Monday, October 26, 2009

Wednesday, August 12, 2009

Dear Readers

I am not exactly signing off, but I am beginning law school, which will basically mean for much less frequent posting. Daily Sources will likely become Intermittent Sources and I will probably write longer pieces dedicated to specific subjects, much as I did at the very start. It is one of my ways of trying to keep abreast of developments in those subjects that I find interesting, so I am not entirely abandoning the blog project, but I simply will not have as much opportunity to devote as much time and energy to it in the future.

All the best,

-- Freude Bud

All the best,

-- Freude Bud

Friday, August 7, 2009

Daily Sources 8/7

1. BALTIC DRY INDEX FALLS 17% ON REDUCED CHINESE DEMAND FOR COAL AND IRON, FUEL OIL--USED FOR SHIPS AND ELECTRICITY GENERATION--SWITCHING INTO CONTANGO ON INCREASED SUPPLY AND FALLING DEMAND, CRUDE RUNS SLIGHTLY DOWN IN CHINA ON 7% INCREASE IN PRODUCT INVENTORIES IN JUNE, AND THE SECOND-LARGEST CHINESE BANK WILL REDUCE NEW LENDING BY 70% IN 2H 2009

Alaric Nightingale at Bloomberg reports that the Baltic Dry Index fell by 17% this week on reduced Chinese demand for coal and iron.

(h/t Yves Smith at naked capitalism.) In that vein, Jonathan Nonis at Platts reports that the 180 CST fuel oil--mostly used for power generation or marine fuel--appears to be set to switch into contango--where the nearby in time price is less than the future price--on increasing supply and less-than-expected demand.

and 7.1% respectively at the end of June from the end of May.

2. INDONESIA TO CUT SUBSIDIES ON FOSSIL FUELS WITHIN A YEAR

Yvonne Chan at Business Green reports that the head of Indonesia's National Council on Climate Change, Agus Purnomo, told Reuters last week that Jakarta was likely to reduce subsidies for fossil fuels within a year.

3.GERMAN EXPORTS UP 7% IN JUNE FROM MAY, DOWN 22.3% FROM JUNE 2008, IMPORTS UP 6.8%

Der Spiegel reports that Germany's Federal Statistics Office announced today that the country's exports were up 7% in June from May, but down 22.3% from June 2008.

James Allen at Platts reports that Russian electricity demand fell by 6.6% in the first seven months of the year, but have risen 4.2% in July from June. Year over year demand was down 5.7% in July.

Doris Leblond at the Oil & Gas Journal report that The European Commission, European Bank for Reconstruction and Development (EBRD), European Investment Bank (EIB), and World Bank

5. UK ENERGY SECURITY REPORT

The recent report by Malcolm Wicks commissioned by UK Prime Minister Gordon Brown on British energy security can be found here. I have not been able to read it, but it was reported that it calls for trebling the amount of nuclear electrical generation in the country--see Daily Sources 8/5 #2.

6. INTERNAL ISRAELI MEMO CRITICAL OF NETANYAHU'S PUBLIC STAND ON SETTLEMENTS

Mark Lavie at the Associated Press reports that an internal memo by the Israeli Consul to Boston which criticized the Netanyahu administration for taking a combative stance with Washington regarding the settlements issue was leaked to an Isreali TV station, which read the report on air. The memo said the disagreement was causing "strategic damage to Israel." It goes on to say:

Chris Stanton at the National reports that Kuwait's first cargo of LNG has arrived at its terminal, making it for the first time a net natural gas importer.

Felix Onuah at Reuters reports that

EFE News Services reports that Brazilian Planning Minister Paulo Bernardo da Silva on Wednesday indicated that the US National Security Advisor, Gen. James Jones, indicated that the US was prepared to offer $10 billion in loans to develop the country's sub-salt reserves off its coast.

Sheila McNulty at FT Energy Source reports that Chevron has invented an innovative carbonated steam flood technology to enhance recovery from oil fields--Berstein Research says it could several times over.

11. UNEMPLOYMENT DOWN TO 9.4% IN JULY FROM JUNE, PRIVATE SECTOR HAS ADDED ZERO NEW JOBS IN 10 YEARS

Justin Fox writes that the July monthly employment report by the Bureau of Labor Statistics showed that non-farm employment was

Jim Tankersley at the Los Angeles Times reports that the federal government yesterday released its most comprehensive study yet of melting glaciers in North America which showed that their rate of shrinkage is accelerating.

Alaric Nightingale at Bloomberg reports that the Baltic Dry Index fell by 17% this week on reduced Chinese demand for coal and iron.

"'The Chinese have backed off and it’s starting to show in the number of shipments this month,' Gavin Durrell, a Cape Town-based official at Island View Shipping SA, Africa’s biggest commodities shipping line, said by phone today. 'Iron ore and coal seem to be slowing down.'

China’s record coal and iron ore imports in the first half helped the index to advance as much as fivefold this year, reversing some of the record 92% collapse in 2008. Demand rose after the country’s government announced a 4 trillion yuan ($586 billion) stimulus package."

(h/t Yves Smith at naked capitalism.) In that vein, Jonathan Nonis at Platts reports that the 180 CST fuel oil--mostly used for power generation or marine fuel--appears to be set to switch into contango--where the nearby in time price is less than the future price--on increasing supply and less-than-expected demand.

"By 11.00 am Singapore time (0300 GMT) the September/October 180 CST spread was pegged at parity, down 50 cents/mt from the Asian close on Thursday. The last time the prompt 180 CST spread had been in contango at the Asian close was on June 16 at minus 50 cents/mt.In late July fuel oil prices rose to nearly the cost of crude--see Daily Sources 7/28 #8. Meanwhile, Jim Bai and Aizhu Chen at Reuters report that Chinese refiners will cut very slightly crude runs in August to

The weaker market structure on the utility grade also dampened the structure for the 380 CST bunker grade with the September/October 380 CST spread narrowing to 1.50/mt, from $2.20/mt on Thursday's close.

The softer fuel oil sentiment is brought about by larger Western arbitrage volumes in August and September, while demand over the same period is expected to decline on higher outright fuel oil prices, traders said.

Between 3.2 to 3.5 million mt of fuel oil is expected to arrive in Singapore in August, while September volumes were said to be in the range of 3.6-3.7 million mt. Meanwhile, the higher fuel oil prices--prompted by the sharp rise in crude prices--in recent weeks has had a negative impact on bunker demand in Singapore as well as regional buyers.

Reflecting this, heavy distillate stocks in landed storage in Singapore recovered from a seven-month low by a massive 5.26 million barrels (800,000 mt) to 19.320 million barrels for the week ended August 5, data from IE Singapore showed."

"2.63 mb/d of crude oil in August, down marginally from 2.65 mb/d in July.Gasoline and diesel stocks held by CNPC and Sinopec rose by 7.7%

The August volume would represent around 88% of their total refining capacity."

and 7.1% respectively at the end of June from the end of May.

"'Demand is not as high as what is being supplied,' a refinery official in east China also said, declining to be named as he is not authorized to speak to the media.Meanwhile, Bloomberg News reports that the President of China's second-largest bank, the China Construction Bank, Zhang Jianguo, said that it would reduce new loans by 70% in the second half of 2009.

'Some plants may just want to accomplish their full-year plan after a slow start this year,' he added."

"'We noticed that some loans didn’t go into the real economy,' Zhang, 54, said in an interview yesterday at the bank’s headquarters in Beijing. 'I feel that some industries are expanding too rapidly. For example, housing prices are rising too fast, and housing sales are growing too fast.'"

"Construction Bank is one of the main beneficiaries of demand for infrastructure loans induced by China’s 4 trillion yuan economic stimulus package. Established in 1954 to fund building of roads, bridges, dams and other infrastructure, it was the nation’s biggest mortgage lender until the first half of 2008, when ICBC pushed it to second place."The People's Bank of China in its recent quarterly monetary report announced that it would continue its policy of easy credit--see Daily Sources 8/6 #2.

2. INDONESIA TO CUT SUBSIDIES ON FOSSIL FUELS WITHIN A YEAR

Yvonne Chan at Business Green reports that the head of Indonesia's National Council on Climate Change, Agus Purnomo, told Reuters last week that Jakarta was likely to reduce subsidies for fossil fuels within a year.

"Some economists have forecast that fossil fuel consumption would drop by one-fifth if the subsidy were scrapped entirely. However, the complete removal of the subsidies is highly unlikely, given that previous cuts have led to social unrest.Subsidies on propane, for example, which is used for cooking, and especially by the poor, are very difficult to scrap given the consequences.

Purnomo said a subsidy would continue to exist but would be 'below the distortion level that discourages renewable energy'."

3.GERMAN EXPORTS UP 7% IN JUNE FROM MAY, DOWN 22.3% FROM JUNE 2008, IMPORTS UP 6.8%

Der Spiegel reports that Germany's Federal Statistics Office announced today that the country's exports were up 7% in June from May, but down 22.3% from June 2008.

"[I]t was the biggest rise in exports since September 2006, when the figure was 7.3%. Experts had only anticipated a 1.1% rise after the figures were seasonally adjusted. The figure in May was a mere 0.2% gain."

