Sharon Otterman at the New York Times reports that Japanese diplomat, Yukiya Amano, was elected to head the UN's atomic watchdog--the IAEA.

"Depicted by experts as the candidate favored by the United States and other wealthy nations, Mr Amano favors maintaining the current approach toward controlling nuclear proliferation in Iran, which Western countries suspect of trying to build nuclear weapons. Iran says its nuclear program is purely for civilian purposes to generate energy.2. CHINA TO RESUME ALLOWING IMF REVIEWS OF ECONOMY

'He’s a nonproliferation and disarmament guy, and he believes in it,' said David A Kay, a former IAEA official and senior fellow at the Potomac Institute for Policy Studies. 'He has been around in trying to keep the inspections in Iran going, and I expect him to continue very much in that line. He will not want to create a situation in which military action is the only alternative.'"

Andrew Batson at the Wall Street Journal reports that China next week will take a step toward reconciling with the IMF, which it has blocked from reviewing its economy for the last three years.

"But a team of IMF officials visited China about a month ago, and have completed a draft review that is now being circulated for comments.Simon Johnson argued in April that the Obama Administration had pulled off a coup at the G20 meeting, effectively getting Europe to make the selection process for the head of the IMF transparent in return, more or less, for opening up the process at the World Bank, the next head of which Johnson thinks is likely to be Chinese--see Daily Sources 4/3 #3. Clearly in order to clear the field for their own candidates and a larger role generally, Beijing will first be forced to work with the organizations they want to influence or lead.

The IMF's draft report says China's exchange rate 'continues to be substantially undervalued,' according to a person who has seen the document, called an Article IV consultation. That's in line with what senior IMF officials have repeatedly said in public. China has kept its currency, the yuan or renminbi, basically fixed against the US dollar since July last year, though it has risen, along with the dollar, against other currencies since then.

That description nonetheless marks a climbdown from an earlier push to label China's exchange rate as 'fundamentally misaligned,' a designation that would suggest the country is in violation of the IMF charter. The draft report also states that Chinese authorities 'disagreed with the staff's assessment' of the exchange rate, and notes their argument that the global turmoil calls for 'a policy of stability.'"

3. PBOC TO ENCOURAGE CROSS-BORDER SETTLEMENT IN YUAN

Bob Chen and David Yong at Bloomberg report that the People's Bank of China will encourage cross border settlement in the renminbi starting today, per regulations posted on the central bank's website.

"Transactions inside China will take place in Shanghai and four cities in southern Guangdong province, including Guangzhou and Shenzhen, while those outside China will occur in Hong Kong, Macau and the Association of Southeast Asian Nations, it said."(h/t Jesse's Café Américain.)

4. CNPC MAY REVIVE BID ON ARGENTINE UNIT OF REPSOL-YPF, CNOOC MAY JOIN IN

Sui-Lee Wee at Reuters reports that CNPC plans to revive its $17 billion bid for the Argentinian unit of Repsol-YPF, reportedly planning to make an offer for as much as 75%. CNOOC also may enter a bid for the remaining 25%. "Goldman Sachs is advising YPF on the sale, while Morgan Stanley and JP Morgan are advising CNPC and CNOOC respectively." YPF, or Yacimientos Petrolíferos Fiscales, was the national oil company of Argentina until 1991, when it was privatized and then purchased by Repsol. (h/t Carola Hoyos at FT Energy Source.)

5. SPANISH CONSUMER CREDIT DOWN 33.7% IN Q1

Edward Harrison at Credit Writedowns reports that consumer credit in Spain fell by 33.7% in the first quarter, according to the National Association of Financial Credit Institutions (Asnef).

"Asnef stressed that the fall in the consumer sector has been mainly due to losses on personal loans, due to the sharp decline in the credit available for consumer goods and by the contraction of revolving credit associated with credit card usage."Harrison says he expects more failures or bailouts of Spanish banks in coming months. Worth reading in full.

