the program, a savings of 72 million gallons means we taxpayers paid $13.89 for each gallon of gasoline/yr saved. Readers know that I am a big fan of much higher fuel efficiency, but $13.89 to save a gallon of gasoline per year? While this benefit will be spread over several years of gasoline savings, surely we can do better than this.

Even if--as one reader suggested--those cars would have been on the road for another 10 years, you are still paying over a buck a gallon for the savings."

"Americans bought 995,000 light vehicles in July, a 16% increase over June and the best monthly report since August 2008. Domestically manufactured light trucks (which includes SUVs) lost market share but still achieved an 8% monthly sales gain. Sales of domestic cars, imported cars, and imported light trucks were all up more than 20% month to month.John Maudlin at the Big Picture quoted from David Rosenberg analysis yesterday:

If we'd seen these kinds of numbers in the absence of the cash for clunkers incentives, I would have viewed it as a strong suggestion that the economic recovery has begun. As is, I'm left wondering, and fundamentally not knowing, whether the auto figures signal the shift we've all been watching for, or sales stolen from September and October and delivered to July."

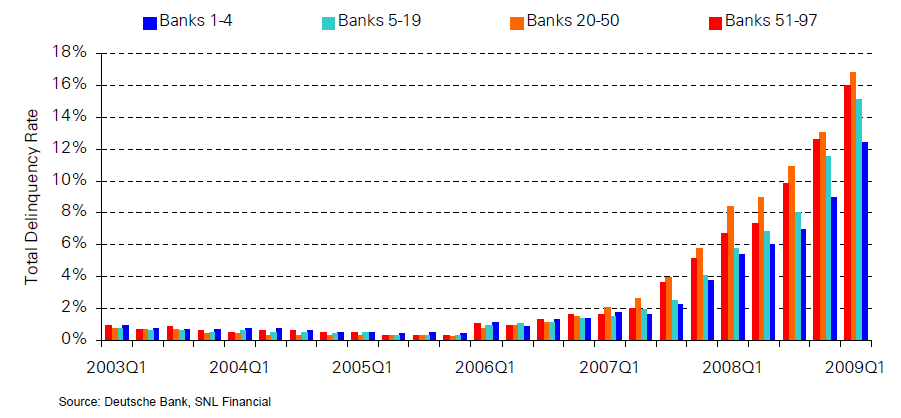

"The details in today’s report left something to be desired. Consumer spending came in at -1.2% annualized, twice the decline expected by the consensus. This occurred in the face of gargantuan fiscal stimulus and leaves wondering how this critical 70% chunk of the economy is going to perform as the cash-flow boost from Uncle Sam’s generosity recedes in the second half of the year. Imagine, government transfers to the household sector exploded at a 33% annual rate, while tax payments imploded at a 33% annual rate and the best we can do is a -1.2% annualized decline in consumer spending in real terms and flat in nominal terms? What do we do for an encore? In the absence of the fiscal largesse, it is quite conceivable that consumer spending would have shrunk at a 10% annual rate last quarter! Nonresidential construction action sagged at an 8.9% annual rate and this was on top of a 44.0% detonation in the first quarter. Ditto for equipment & software ‘capex’ spending, also down at a 9.0% annual rate and this too followed a 36.0% collapse in the first quarter. Residential construction slumped sharply yet again, this time at a 29.0% annual rate. These are the guts of private sector spending and collectively, they contracted at a 3.3% annual rate--the sixth decline in a row. So while there are many calls out there for the recession’s end, it remains a forecast as opposed to a present-day reality."And Barry Ritholtz, also at Big Picture, notes the recent Deutsche Bank report which suggests that construction loans are likely to become a larger problem for the banks over time.

"Construction loans are structured with upfront reserves--meaning that it takes much longer for [Commercial Real Estate] defaults to occur. Low short-term interest rates also means reserves can last longer--BUT, as DB notes, Once reserves are exhausted, defaults will skyrocket."

9. COMMERCIAL CRUDE STOCKS BUILD MORE THAN EXPECTED, GASOLINE PRICES RISE, REFINING UTILIZATION DOWN

The EIA reports that crude oil commercial stocks built by 1.7 million barrels to 349.5 million barrels in the week ended July 31--above the five year historical range for this time of year. A Bloomberg survey had the median expectation of analysts at a 600,000 barrel build. Gasoline stocks fell by 200,000 barrels, are at the top of the historical range, and versus analyst expectations of a 800,000 barrel draw. Distillate stocks fell by 1.1 million barrels and at 161.5 million barrels are 28.2 million larger (or 21.2% more) than the comparable stock level seen last year--well above the five historical range. Analysts had expected a 1.23 million barrel build. Refining utilization fell to 84.54% from 84.57% the previous week. The national average of regular gasoline prices rose 5.4¢ to $2.557/gallon in the week ended August 3. (People tend to start driving less at prices between $2.50-$3.00/gallon.) The report also includes a helpful explanation of why refinery outages on the Gulf Coast have a large effect upon national prices.

10. POTATOES MAY ACCOUNT FOR AS MUCH AS 22% OF POPULATION GROWTH AND 47% OF URBANIZATION IN THE 18TH AND 19TH CENTURIES

Nathan Nunn and Nancy Qian at VoxEU argue that the introduction of new world crops to the old world--and in particular the potato--is in great part responsible for the population explosion and urbanization from 1800:

"The traditional explanation for the rise in population is that medical advances, such as the understanding of the germ theory or the innovation of vaccinations, and improvements in public sanitation greatly decreased infant and child mortality, which in turn led to an increase in population (e.g. Preston, 1975, 1980, 1996; Cutler, Deaton and Lleras-Muney, 2005, 2006). However, in recent years, scholars such as Thomas McKeown (1976) and Robert Fogel (1984, 1987, 1994, 2004) have argued that the increase in population was mostly due to an improvement in nutrition rather than the advances in medicine or sanitation. McKeown argued that the decline in mortality began to occur well before the most important innovations such as antibiotics or vaccinations, which did not become prevalent until the 20th century, and therefore, there is scope for other factors to contribute to the rise in population. Fogel argued that since height is positively correlated with nutritional investment during childhood as well as lower mortality rates, then the observation that heights in America and the UK were increasing is evidence that nutrition was improving during this period.

If Fogel is right, then we have to ask what caused the improvements in nutrition. Certainly, improvements in agricultural technology are part of the story. During this time, a number of productivity-enhancing technologies were developed. Examples include the seed drill, the threshing machine, and the Rotherham swing plough.

In recent research, we argue that another main contributor was the discovery of New World food crops, namely, the potato (Nunn and Qian 2009). Potatoes are extremely nutritious and a very 'cheap' source of calories. They produced much higher yields per acre relative to pre-existing Old World staple crops. Historical survey data from England show that if a family of four were to subsist on only one crop, it would require 66% less land if it were to plant potatoes rather than staples such as barley, wheat, or oats (Young, 1771). Potatoes are also easy to store and were popular as fodder for livestock through the winter. Therefore, cultivating potatoes also indirectly improved protein intake. The diffusion of potatoes also had a tremendous impact on nutrition in the Old World because vast land areas in Northern Europe, Asia, and high altitude areas of Africa were suitable for cultivating potatoes. Figure 2 maps suitability for potato cultivation. Yellow and brown colored regions are suitable. Darker colored regions are more suitable."

No comments:

Post a Comment