"The Federation of German Wholesale and Foreign Trade (BGA) is forecasting an 18% slump in export sales for 2009, the first contraction since 1993 and the largest in postwar history. For 2010, BGA president Anton Börner is anticipating a return to growth of 5 or 10%.3. RUSSIAN ELECTRICITY DEMAND UP 4.2% IN JULY FROM JUNE ON INCREASING INDUSTRIAL DEMAND

Imports to Germany were also up slightly in June, climbing by 6.8% compared to the previous month. In total, goods valued at €56.3 billion euros were imported--17.2% less than the same period in 2008."

James Allen at Platts reports that Russian electricity demand fell by 6.6% in the first seven months of the year, but have risen 4.2% in July from June. Year over year demand was down 5.7% in July.

"'We think the July increase in consumption may be a sign of economic recovery in Russia given the increasing capacity utilization being observed in some industries, particularly the metals sector,' said analysts at Alfa Bank in a daily briefing Friday.4. UKRAINE TO RECEIVE INTERNATIONAL FINANCING TO COVER PAYMENTS FOR GAZPROM GAS

Consumption in the Southern Russian, Mid-Volga and industrialized Urals Integrated Power Systems rose, respectively, 10.7%, 7.2% and 4.8% month on month while electricity demand in the northwestern region stayed flat after falling 7.6% month on month in June."

Doris Leblond at the Oil & Gas Journal report that The European Commission, European Bank for Reconstruction and Development (EBRD), European Investment Bank (EIB), and World Bank

"have agreed to cooperate on a support package to help Ukrainian authorities develop 'sustainable solutions to Ukraine's medium-term gas transit payment obligations,' and to continue to 'support Ukraine's economic stabilization reform, including reform of the gas sector and accompanying reform of the social safety net,' according to a joint statement by the organizations."The EIB and the EBRD are each considering loan packages of as much as $450 million; the World Bank is considering committing as much as $500 million.

5. UK ENERGY SECURITY REPORT

The recent report by Malcolm Wicks commissioned by UK Prime Minister Gordon Brown on British energy security can be found here. I have not been able to read it, but it was reported that it calls for trebling the amount of nuclear electrical generation in the country--see Daily Sources 8/5 #2.

6. INTERNAL ISRAELI MEMO CRITICAL OF NETANYAHU'S PUBLIC STAND ON SETTLEMENTS

Mark Lavie at the Associated Press reports that an internal memo by the Israeli Consul to Boston which criticized the Netanyahu administration for taking a combative stance with Washington regarding the settlements issue was leaked to an Isreali TV station, which read the report on air. The memo said the disagreement was causing "strategic damage to Israel." It goes on to say:

"In the distance created between us and the US administration, there are clear implications for Israel's deterrent capabilities. ...7. KUWAIT BECOMES NET NATURAL GAS IMPORTER

There have always been differences between the governments, but coordination was always maintained. Now there is the feeling in Washington that Obama has to deal with obstinacy from the governments of Iran, North Korea and Israel. ...

The US administration makes efforts to lower the profile of the disagreements, but ironically, we are the source of the public disputes. ...

The standing of American Jews is also being damaged ... . The perception of confrontation between the governments of Israel and Obama puts the American Jewish community, which is so important to us, in a problematical position. The confrontation is distancing many from Israel."

Chris Stanton at the National reports that Kuwait's first cargo of LNG has arrived at its terminal, making it for the first time a net natural gas importer.

"Officials say LNG is an interim solution to plug the summer deficit, when consumption of gas at power stations spikes. Domestic supplies under development by Kuwait Oil Company (KOC) will eventually supplant the imports, the government said in June when it signed a supply contract.8. 32 MEMBERS OF MEND MEET WITH NIGERIAN PRESIDENT ON AMNESTY PROGRAM

But imports could be necessary for years to come, given the difficulty Kuwait will face in raising domestic production, said Raja Kiwan, an analyst at PFC Energy, a US-based consultancy."

Felix Onuah at Reuters reports that

"[t]hirty-two members of the Movement for the Emancipation of the Niger Delta (MEND) led by the group's leader in Bayelsa state--Ebikabowei Victor Ben, known locally as Boyloaf--met Yar'Adua at the presidential villa in the capital Abuja.9. US TO PROVIDE $10 BILLION IN FINANCING FOR BRAZIL'S EXPLOITATION OF PRE-SALT FIELDS, BRAZIL AND PERU CONSIDERING $15 BILLION IN HYDROELECTRIC PROJECTS

'We on our part in the spirit of fair bargain hereby declare and agree to lay down our arms for this administration to immediately commence the other part of the bargain,' Ben said."

EFE News Services reports that Brazilian Planning Minister Paulo Bernardo da Silva on Wednesday indicated that the US National Security Advisor, Gen. James Jones, indicated that the US was prepared to offer $10 billion in loans to develop the country's sub-salt reserves off its coast.

"He said the US Export-Import Bank already has signed a letter of intent in that regard with Brazilian state oil company Petrobras.Meanwhile, Andre Soliani Costa and Alex Emery at Bloomberg report that the Brazilian Energy Minister, Edison Lobao, told reporters that Brazil and Peru are considering five hydroelectric projects that may cost as much as $15 billion.

The loan is equal in value to a similar credit line agreed to with the China Development Bank, also for exploiting Brazil's 'pre-salt' area, so-named because the estimated 80 billion barrels of high-quality crude in that new oil frontier lie far beneath the ocean floor under layers of rock and an unstable salt formation."

"'We need to have energy, to ensure Brazil’s energy security,' Lobao said. 'Whatever exceeds Peruvian needs will be exported to Brazil, which may re-ship the energy to other neighboring countries.'10. NEW ENHANCED RECOVERY TECHNOLOGY DEVELOPED BY CHEVRON MAY SUBSTANTIALLY INCREASE THEIR BOOKABLE BARRELS

Brazil is expanding its electricity grid to link jungle dams to industrial centers and reduce costly diesel-fuel generation. Latin America’s largest economy needs to boost its generating capacity by 50% in 10 years to 150,000 megawatts, Lobao said in March."

Sheila McNulty at FT Energy Source reports that Chevron has invented an innovative carbonated steam flood technology to enhance recovery from oil fields--Berstein Research says it could several times over.

"It notes in a new report that the Middle East has many other examples of large scale heavy and intermediate oil accumulations trapped within carbonate reservoirs, and the role of steam assisted recovery in accessing these resources is only just getting started.Berstein estimates that the new method of enhancing recovery could increase Chevron's booked barrels quite substantially,

Chevron’s technology works by pumping steam into the carbonate reservoir, which heats up the heavy oil in the reservoir, reducing its viscosity so that it can more easily flow. At the same time it creates a pressure gradient, which pushes the oil towards vertical production wells.

Chevron this year began testing the technology in the partitioned neutral zone between Saudi Arabia and Kuwait, in which Chevron owns a 50% share of the resources."

"this could equate to an additional 600-1,800 million barrels of oil equivalent of booked reserves being added over a number of years. This equates to approximately 5%-16% of Chevron’s 2008 end of year reserve base."Worth reading in full.

11. UNEMPLOYMENT DOWN TO 9.4% IN JULY FROM JUNE, PRIVATE SECTOR HAS ADDED ZERO NEW JOBS IN 10 YEARS

Justin Fox writes that the July monthly employment report by the Bureau of Labor Statistics showed that non-farm employment was

"down 247,000 in July—compared with 395,000 in June and an average of 645,000 during the dark months of November through April."The official unemployment rate fell to 9.4% from 9.5% in June. The U-6 number, for "marginally attached workers," also fell.

"Without the seasonal adjustments, employment fell a whopping 1.3 million in the month. And there were 5.9 million fewer jobs in July 2009 than in July 2008.'Floyd Norris at the New York Times reports that for the first time since the Great Depression, the US has added virtually zero jobs in the private sector.

"Until the current downturn, the long-term annual growth rate for private sector jobs had not dipped below 1% since the since the early 1960s. Most often, the rate was well above that."12. NEW FED REPORT SHOWS RATE OF GLACIERS MELTING IN NORTH AMERICA ACCELERATING

Jim Tankersley at the Los Angeles Times reports that the federal government yesterday released its most comprehensive study yet of melting glaciers in North America which showed that their rate of shrinkage is accelerating.

"For five decades, USGS researchers have periodically measured the glaciers' size with tools including measurement stakes and photographic surveys. Their data include tallies of winter snow accumulation and summer melt.

In each case, the data show that summer melting accelerated in the last 20 years. At the same time, winter snowpacks have tapered off. The reduced accumulations and increased melts have resulted in shrinking glaciers.

South Cascade Glacier, for example, had a volume of nearly 0.06 cubic mile of water in 1958, Josberger said. By 2008, it was down to 0.03 cubic mile.

When glaciers shrink, water runoff declines, setting the stage for drier conditions in the region, particularly at the end of summer, when other supplies of water dwindle."

Thursday, August 6, 2009

Daily Sources 8/6

1. JAPANESE GOVT REPORT COMPARES PARTY PLANS FOR GREENHOUSE GAS EMISSIONS REDUCTIONS ON ECONOMY

Yoko Kubota at Reuters reports that the plan by Japanese opposition party to cut greenhouse gas emissions by 25% from 1990 levels by 2020 would, per a government report, "push down real gross domestic product growth by 3.2 percentage points and the unemployment rate could grow by 1.3 percentage points." The government plan for an 8% reduction from 1990 levels by 2020 would, per the report, "push down Japan's economic growth by 0.6 percentage points and raise unemployment by 0.2 percentage points in 2020."