6. RIKSBANK CUTS BENCHMARK INTEREST RATE TO 0.25%

Malin Rising at the Associated Press reports that the Riksbank cut its benchmark interest rate by 0.25% to 0.25% today.

"The central bank said it now expects Swedish gross domestic product to decline by 5.4% in 2009 -- a sharper drop than its previous forecast of a 4.5% fall. However, it raised its outlook for 2010 GDP to a growth rate of 1.4% from 1.3% previously.7. FINAL SECTION OF SINO-KAZAKH CRUDE PIPELINE COMPLETED

It said the economic outlook is still uncertain and that although GDP is expected to be positive in 2010, employment will not begin to rise until 2011."

Naubet Bisenov at Platts reports that Kazakhstan's KazStroyService has finished the 10 million metric ton/annum (200 kb/d) Kenkiyak-Kumkol pipeline and will begin test runs on it shortly.

"The Kenkiyak-Kumkol link is the final section of the Sino-Kazakh crude pipeline which runs from Atyrau on the Caspian Sea coast of the Central Asian nation, to Atasu near Kazakhstan's eastern border, then onwards to Alashankou in China's northwestern Xinjiang Uygur autonomous region.

The Sino-Kazakh crude pipeline is jointly developed by Kazakh state oil company KazMunaiGaz and Chinese state oil giant China National Petroleum Corp."

8. TALIBAN HAS WORN OUT ITS WELCOME IN PAKISTAN

In another interesting report by World Public Opinion, an institute based out of the University of Maryland, Pakistani opinion has turned sharply against the Taliban.

"Large majorities express confidence in the government (69%) and the military (72%) to handle the situation [in Swat]. Retrospectively, the public leans (by 45% to 40%) toward thinking the government was right to try to make an agreement in which the Pakistani Taliban would shut down its camps and turn in its heavy weapons in return for a shari'a court system in Swat. But now 67% think the Pakistani Taliban violated the agreement when it sent its forces into more areas, and 63% think the people of Swat disapprove of the agreement.Unsurprising, to me, but still well worth reading in full. (h/t Juan Cole at Informed Comment.)

On the Afghan Taliban, an overwhelming 87% think that groups fighting to overthrow the Afghan government should not be allowed to have bases in Pakistan. Most (77%) do not believe the Afghan Taliban has bases in Pakistan. However, if Pakistan's government were to identify such bases in the country, three in four (78%) think it should close the bases even if it requires using military force.

Public attitudes toward al Qaeda training camps follow the same pattern. Those saying the 'activities of al Qaeda' are a critical threat to Pakistan are up 41 points to 82%. Almost all (88%) think al Qaeda should not be allowed to operate training camps in Pakistan. Though 76% do not believe there are such camps, if the Pakistani government were to identify them, 74% say the government should close them, with force if necessary."

9. PETROBRAS STRIKES MORE OIL ONSHORE IN THE ESPIRITO SANTO BASIN

Tom Hennigan at Platts reports that Petrobras struck oil onshore in the Espirito Santo basin.

"The Espirito Santo basin has seen a string of strikes in recent months. Last week the company reported strikes in blocks ES-T-390 and BT-ES-15. Since March it has also made four oil strikes in the onshore ES-T-364 block alone.The block block is 100% owned by Petrobras. Seems like every other week they make a new announcement of new oil.

The company also announced a gas and an oil and gas find in the onshore ES-T-505 block."

10. HONDURAN CRISIS IN PART DUE TO NO PROCESS FOR REMOVING PRESIDENT IN CONGRESS & HIS RELATIONSHIP WITH CHÁVEZ, SAY EXPERTS

Kevin Sullivan at Real Clear World posts the quick analysis of several Honduras experts. Juan Carlos Hidalgo at the CATO Institute makes the interesting observation:

"The Honduran constitution does not provide an effective civilian mechanism for removing a president from office after repeated violations of the law, such as impeachment. Honduras’ Supreme Court nonetheless ordered Zelaya’s removal and Congress bestowed the presidency on the civilian figure--the president of Congress--next in the line of succession according to the constitution. "Jesus Rios at Gallup World Poll makes another interesting observation:

"The latest remarks by interim leader Micheletti suggest Zelaya’s increasing alignment to President Hugo Chavez’s regime is at the core of the crisis. So, if Zelaya does in fact return to power before the November presidential election, the question then becomes: how will he manage to govern amidst an adverse public opinion environment and among institutions that backed his ousting, including his own political party? And, what role, if any, will Chávez play in Honduran politics from now on? Will Zelaya drop or moderate his pro-Chávez stance to regain political support? According to the 2008 Gallup survey, just 20% of Hondurans approve of President Hugo Chávez."11. WTO WARNS ON INCREASING PROTECTIONISM, SAYS GLOBAL TRADE VOLUMES WILL CONTRACT BY 10% IN 2009

Joshua Chaffin at the Financial Times reports that the WTO published a report today which warns that

"[g]overnments around the world have continued to push up trade barriers in spite of high-profile pledges at the G20 summit and other forums to resist protectionism"The organization lowered its forecast for world trade to a contraction of 10% in the volume of goods and services.

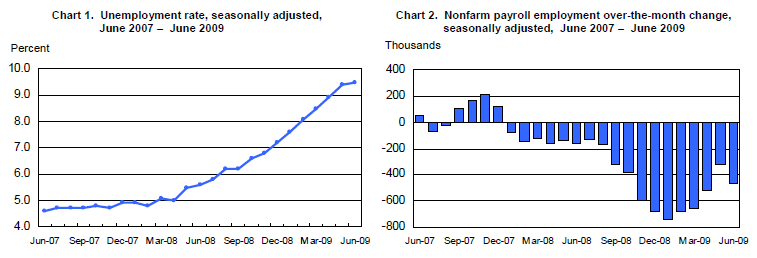

12. BLS REPORTS 476,000 JOB LOSSES IN JUN, STATE FISCAL RESPONSIBILITY MEANS STATE ECONOMIC POLICY CONTRACTIONARY IN RECESSION

Barry Ritholtz at the Big Picture reports that the Bureau of Labor Statistics announced today that there were 467,000 job losses in June. The unemployment rate rose by 0.1% to 9.5%. The U-6 measure--marginally attached and involuntary part time workers--rose to 16.5%. Temporary employment fell by 37,600.

"Hours worked fell 0.8%, bringing the average workweek down 0.1 hours to 33; This is a record low going back to 1964."

Peter Boockvar, also at the Big Picture, also notes that initial jobless claims totaled 614,000. Continuing claims fell by 58,000 from last week.

"While there is no question benefits are expiring without one finding a job, as evidenced by the rising exhaustion rate, many losing those benefits now started getting them when initial claims were running in the 400k range last summer. Now its running above 600k, so there are still more people filing initial claims than getting removed from the continuing claims data, thus continuing claims still should trend higher assuming no sudden change in hiring trends."Meanwhile, Free exchange makes the important observation:

"[S]tate budget policies are sharply contractionary at this point. Despite allocations of federal aid to states, services are being cut, state employees are being laid off, and taxes are being raised in order to balance the budgets of local governments constitutionally unable to run deficits. It's not at all clear that the federal stimulus will entirely compensate for state-level fiscal tightening, which means that American fiscal policy could, on net, be contractionary."13. BARCLAYS EXPECTS WTI TO AVG $71/B IN W3

Yee Kai Pin at Bloomberg reports that Paul Horsnell's commodity team at Barclays has lifted its third quarter forecast for WTI to $71/b from $62/b. Horsnell increased his Q3 forecast for Brent to $69/b.

"'Among all the changes that have kept commodities on the boil in recent years, the key factor is that 'normal' is not what it used to be,' the analysts said in the report. 'Oil prices below $70 or copper prices below $3,000 are no longer normal.'"I think he's wrong, but he does know of what he speaks.

1 comment:

today is 7-8-9 you there?

Post a Comment