2. PBOC'S MONETARY REPORT INDICATES EASY CREDIT POLICY TO CONTINUE, MINISTRY OF HUMAN RESOURCES WARNS EMPLOYMENT SITUATION GRAVE, ELECTRICITY DATA SHOWS STEEP FALLS IN CONSUMPTION, BANKS LEND LESS IN JULY CONTRA PBOC REPORT, AND BP SAYS GDP DATA MORE OR LESS TRUSTWORTHY

Andrew Batson at the Wall Street Journal reports that the People's Bank of China's quarterly monetary report reaffirmed its commitment to continuing easy credit policies.

3. GERMAN FINANCE MINISTER SAYS FINANCIAL SECTOR RETURNING TO 'CASINO CAPITALISM', ECB MAINTAINS BENCHMARK RATE AND INDICATES THERE WILL BE NO ADDT'L STIMULUS

Der Spiegel reports that Finance Minister Peer Steinbrück is in the media warning against the return of 'casino capitalism.' Among other comments, he said:

Niel Shah at the Wall Street Journal reports that the Bank of England today announced it would expand its quantitative easing program, increasing purchases by £50 billion (~ $85 billion) to a total of £175 billion.

5. GEORGIAN AND RUSSIAN OFFICIALS TRY TO CALM WORRIES ABOUT NEW FIGHTING BREAKING OUT, SAAKASHVILI LAYS BLAME FOR 2008 CONFLICT ON MOSCOW IN OP ED

Jim Heintz at the Associated Press reports that senior officials in Tblisi and Moscow are walking back from rhetoric suggesting the possibility of renewed fighting.

Nicholas Birch at the Wall Street Journal reports that Prime Minister Recep Tayyip Erdogan of Turkey met with the leader of the main Kurdish party in the country Wednesday, in what is the first meeting of the head of government with the party in the country's history.

Yee Kai Pin at Bloomberg reports that the National Iranian Oil Company will reduce the official selling price of Iranian Light into Asia for the first time in four months.

8. DUBAI'S PROPERTY PRICE COLLAPSE SHARPEST IN WORLD

Kevin Brass at the New York Times reports that Dubai's property market is leading the world in price collapse.

Dulue Mbachu at Bloomberg reports that the leader of Nigerian militant group MEND indicated in a telephone interview that most fighters want to accept the government's amnesty program, saying "Like the government, we also want peace for there to be development."

Tom Burgis at FT Energy Source reports that many believe that the current numbers for oil production coming from official Nigerian government sources are deliberately understated.

Helder Marinho and Alexander Ragir at Bloomberg report that the Brazilian Senate's investigation into tax evasion and corruption allegations against state oil company Petrobras began today.

11. VENEZUELA TO PURCHASE SEVERAL DOZEN TANKS FROM RUSSIA, BANS COLOMBIAN STATE OIL COMPANY FROM PARTICIPATION IN ORINOCO BELT

Fabiola Sanchez at the Associated Press reports that President Hugo Chávez in a news conference yesterday said that Venezuela was going to purchase several dozen Russian tanks in a deal he wants to seal during a visit to Russia in September.

Nick Timiraos at Developments reports that 24% of owner-occupied homes had mortgage debt which exceeded the market value of the home in question at the end of June, according to data from Equifax and Moody’s Economy.com.

And b) that the Daily Treasury Statement of August 4 "shows that the 1-month cumulative sum of income tax receipts (withheld plus paid taxes) is dropping at a 13% annual pace." She comments:

13. RAIL TRAFFIC VOLUMES BOTTOMED OUT AT 18.9% BELOW LAST YEAR'S NUMBERS

The Railfax report is out today, and seems to indicate that rail traffic volumes have reached a bottom and holding steady at about 18.9% below their seasonal levels. Their chart for weekly loaded units in North America for the week ended August 1 in four week rolling averages:

Their chart for crushed stone and lumber and wood products, key components in construction, in four week rolling averages for North America:

Yoko Kubota at Reuters reports that the plan by Japanese opposition party to cut greenhouse gas emissions by 25% from 1990 levels by 2020 would, per a government report, "push down real gross domestic product growth by 3.2 percentage points and the unemployment rate could grow by 1.3 percentage points." The government plan for an 8% reduction from 1990 levels by 2020 would, per the report, "push down Japan's economic growth by 0.6 percentage points and raise unemployment by 0.2 percentage points in 2020."

2. PBOC'S MONETARY REPORT INDICATES EASY CREDIT POLICY TO CONTINUE, MINISTRY OF HUMAN RESOURCES WARNS EMPLOYMENT SITUATION GRAVE, ELECTRICITY DATA SHOWS STEEP FALLS IN CONSUMPTION, BANKS LEND LESS IN JULY CONTRA PBOC REPORT, AND BP SAYS GDP DATA MORE OR LESS TRUSTWORTHY

Andrew Batson at the Wall Street Journal reports that the People's Bank of China's quarterly monetary report reaffirmed its commitment to continuing easy credit policies.

"'China's economy is now in a critical period of stabilization and recovery, and maintaining stable and rapid economic growth is still the most important task we face ... . Although the general trend of stabilization in the [global] economy has been basically established, the process of recovery may be slow and tortuous.'In a somewhat different take on the question of whether migrant unemployed in China are a reason to worry from the story cited yesterday--see Daily Sources 8/5 #1--Yves Smith links to an AFP report that

With global demand for China's exports still weak, a solid rebound depends on domestic consumption and investment, the central bank said. Chinese companies may be more willing to ramp up production now that inventories have been reduced.

Sentiment among private-sector businesses remains weak, it said, and consumers' worries about future income could crimp spending. 'The foundation of the economic recovery is not yet stable,' it said, echoing other agencies' recent comments."

"China Tuesday warned of a 'grave' situation in the jobs market with millions of graduates and migrant workers yet to find work as companies continue to struggle with the effects of the global slump...She also notes that:

'China's current employment situation is still grave and the pressure for job creation remains large,' said Wang Yadong, a senior official at the Ministry of Human Resources and Social Security's employment section."

"First-half electricity use by small and medium-sized enterprises fell almost 50% year-on-year, as these companies were more exposed to the economic downturn, the National Bureau of Statistics said on August 3.And in contrast to the affirmation of the People's Bank of China in its quarterly report mentioned above:

SMEs saw power consumption plunge 48.9% year-on-year, against a 5.9% industry-wide drop."

"China's big state-owned commercial banks extended around 168 billion yuan worth of new loans in July, down sharply from the 497 billion issued in June, banking sources told Caijing on August 4."And she picks up on the story in the FT yesterday that if you add up the output numbers of the various provinces, they are 10% more than overall national output as reported by Beijing. And to muddy the waters further, Sheetal Nasta at Platts reports that the chief Asia economist of BP, Chi Zhang, said at an event at the British Chamber of Commerce in Shanghai Wednesday that

"'in general, [the] data reflects economic growth reality,' given that China is 'very manufacturing intensive and there has been a lot of industrialization and an urbanization process is going on.'The continuing incredulity regarding official output growth numbers in China was driven by the disparity between the electricity consumption numbers, which are no longer published--see Daily Sources 6/8 #6--later reinforced by skepticism expressed in the May report by the International Energy Agency which suggested that oil demand would have been stronger than reported if it were to reconcile with the GDP numbers and suggested the possibility that "Real GDP data aren’t accurate and shouldn’t be taken at face value"--see Daily Sources 5/14 #2.

While he admitted the Chinese have been likely 'taking advantage of low energy prices,' he retreated from the notion that government stockpiling was inflating prices.

Speaking of the oil price spike in 2008, he said data from BP's annual statistical review, issued earlier this year, shows that the 'big spike' in (price) coincided with related economic activity, primarily supply-side constraints due to investment shortfalls, geopolitical issues and few technological breakthroughs."

3. GERMAN FINANCE MINISTER SAYS FINANCIAL SECTOR RETURNING TO 'CASINO CAPITALISM', ECB MAINTAINS BENCHMARK RATE AND INDICATES THERE WILL BE NO ADDT'L STIMULUS

Der Spiegel reports that Finance Minister Peer Steinbrück is in the media warning against the return of 'casino capitalism.' Among other comments, he said:

"In the United States and Britain, lobbyists are already questioning some regulatory measures."and, in Germany,

"Taxpayers are continuing to completely finance big bonuses [at banking firms]."Meanwhile, Christian Vits and Simone Meier at Bloomberg report that European Central Bank president Jean-Claude Trichet indicated that the bank is unlikely to provide further stimulus after its monetary committee left the benchmark interest rate at 1%.

"Rates are 'appropriate' and policy makers are 'satisfied' with their asset-purchase program and measures to improve the flow of credit, he said."

"The ECB currently predicts the euro-region economy will contract about 4.6% this year and 0.3% in 2010. Inflation will average about 0.3% this year and 1% in 2010. The bank aims to keep inflation just below 2%."4. BANK OF ENGLAND TO EXPAND QUANTITATIVE EASING, LONDON TO REPLACE SHORT HAUL AVIATION WITH HIGH SPEED RAIL

Niel Shah at the Wall Street Journal reports that the Bank of England today announced it would expand its quantitative easing program, increasing purchases by £50 billion (~ $85 billion) to a total of £175 billion.

"The increase required the bank to get special permission from the UK Treasury, which had previously capped the program at £150 billion.

The expansion of the program suggests policy makers are still worried about the long term outlook for the UK economy despite a recent spate of positive data pointing to recoveries in house prices, manufacturing and services."

"While banks' reserves of cash have more than tripled since the central bank launched the program back in March, one broad measure of lending in the economy--M4 money supply excluding certain financial intermediaries--has hardly budged. In the second quarter, the measure was up just 3.1% from the same period a year earlier, the weakest expansion since 1999.Meanwhile, Dan Milmo and Julian Glover at the Guardian report that Downing Street has announced plans which would replace domestic air travel with a high speed--250 mph--rail.

Beyond that, rising unemployment and peoples' efforts to pare down heavy debt loads are likely to weigh on consumer spending, by far the largest driver of demand in the UK economy. As of May, the UK unemployment rate stood at 7.6%, the highest level in 12 years."

"The transport secretary, Lord Adonis, said switching 46 million domestic air passengers a year to a multibillion-pound north-south rail line was 'manifestly in the public interest'. Marking a government shift against aviation, Adonis added that rail journeys should be preferred to plane trips.

'For reasons of carbon reduction and wider environmental benefits, it is manifestly in the public interest that we systematically replace short-haul aviation with high-speed rail. But we would have to have, of course, the high-speed network before we can do it,' he said."

5. GEORGIAN AND RUSSIAN OFFICIALS TRY TO CALM WORRIES ABOUT NEW FIGHTING BREAKING OUT, SAAKASHVILI LAYS BLAME FOR 2008 CONFLICT ON MOSCOW IN OP ED

Jim Heintz at the Associated Press reports that senior officials in Tblisi and Moscow are walking back from rhetoric suggesting the possibility of renewed fighting.

"The deputy chief of Russia's general staff says Georgia is too weak after the war that devastated its military and caused an estimated $1 billion damage to the struggling country.In the meantime, Georgian President Mikheil Saakashvili has an op ed in today's Washington Post which lays the blame on last year's conflict squarely on Russia. Key excerpt:

Georgia's national security adviser, however, says the danger of new fighting appears low because of 'preventive diplomacy' and because Russia knows a new war would undermine its influence among neighbors and rapprochement with the West."

"Russian provocations have not stopped; snipers in Russian-controlled areas have killed 28 Georgian policemen. In recent days, Moscow has engaged in a series of provocative acts and statements, echoing its prelude to last year's invasion. Even as the world watches, Moscow has vetoed monitoring missions from the United Nations and the Organization for Security and Cooperation in Europe. In violation of the cease-fire, Russia also denies European Union monitors access to the occupied territories.6. TURKISH PM MEETS WITH HEAD OF LARGEST TURKISH KURD PARTY, ANKARA SIGNS ON TO SOUTH STREAM

Despite all this, and contrary to some expectations, Georgia has rebounded. Our democratic institutions are growing. Foreign investors are returning. The world should recognize that the kind of behavior Russia exhibited last August threatens not only Georgia but our entire region."

Nicholas Birch at the Wall Street Journal reports that Prime Minister Recep Tayyip Erdogan of Turkey met with the leader of the main Kurdish party in the country Wednesday, in what is the first meeting of the head of government with the party in the country's history.

"[M]any analysts say the new Kurdish opening is qualitatively different from anything that came before.

'For the first time ever, Turkish state institutions are working in synch to solve the problem,' said Henri Barkey, a Turkish expert at the Carnegie Endowment for International Peace, a Washington-based think tank.

The main catalyst for Turkey's new sense of urgency is Washington's announcement that it plans to pull its soldiers out of Iraq, Turkey's southern neighbor, by 2011.

The planned withdrawal has speeded up a rapprochement between Turkey and Iraqi Kurds, whose relations have been blighted for years by the PKK's use of Iraqi Kurdish mountains for its military bases."

"'There is an economic side to the rapprochement. "Turkey wants to use northern Iraqi gas for Nabucco,' says Bayram Bozyel, a Turkish Kurdish politician, referring to a pipeline project that the US and EU hope will help break a Russian stranglehold on European natural-gas supplies. 'And the [Iraqi] Kurds want to pump gas north.' That would be risky in the midst of a guerrilla war. The PKK claimed responsibility last year for a bomb attack on a major oil pipeline that passes through the same region."Well worth reading.Today Russia and Turkey signed a deal to route Russia's South Stream pipeline through Turkey, per Charles Recknagel at RFE/RL.

"'The South Stream pipeline is a much needed project that is particularly important in the context of ensuring the energy security of the whole of Europe and the development of a broad range of ties between Russia and Turkey,' Putin said. 'Our negotiations showed that we can find solutions, together with the Turkish leadership, that open the way to new, large-scale energy projects.'"7. IRAN LOWERS OFFICIAL PRICE OF OIL SOLD TO ASIA, QATAR LOWERS OFFICIAL PRICE OF OIL, FOLLOWING SAUDI ARAMCO REDUCTION ON PRICE TO ASIA

Yee Kai Pin at Bloomberg reports that the National Iranian Oil Company will reduce the official selling price of Iranian Light into Asia for the first time in four months.

"[NIOC] will set Iranian Light for September at 9 cents a barrel above the average of Persian Gulf benchmarks Oman and Dubai grades, based on a quarterly formula tied to prices set by Saudi Arabian Oil Co. The premium will be down $1.75, or 95%, from August and will be the smallest in seven months."Meanwhile, Yee Kai Pin reports that Qatar Petroleum will also reduce the official selling price of Qatari crudes.

"The state-owned company cut its July price of Qatar Land crude oil to $65.50/b, down $5.60 from June, the official Qatar News Agency said on its Web site. The July price of Qatar Marine grade was reduced by $5.38 to $64.72/b. The cuts are the first in five months."Earlier this week, Saudi Aramco cut its official selling price of Arab Light into Asia--see Daily Sources 8/3 #6. (The middle eastern national oil companies have different official prices for different regions of the world.)

8. DUBAI'S PROPERTY PRICE COLLAPSE SHARPEST IN WORLD

Kevin Brass at the New York Times reports that Dubai's property market is leading the world in price collapse.

"Dubai prices have dropped 32% in the last year and 40% in the last quarter, according to the latest edition of the Knight Frank Global House Price Index, released today.9. MEND LEADER INDICATES MOST NIGER DELTA MILITANTS WANT TO TAKE ADVANTAGE OF AMNESTY PROGRAM WHICH OFFICIALLY BEGAN TODAY; ANALYSTS DOUBT DIRE NIGERIAN PRODUCTION NUMBERS

Along with Dubai, Latvia (36%) and Singapore (23.8%) saw the largest declines since the first quarter of 2008, the property firm reports."

Dulue Mbachu at Bloomberg reports that the leader of Nigerian militant group MEND indicated in a telephone interview that most fighters want to accept the government's amnesty program, saying "Like the government, we also want peace for there to be development."

"A government panel set up last year recommended raising the share of revenue going to states in the oil region to 25% from the current 13%. MEND wants the oil region to control 100% of oil revenue and pay a tax to the central government, according to the group’s spokesman, Jomo Gbomo.BBC News reports on the amnesty program which officially began today.

'Whatever the people are demanding is also what I want,' Okah said, declining to commit to a figure.

The MEND leader said militant commanders in the oil region are divided between those who want money in exchange for weapons, as offered by the government, and those who want their political demands met.

'Personally I want a situation where weapons will be surrendered without cash,' Okah said. 'Because people can submit their weapons and buy new ones.'"

"Officials said gunmen who accept amnesty would be given 65,000 naira ($433; £255) a month for food and living expenses during the rehabilitation program, which runs from 6 August to 4 October.

But the main rebel group in the region, the Movement for the Emancipation of the Niger Delta (MEND), has not yet said it will take part in the amnesty.

'When we choose to disarm, it will be done freely, knowing that the reason for our uprising which is the emancipation of the Niger Delta from neglect and injustice has been achieved,' the group said in statement e-mailed to the AFP news agency.

The group, which called a temporary ceasefire last month after one of its leaders was freed from jail, is in talks with senior officials about the terms of any possible amnesty."

Tom Burgis at FT Energy Source reports that many believe that the current numbers for oil production coming from official Nigerian government sources are deliberately understated.

"On Wednesday afternoon, a Nigerian oil executive speaking in private snorted at the idea that production could be so low, suggesting 1.6m b/d was more accurate. Stewart Williams, principal sub-Saharan Africa analyst at energy consultancy Wood Mackenzie, puts production at 1.5m b/d to 1.6m b/d.10. BRAZILIAN SENATE'S INVESTIGATION INTO PETROBRAS TAX EVASION AND CORRUPTION CHARGES BEGIN TODAY, LULA INDICATES THAT HE BACKS FULL CONTROL OF PRE-SALT FOR PETROBRAS

Why the discrepancy? Analysts with a cynical streak (easily acquired in a country so riddled with corruption and electoral violence) remark that it is in the state’s interest to create a sense of crisis as it tries to force through a comprehensive reform of the oil sector.

That the bill has merits--including the promise of greater transparency and restructuring the hopelessly ineffective state company--misses the point. Oil companies and the delta’s influential governors, who stand to get less cash as a result, are united in opposition to it.

The oil companies, too, are making data scarce at the moment. Like the government, they may have an interest in uncertainty as the negotiations continue."

Helder Marinho and Alexander Ragir at Bloomberg report that the Brazilian Senate's investigation into tax evasion and corruption allegations against state oil company Petrobras began today.

"An 11-member Senate committee, led by a member of [Brazilian President Luiz Inacio Lula da Silva's], Workers’ Party, is investigating the allegations. [CEO Jose Sergio] Gabrielli told Petrobras’s 74,000 employees in a July 14 letter that the company fired three employees after an internal investigation, and cooperated with the prosecutor’s office and federal police, into the bidding process for oil platforms.

Gabrielli, Chief Financial Officer Almir Barbassa and Haroldo Lima, the head of Brazil’s petroleum regulator, are among officials the committee in charge of the probe will invite to testify, according to a list senators handed to reporters during a session of the probe committee held today.

The officials will not be legally summoned or required to speak under oath, and the hearings will be arranged at their convenience, Senator Romero Juca said today in Brasilia. Juca, the head of the government coalition in the Senate, is responsible for leading the probe and writing its reports. Fired Petrobras executives will not be called to testify, he said."

"Since Lula first took office in January 2003, lawmakers have set up 25 committees to investigate everything from health insurance plans to piracy of industrial goods and corruption, according to CAC Consultoria Politica, a Brasilia-based political consultancy. While some ended without any conclusion, a 2005 investigation into allegations the Workers’ Party paid bribes to legislators in exchange for votes in Congress led to the resignation of Lula’s chief of staff, Jose Dirceu."Natuza Nery at Reuters reported yesterday that Lula was to propose to Congress today that Petrobas be the exclusive operator of new offshore sub-salt oil fields. In June, resolutions were being introduced in the Brazilian Senate to create a new, 100% state-owned company, to lease Brazil's sub-salt fields--see Daily Sources 6/12 #11. (A majority of voting shares in Petrobras are owned by the government, but foreign investors own about 60% of its total outstanding stock.)

11. VENEZUELA TO PURCHASE SEVERAL DOZEN TANKS FROM RUSSIA, BANS COLOMBIAN STATE OIL COMPANY FROM PARTICIPATION IN ORINOCO BELT

Fabiola Sanchez at the Associated Press reports that President Hugo Chávez in a news conference yesterday said that Venezuela was going to purchase several dozen Russian tanks in a deal he wants to seal during a visit to Russia in September.

"'We're going to buy several battalions of Russian tanks,' Chavez said ...

Chavez's government has already bought more than $4 billion worth of Russian arms since 2005, including helicopters, fighter jets and Kalashnikov assault rifles.

The socialist leader called Colombia's plan to host more US soldiers a 'hostile act' and a 'true threat' to Venezuela and its leftist allies. He warned that a possible US buildup could lead to the 'start of a war in South America,' but gave no indication that Venezuela's military is mobilizing in preparation for any conflict."

"Cuban ex-President Fidel Castro supported Chavez in a column published Wednesday on the Cubadebate Web site, saying that 'Venezuela isn't arming itself against the sister nation of Colombia, it's arming itself against the (US) empire.'Meanwhile, Upstream online reports that Chávez told journalists yesterday that Ecopetrol, Colombia's national oil company, will have no role in developing the Orinoco belt.

'The threat ... is directed at all the countries' of South America, Castro wrote."

"Chávez said ... that Colombia’s increased cooperation with the US to fight guerrillas and drugs is part of the US’s long- term plan to invade Venezuela and seize the Orinoco Belt."

"Ecopetrol was one of 19 companies that paid $2 million apiece for detailed information on the Carabobo block in the Orinoco Belt."12. 24% OF OWNER-OCCUPIED HOMES UNDER WATER IN US, PERSONAL SAVINGS RATE INCREASE AHISTORICAL IN FACE OF REDUCED FEDERAL TAX RECEIPTS, AND AS UNEMPLOYMENT LOOKS SET TO CONTINUE TO RISE

Nick Timiraos at Developments reports that 24% of owner-occupied homes had mortgage debt which exceeded the market value of the home in question at the end of June, according to data from Equifax and Moody’s Economy.com.

"That number rises to 32% when looking at the share of homeowners with mortgages that don’t have equity left in their homes.In her most recent series of posts, Rebecca Wilder at News N Economics notes that a) this recession is different from past recessions in the sense that the personal savings rate is trending up:

Overall, 16 million homeowners are 'upside-down' on their mortgages, up from 10 million, or 15% of owner-occupied homes, one year ago.

Nearly 10% of owner-occupied homes now have mortgage debt with loan-to-value ratios of at least 125%, and roughly half of those homes have mortgage debt with loan-to-value ratios of 150% or more."

And b) that the Daily Treasury Statement of August 4 "shows that the 1-month cumulative sum of income tax receipts (withheld plus paid taxes) is dropping at a 13% annual pace." She comments:

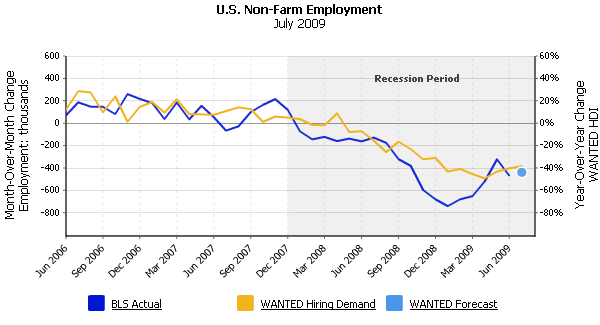

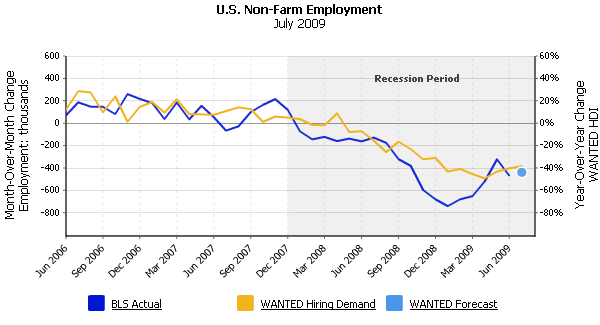

"This is the most up-to-date macroeconomic information out there, as most of the reports are 1-2 months old at the time of release. And the implication of this DTS is: that personal income and spending, which just released this week for June ... are likely to be weak into July."In that vein, Barry Ritholtz links to a graph by Bruce Murray, CEO of WANTED USA, plotting the actual month over month change in non-farm unemployment against year over year percent change in hiring demand:

13. RAIL TRAFFIC VOLUMES BOTTOMED OUT AT 18.9% BELOW LAST YEAR'S NUMBERS

The Railfax report is out today, and seems to indicate that rail traffic volumes have reached a bottom and holding steady at about 18.9% below their seasonal levels. Their chart for weekly loaded units in North America for the week ended August 1 in four week rolling averages:

Their chart for crushed stone and lumber and wood products, key components in construction, in four week rolling averages for North America:

Wednesday, August 5, 2009

Daily Sources 8/5

1. CHINESE TRANSPORT DATA SHOW YOY INCREASE IN IRON IMPORTS OF 35%; PROPERTY SALES IN CHINA FALL 4% IN JUNE; UNEMPLOYED MIGRANT WORKER CONCERNS PROVE OVERBLOWN; THE PEOPLE'S BANK OF CHINA WARNS OF THE DANGERS OF QUANTITATIVE EASING

Bloomberg reports that in the Ministry of Transport data released yesterday ships unloaded 35% more iron ore in July from July 2008. "Ships unloaded 56.5 million metric tonnes of iron ore in July at major ports." Meanwhile, China Daily reports that property sales across 30 Chinese cities fell by 4% in July from June. Property prices for 70 major Chinese cities rose by 0.8% in June.

Robin Pagnamenta at the Times reports that the UK's Prime Minister’s special envoy on energy security, Malcolm Wicks, will publish a report today arguing that Britain should triple the amount of energy it generates from nuclear power. A Times source familiar with the report said it would argue:

Mark Mazzetti and Thom Shanker at the New York Times yesterday reported that two nuclear-powered attack submarines have been patrolling off the eastern coast of the US recently.

4. PAKISTAN TALIBAN SEES ITSELF AS PROVIDING GOOD GOVERNMENT

Qandeel Siddique at jihadica summarizes an Urdu-language interview of a Taliban commander in Pakistan. Key excerpt:

Uchenna Izundu at the Oil & Gas Journal notes that a Russian security and maintenance company, Ruscorp, has signed a memorandum of understanding with the Nigerian National Petroleum Corp. to monitor the country's pipeline network, improve the existing pipelines as well as build new distribution lines.

6. CHÁVEZ ISSUES DECREE NATIONALIZING EQUIPMENT AND WAREHOUSING FACILITIES AT PORTS

Rainbow Nelson at Lloyd's List reports that Caracas has issued a decree effectively terminating all private concessions at the countries ports, with state-owned companies taking over all equipment and warehousing facilities. (Subscription only, but the headline is a decent datapoint.)

7. CREDIT CARD JUNK MAIL BOTTOMS

Barbara Kiviat at the Curious Capitalist notes that Synovate, a firm which tracks junk mail, has produced a chart--available at her blog--which shows that credit card offers going out underwent a sharp fall from the fourth quarter of 2007, but seem to have bottomed out in the second quarter of 2009.

8. CASH FOR CLUNKERS MOSTLY STIMULUS FOR AUTO INDUSTRY; AUTO INDUSTRY RESPONSIBLE FOR MOST OF MANUFACTURING REBOUND IN JULY; MINUS STIMULUS CONSUMER SPENDING MAY WELL HAVE SHRUNK BY 10% IN 2Q; PROBLEMATIC CONSTRUCTION LOANS LIKELY TO UNDERMINE BANK BALANCES GOING FORWARD

To answer what aim was intended by the cash for clunkers program, see Robert Rapier's R-Squared blog, which notes that the US will consume approximately 72 million gallons less gasoline annually because of the program.

9. COMMERCIAL CRUDE STOCKS BUILD MORE THAN EXPECTED, GASOLINE PRICES RISE, REFINING UTILIZATION DOWN

The EIA reports that crude oil commercial stocks built by 1.7 million barrels to 349.5 million barrels in the week ended July 31--above the five year historical range for this time of year. A Bloomberg survey had the median expectation of analysts at a 600,000 barrel build. Gasoline stocks fell by 200,000 barrels, are at the top of the historical range, and versus analyst expectations of a 800,000 barrel draw. Distillate stocks fell by 1.1 million barrels and at 161.5 million barrels are 28.2 million larger (or 21.2% more) than the comparable stock level seen last year--well above the five historical range. Analysts had expected a 1.23 million barrel build. Refining utilization fell to 84.54% from 84.57% the previous week. The national average of regular gasoline prices rose 5.4¢ to $2.557/gallon in the week ended August 3. (People tend to start driving less at prices between $2.50-$3.00/gallon.) The report also includes a helpful explanation of why refinery outages on the Gulf Coast have a large effect upon national prices.

10. POTATOES MAY ACCOUNT FOR AS MUCH AS 22% OF POPULATION GROWTH AND 47% OF URBANIZATION IN THE 18TH AND 19TH CENTURIES

Nathan Nunn and Nancy Qian at VoxEU argue that the introduction of new world crops to the old world--and in particular the potato--is in great part responsible for the population explosion and urbanization from 1800:

Bloomberg reports that in the Ministry of Transport data released yesterday ships unloaded 35% more iron ore in July from July 2008. "Ships unloaded 56.5 million metric tonnes of iron ore in July at major ports." Meanwhile, China Daily reports that property sales across 30 Chinese cities fell by 4% in July from June. Property prices for 70 major Chinese cities rose by 0.8% in June.

"Property transactions in Guangzhou [formerly Canton, the capital of Guangdong province] fell 36% over June. The figure is only half of that of May, said Guangzhou's official property website.Meanwhile, Andrew Batson at the China Journal reports that worries regarding large numbers of unemployed migrant workers have proven overstated. The IMF China mission chief, who visited the country in late May early June, told reporters in a conference call:

'The fall has been triggered by high property prices and shrinking supplies in some cities,' said Qin Xiaomei, head of research, Jones Lang LaSalle Beijing. 'Property developers have slowed down the pace of new projects in the second half after robust sales in the first half,' she said."

"I think our sense is that while there is certainly some dislocation in the labor markets as export sectors in the coastal regions have declined, but in general that process of reallocation of labor has been relatively smooth. Part of it has been that labor has returned back to export sectors, perhaps with some reduction in real wages, and been reabsorbed into those areas.Meanwhile, Bloomberg News reports that the People's Bank of China yesterday in its quarterly monetary policy report warned that the quantitative easing policies of the developed nations threatens to spark sever inflation and currency volatility.

Part of it is that the interior of the country is doing quite well, and so some of that migrant labor has moved geographically across regions to where growth is stronger. And I think we’re seeing right now a dynamic where the historical pattern of very strong growth in the coastal regions and slower than average, national average growth in the interior is reversing, and you’re seeing much stronger growth in rural areas and in the interior provinces. And some of that labor has been reabsorbed into public infrastructure projects."

"Exiting too quickly from such policies, which the Chinese central bank said helped to prevent a repeat of the Great Depression, may undermine an economic recovery, the report said. Waiting for too long may trigger 'a new round of asset bubbles and severe inflation,' the central bank added.2. UK ENERGY SECURITY ENVOY TO RECOMMEND TRIPLING NUCLEAR ELECTRICITY GENERATION CAPACITY; JULY SERVICES INDEX SHOWS SIGNIFICANT IMPROVEMENT

'Central banks in major developed nations face a difficult choice between keeping government bond yields relatively low to promote economic recovery and maintaining currency stability' to protect national creditworthiness, it said."

Robin Pagnamenta at the Times reports that the UK's Prime Minister’s special envoy on energy security, Malcolm Wicks, will publish a report today arguing that Britain should triple the amount of energy it generates from nuclear power. A Times source familiar with the report said it would argue:

"The question is whether or not the same rigor [that is being devoted to cutting emissions] is being applied to energy security.Meanwhile, Vanessa Houlder at the Financial Times reports that the Markit Economics purchasing managers survey of the services sector rose to 53.2 in July from 51.6 in June, it's highest reading since February 2008. It is the third consecutive month with a reading above 50--above 50 indicates expansion and below indicates contraction.

The Government has not been good at asking serious questions about whether or not the UK is in the right place ... It’s a dangerous world and when we emerge from recession there will be a global grab for diminishing supplies of energy. Where is it all going to come from?"

"Analysts welcomed the latest figures as providing more evidence the recession was receding. Vicky Redwood, of Capital Economics, said: 'The latest UK data on both services and manufacturing suggest that a decent recovery is continuing across the economy.'3. TWO RUSSIAN SUBS PATROLLING OFF US COAST

Kevin Daly, of Goldman Sachs, said the 'very strong' services survey was consistent with annualized growth in gross domestic product of between 1.5% and 2%."

Mark Mazzetti and Thom Shanker at the New York Times yesterday reported that two nuclear-powered attack submarines have been patrolling off the eastern coast of the US recently.

"'I don’t think they’ve put two first-line nuclear subs off the US coast in about 15 years,' said Norman Polmar, a naval historian and submarine warfare expert.Galrahn at Information Dissemination notes that the report suggests that the submarines are staying out of the Economic Exclusion Zone--about 200 miles off the coast. He also asks why this information was leaked.

The submarines are of the Akula class, a counterpart to the Los Angeles class attack subs of the United States Navy, and not one of the larger submarines that can launch intercontinental nuclear missiles."

4. PAKISTAN TALIBAN SEES ITSELF AS PROVIDING GOOD GOVERNMENT

Qandeel Siddique at jihadica summarizes an Urdu-language interview of a Taliban commander in Pakistan. Key excerpt:

"The Swati Taliban claims to have the locals on their side: '… We are children of these people and they are our own. We live like brothers. We have a healthy relationship with them where they give us food and shelter, and we cooperate on matters. We are always in touch with the locals and share with them their burdens/grievances. We have built roads [for the Swati people] where in over 60 years the government could not. The locals are happy with us. They no longer need to pay tax to the government. We have build pipelines and provided water to people. [...] Also we resolved decade-long rivalries that had been going on and which the government failed to bring about peace. The Taliban have appointed ulema to solve these cases and bring peace.'5. RUSCORP SIGNS MOU WITH NIGERIAN STATE OIL COMPANY TO PROVIDE SECURITY, MAINTAIN PIPELINE NETWORK

The Swati Taliban assumes the role of a surrogate government by providing its citizen’s basic amenities--roads and water. And of course justice, which the locals feel deprived of, believing that the Pakistani government time and again ignores the developmental needs of this region. On top of this, the commander conjures a horrific picture of the Pakistani army; he pins the blame for collateral damage during warfare on the military--not only do they take innocent lives, they also steal from peoples’ homes."

Uchenna Izundu at the Oil & Gas Journal notes that a Russian security and maintenance company, Ruscorp, has signed a memorandum of understanding with the Nigerian National Petroleum Corp. to monitor the country's pipeline network, improve the existing pipelines as well as build new distribution lines.

6. CHÁVEZ ISSUES DECREE NATIONALIZING EQUIPMENT AND WAREHOUSING FACILITIES AT PORTS

Rainbow Nelson at Lloyd's List reports that Caracas has issued a decree effectively terminating all private concessions at the countries ports, with state-owned companies taking over all equipment and warehousing facilities. (Subscription only, but the headline is a decent datapoint.)

7. CREDIT CARD JUNK MAIL BOTTOMS

Barbara Kiviat at the Curious Capitalist notes that Synovate, a firm which tracks junk mail, has produced a chart--available at her blog--which shows that credit card offers going out underwent a sharp fall from the fourth quarter of 2007, but seem to have bottomed out in the second quarter of 2009.

8. CASH FOR CLUNKERS MOSTLY STIMULUS FOR AUTO INDUSTRY; AUTO INDUSTRY RESPONSIBLE FOR MOST OF MANUFACTURING REBOUND IN JULY; MINUS STIMULUS CONSUMER SPENDING MAY WELL HAVE SHRUNK BY 10% IN 2Q; PROBLEMATIC CONSTRUCTION LOANS LIKELY TO UNDERMINE BANK BALANCES GOING FORWARD

To answer what aim was intended by the cash for clunkers program, see Robert Rapier's R-Squared blog, which notes that the US will consume approximately 72 million gallons less gasoline annually because of the program.

"In the context of the amount of gasoline we use--140 billion or so gallons per year (a bit less now because of the recession)--this amounts to only 0.05% of our annual gas usage. Experts have suggested that making sure tires are properly inflated could save 3% on gas usage, or 60 times the amount saved by "Cash for Clunkers" if the majority of people are driving around on under-inflated tires.Which nicely dovetails with James Hamilton's post on whether there be an economic recovery in the offing, writing:

So, for $1 billion invested in the program, a savings of 72 million gallons means we taxpayers paid $13.89 for each gallon of gasoline/yr saved. Readers know that I am a big fan of much higher fuel efficiency, but $13.89 to save a gallon of gasoline per year? While this benefit will be spread over several years of gasoline savings, surely we can do better than this.

Even if--as one reader suggested--those cars would have been on the road for another 10 years, you are still paying over a buck a gallon for the savings."

"Americans bought 995,000 light vehicles in July, a 16% increase over June and the best monthly report since August 2008. Domestically manufactured light trucks (which includes SUVs) lost market share but still achieved an 8% monthly sales gain. Sales of domestic cars, imported cars, and imported light trucks were all up more than 20% month to month.John Maudlin at the Big Picture quoted from David Rosenberg analysis yesterday:

If we'd seen these kinds of numbers in the absence of the cash for clunkers incentives, I would have viewed it as a strong suggestion that the economic recovery has begun. As is, I'm left wondering, and fundamentally not knowing, whether the auto figures signal the shift we've all been watching for, or sales stolen from September and October and delivered to July."

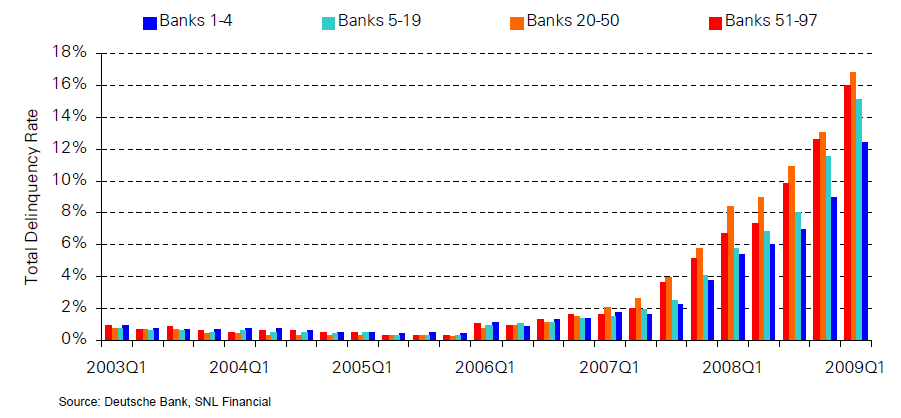

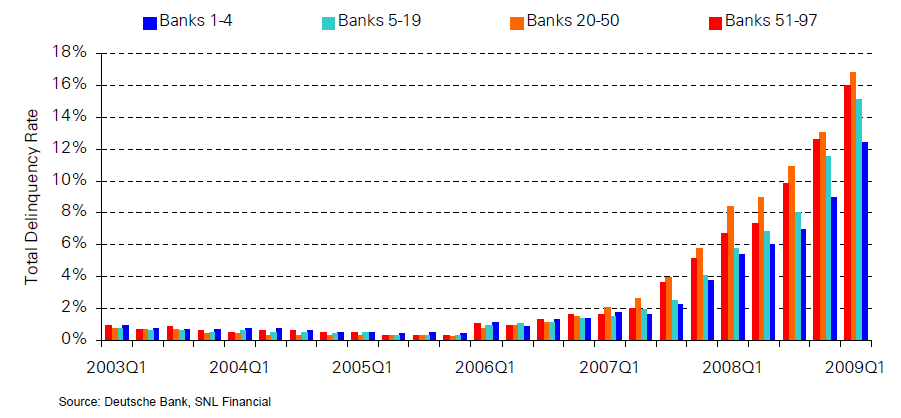

"The details in today’s report left something to be desired. Consumer spending came in at -1.2% annualized, twice the decline expected by the consensus. This occurred in the face of gargantuan fiscal stimulus and leaves wondering how this critical 70% chunk of the economy is going to perform as the cash-flow boost from Uncle Sam’s generosity recedes in the second half of the year. Imagine, government transfers to the household sector exploded at a 33% annual rate, while tax payments imploded at a 33% annual rate and the best we can do is a -1.2% annualized decline in consumer spending in real terms and flat in nominal terms? What do we do for an encore? In the absence of the fiscal largesse, it is quite conceivable that consumer spending would have shrunk at a 10% annual rate last quarter! Nonresidential construction action sagged at an 8.9% annual rate and this was on top of a 44.0% detonation in the first quarter. Ditto for equipment & software ‘capex’ spending, also down at a 9.0% annual rate and this too followed a 36.0% collapse in the first quarter. Residential construction slumped sharply yet again, this time at a 29.0% annual rate. These are the guts of private sector spending and collectively, they contracted at a 3.3% annual rate--the sixth decline in a row. So while there are many calls out there for the recession’s end, it remains a forecast as opposed to a present-day reality."And Barry Ritholtz, also at Big Picture, notes the recent Deutsche Bank report which suggests that construction loans are likely to become a larger problem for the banks over time.

"Construction loans are structured with upfront reserves--meaning that it takes much longer for [Commercial Real Estate] defaults to occur. Low short-term interest rates also means reserves can last longer--BUT, as DB notes, Once reserves are exhausted, defaults will skyrocket."

9. COMMERCIAL CRUDE STOCKS BUILD MORE THAN EXPECTED, GASOLINE PRICES RISE, REFINING UTILIZATION DOWN

The EIA reports that crude oil commercial stocks built by 1.7 million barrels to 349.5 million barrels in the week ended July 31--above the five year historical range for this time of year. A Bloomberg survey had the median expectation of analysts at a 600,000 barrel build. Gasoline stocks fell by 200,000 barrels, are at the top of the historical range, and versus analyst expectations of a 800,000 barrel draw. Distillate stocks fell by 1.1 million barrels and at 161.5 million barrels are 28.2 million larger (or 21.2% more) than the comparable stock level seen last year--well above the five historical range. Analysts had expected a 1.23 million barrel build. Refining utilization fell to 84.54% from 84.57% the previous week. The national average of regular gasoline prices rose 5.4¢ to $2.557/gallon in the week ended August 3. (People tend to start driving less at prices between $2.50-$3.00/gallon.) The report also includes a helpful explanation of why refinery outages on the Gulf Coast have a large effect upon national prices.

10. POTATOES MAY ACCOUNT FOR AS MUCH AS 22% OF POPULATION GROWTH AND 47% OF URBANIZATION IN THE 18TH AND 19TH CENTURIES

Nathan Nunn and Nancy Qian at VoxEU argue that the introduction of new world crops to the old world--and in particular the potato--is in great part responsible for the population explosion and urbanization from 1800:

"The traditional explanation for the rise in population is that medical advances, such as the understanding of the germ theory or the innovation of vaccinations, and improvements in public sanitation greatly decreased infant and child mortality, which in turn led to an increase in population (e.g. Preston, 1975, 1980, 1996; Cutler, Deaton and Lleras-Muney, 2005, 2006). However, in recent years, scholars such as Thomas McKeown (1976) and Robert Fogel (1984, 1987, 1994, 2004) have argued that the increase in population was mostly due to an improvement in nutrition rather than the advances in medicine or sanitation. McKeown argued that the decline in mortality began to occur well before the most important innovations such as antibiotics or vaccinations, which did not become prevalent until the 20th century, and therefore, there is scope for other factors to contribute to the rise in population. Fogel argued that since height is positively correlated with nutritional investment during childhood as well as lower mortality rates, then the observation that heights in America and the UK were increasing is evidence that nutrition was improving during this period.

If Fogel is right, then we have to ask what caused the improvements in nutrition. Certainly, improvements in agricultural technology are part of the story. During this time, a number of productivity-enhancing technologies were developed. Examples include the seed drill, the threshing machine, and the Rotherham swing plough.

In recent research, we argue that another main contributor was the discovery of New World food crops, namely, the potato (Nunn and Qian 2009). Potatoes are extremely nutritious and a very 'cheap' source of calories. They produced much higher yields per acre relative to pre-existing Old World staple crops. Historical survey data from England show that if a family of four were to subsist on only one crop, it would require 66% less land if it were to plant potatoes rather than staples such as barley, wheat, or oats (Young, 1771). Potatoes are also easy to store and were popular as fodder for livestock through the winter. Therefore, cultivating potatoes also indirectly improved protein intake. The diffusion of potatoes also had a tremendous impact on nutrition in the Old World because vast land areas in Northern Europe, Asia, and high altitude areas of Africa were suitable for cultivating potatoes. Figure 2 maps suitability for potato cultivation. Yellow and brown colored regions are suitable. Darker colored regions are more suitable."

Tuesday, August 4, 2009

Daily Sources 8/4

1. IEA WARNS THAT $70 OIL COULD UNDERMINE ECONOMIC RECOVERY

Kate Mackenzie at the Financial Times reports that the IEA's chief economist, Fatih Birol, told the newspaper in an interview that oil prices above $70/b would likely undermine any economic recovery.

Wang Ming and Rose Yu at the Wall Street Journal report that the China Banking Regulatory Commission

Bloomberg reports that preliminary data from the Chinese Ministry of Transportation indicates that Chinese seaborne imports grew by 26% in July from a year previous.

Heejin Koo at Bloomberg reports that North Korean leader Kim Jong Il pardoned and ordered the release of two American journalists who had been arrested after allegedly crossing into North Korean territory.

5. AUSTRALIAN CENTRAL BANK LEAVES BENCHMARK INTEREST RATE UNCHANGED AT 3%, RETAIL SALES ARE DOWN 1.4% IN JUNE FROM MAY

EcPulse reports that the Reserve Bank of Australia decided today to maintain their benchmark interest rate at 3%.

Ali Berat Meric and Stephen Bierman at Bloomberg report that Russia and Turkey will sign an accord to build a pipeline to send oil to the Mediterranean bypassing the Strait of Bosphorus.

Der Spiegel reports that a report released yesterday by Eurostat indicates that

Nada Bakri at the Washington Post reports that yesterday Secretary of State Hillary Clinton expressed concern about the welfare of three American hikers who were arrested after entering an area near the Iranian border. Of course, the incident will be used by elements in Tehran as evidence that the recent elections unrest is the result of foreign meddling.

9. MEXICO MAY INTRODUCE FUEL EFFICIENCY STANDARDS

Robert Campbell at Reuters reported yesterday that the head of the Mexican National Ecology Institute, Adrian Fernandez, said in an interview that Mexico is planning to introduce fuel efficiency standards for all new cars sold in the country.

10. VENEZUELA TO NATIONALIZE COFFEE COMPANIES, LAUNCHES INVESTIGATION INTO SWEDISH ARMS FOUND IN FARC CAMP

Steven Bodzin and Daniel Cancel at Bloomberg report that Venezuelan President Hugo Chávez said today on state television that he was considering nationalizing two coffee companies after having seized their processing plants yesterday. He said,

Eric Watkins at the Oil & Gas Journal reports that the Nicaraguan government has signed accords with a Russian consortium allowing for oil and gas exploration and production in the country.

Nika Kentish at the Associated Press reports that the Antiguan Prime Minister, Baldwin Spencer, today renamed the highest mountain in Antigua and Barbuda "Mount Obama." He said at the dedication ceremony:

Julie Haviv at Reuters reports that so-called "shadow inventory" is hanging over the US home market.

Jesse's Café Américain notes that the hurricane season is underway, and that the peak is usually in mid-September. He notes that "Hurricanes offer a tempting opportunity for energy 'investment.'" I would note, however, that insofar as a legitimate reason for hedging goes, hurricanes are certainly one--and those who want to hedge will need counterparties. Meanwhile, Michael Giberson at Knowledge Problem has the fascinating news that the Government Accountability Office has released a report showing that refinery outages generally have a very small affect upon prices. The report, which I have not had time to read, can be found here.

16. WAL-MART LAST WEEK ISSUED $1.1 BILLION IN SAMURAI BONDS

In a story I missed last week, Lisa Twaronite at MarketWatch reported that Wal-Mart issued US$1.1 billion in yen-denominated bonds (¥100 billion).

Kate Mackenzie at the Financial Times reports that the IEA's chief economist, Fatih Birol, told the newspaper in an interview that oil prices above $70/b would likely undermine any economic recovery.

"'If we go one step further, if we see prices go much higher than that, we may see it slow down and strangle economic recovery,' he said of oil prices on Friday, when the European benchmark was around $70."2. CHINA MAY CHANGE RULES TO MAKE SUBORDINATED BONDS INELIGIBLE AS CAPITAL, WHICH SHOULD REDUCE THE VOLUME OF CREDIT

Wang Ming and Rose Yu at the Wall Street Journal report that the China Banking Regulatory Commission

"may deem subordinated bonds issued by a bank ineligible as capital if those bonds are held by another bank, the person said. The banking regulator estimates about half the subordinated bonds in circulation are held by other banks.

The amount that banks in China can lend is governed by technical capital ratios -- the more capital, the more room to lend. A big way banks have raised capital is by selling yuan-denominated subordinated bonds, or debt instruments that offer investors less protection in the event an issuer can't repay but also a higher yield than regular bonds."

"Analysts said any curb on how subordinated debt can be used would likely slow lending, because it would limit the appetite of the market's biggest investors, which are banks.3. CHINESE SEABORNE OIL IMPORTS UP 26% IN JULY YOY

'If the regulator excludes cross-held subordinated bonds from being classified as part of banks' capital, banks will have to try to sell their bonds to nonbanking investors,' said Guo Tianyong, the director of the Finance Research Center at Beijing's Central University of Finance and Economics. That will be difficult, Mr Guo said, and 'as a result, banks will slow the pace of subordinated-bond issues, which would eventually lead to a slowdown in credit growth.'

She Minhua, an analyst at Haitong Securities, said, 'Changing the rules would effectively cause a further decline in banks' capital adequacy ratios, so the fastest way for them to maintain a healthy ratio would be to cut loans.'"

Bloomberg reports that preliminary data from the Chinese Ministry of Transportation indicates that Chinese seaborne imports grew by 26% in July from a year previous.

"Chinese ports unloaded about 16.27 million metric tons, or 3.8 million barrels a day, of imported crude last month ... ."4. NORTH KOREA RELEASES US JOURNALISTS DURING FORMER POTUS VISIT

Heejin Koo at Bloomberg reports that North Korean leader Kim Jong Il pardoned and ordered the release of two American journalists who had been arrested after allegedly crossing into North Korean territory.

"By seeking an amnesty, the US appears to be conceding that the two reporters broke North Korea’s laws, Paik [Hak Soon, a researcher on North Korean issues at Sejong Institute] said.

'The visit indicates that the US and North Korea are willing to resolve this matter through dialogue,' he said. 'We’ll have to see if this expands to the nuclear issue.'"

"The former president and the North Korean leader 'had an exhaustive conversation' and a 'wide-ranging exchange of views on the matters of common concern,' [the] Korean Central News Agency said without giving further details. The country’s National Defense Commission hosted Clinton at a dinner in his honor, the agency said."Pyongyang has been long seeking direct bilateral talks with the US regarding its disputes with the international community.

5. AUSTRALIAN CENTRAL BANK LEAVES BENCHMARK INTEREST RATE UNCHANGED AT 3%, RETAIL SALES ARE DOWN 1.4% IN JUNE FROM MAY

EcPulse reports that the Reserve Bank of Australia decided today to maintain their benchmark interest rate at 3%.

"[Reserve Bank Governor] Stevens said in his statement that the world economy started to show clear signs of stability, thanks for the global stimulus plans set by governments around the world that led to an improving outlook for the world economy. He added that the US economy reached a turning point, while the economy in the euro zone is still weak."Meanwhile, Jacob Greber at Bloomberg reports that Australian retail sales fell by 1.4% in June from May.

"Today’s report suggests the impact from A$12 billion ($10 billion) in government cash handouts to households is waning after consumer spending helped Australia avoid a recession in the first quarter. Still, the economy may expand in the second quarter after retail sales rose 2% in the three months through June. Economists forecast a 1.3% gain.6. RUSSIA AND TURKEY TO SIGN PACT TO BUILD OIL PIPELINE WHICH WOULD BYPASS THE BOSPHORUS

'We still have retail sales at a very strong levels,' said Ben Dinte, an economist at Macquarie Group Ltd. in Sydney. 'With the strengthening consumer sentiment, we should see retail sales hold up.'

The quarterly retail sales figure accounts for as much as 25% of Australia’s gross domestic product, Dinte added."

Ali Berat Meric and Stephen Bierman at Bloomberg report that Russia and Turkey will sign an accord to build a pipeline to send oil to the Mediterranean bypassing the Strait of Bosphorus.

"OAO Gazprom, Russia’s largest company, and Turkey’s Calik Holding AS will sign an accord to build a pipeline between the northeastern port of Samsun and a terminal at Ceyhan on Turkey’s Mediterranean coast, Russian Energy Minister Sergei Shmatko told reporters in Ankara today before a visit by Russian Prime Minister Vladimir Putin later this week."7. GERMAN BIRTH RATE MAY HAVE DECLINED

Der Spiegel reports that a report released yesterday by Eurostat indicates that

"for every thousand inhabitants in Germany, only 8.2 children were born in 2008. Which indicates a decrease of 0.1% in the German birth rate and makes Germany the only EU member in which the crude birth rate did not increase between 2007 and 2008."8. HILLARY CLINTON EXPRESSES CONCERN REGARDING HIKERS ARRESTED NEAR IRANIAN BORDER

Nada Bakri at the Washington Post reports that yesterday Secretary of State Hillary Clinton expressed concern about the welfare of three American hikers who were arrested after entering an area near the Iranian border. Of course, the incident will be used by elements in Tehran as evidence that the recent elections unrest is the result of foreign meddling.

9. MEXICO MAY INTRODUCE FUEL EFFICIENCY STANDARDS

Robert Campbell at Reuters reported yesterday that the head of the Mexican National Ecology Institute, Adrian Fernandez, said in an interview that Mexico is planning to introduce fuel efficiency standards for all new cars sold in the country.

"The government is currently studying which type of standards to impose but it is leaning towards a plan that would be similar to proposed fuel efficiency rules in California or other parts of the United States, ... Fernandez said in an interview.Imprecise, but it would have a significant effect.

'The standard will cut gasoline imports by as much as a new refinery.'"

10. VENEZUELA TO NATIONALIZE COFFEE COMPANIES, LAUNCHES INVESTIGATION INTO SWEDISH ARMS FOUND IN FARC CAMP

Steven Bodzin and Daniel Cancel at Bloomberg report that Venezuelan President Hugo Chávez said today on state television that he was considering nationalizing two coffee companies after having seized their processing plants yesterday. He said,

"We’ve intervened in these big companies. Now we are conducting a study to expropriate them. They will become property of the nation."Meanwhile, the Associated Press reports that Caracas has indicated it has launched a probe into how arms purchased from Sweden ended up in the hands of FARC guerrillas in Colombia.