2. This week's Newsweek also carries a book review by Henry Kissinger of "Lessons in Disaster: McGeorge Bundy and the Path to War in Vietnam" by Gordon M. Goldstein. Kissinger, arch-appeaser, also stresses the importance of diplomacy in the few observations he thought were "in order":

• WHEN THE PRESIDENT IS ASKED TO CONSIDER GOING TO WAR, HE MUST BE PRESENTED, ABOVE ALL, WITH AN ANALYSIS OF THE GLOBAL STRATEGIC SITUATION ON WHICH THE RECOMMENDATION IS BASED.Perhaps it was forgivable that Bundy did not reach those conclusions in time. How it is that this wasn't clear to US policymakers prior to the second Gulf War--and that rhetoric in the 2008 presidential campaign deliberately controverts it still--I think can only be called calculated negligence.

• THE PURPOSE OF WAR IS VICTORY. STALEMATE IS A LAST RESORT, NOT A DESIRABLE STRATEGIC OBJECTIVE.

• VICTORY NEEDS TO BE DEFINED AS AN OUTCOME ACHIEVABLE IN A TIME PERIOD SUSTAINABLE BY AMERICAN PUBLIC OPINION.

• HAS TO BE PRESENTED TO THE PRESIDENT A SUSTAINABLE DIPLOMATIC FRAMEWORK.

• DIPLOMACY AND STRATEGY MUST BE TREATED AS A WHOLE, NOT AS SUCCESSIVE PHASES OF POLICY.

• AUTHORITY FOR DIPLOMACY AND STRATEGY MUST BE CLEARLY ASSIGNED.

• THE ADMINISTRATION AS WELL AS CRITICS SHOULD CONDUCT THEIR DEBATES WITH THE RESTRAINT IMPOSED BY THE KNOWLEDGE THAT THE UNITY OF OUR SOCIETY HAS BEEN THE HOPE OF THE WORLD.

3. Eurointelligence reported on the 24th that President Sarkozy, on the 23rd, announced the creation of a French "Strategic Investment Fund", established to prevent French companies from falling into the hands of foreign "predators." The fund will be operated by Caisse des Dépôts et Consignations, that is by France's existing Sovereign Wealth Fund, but it will be "more active, more offensive, more mobile" in defense of national assets. I imagine that the folks in the Kremlin are amused. I do not think it is impossible that some folks in Paris desperately mean to prevent the successful conclusion of a Reinsurance Treaty II.

4. The Eurointelligencer reports that in an interview with with Frankfurter Allgemeine Zeitung, German Finance Minister Peer Steinbruck said

"a euro area wide rescue plan was not acceptable to Germany, because Germany would have to pay the lion share, and have only limited controls. ... He said one should ensure that euro area summits remain the exception, not the rule. He gave two reasons. The first is that such summits raise expectations. The second is that Europe gets divided into a euro area, and the remaining 12 member states."5. Tunku Varadarajan has an op ed in yesterday's New York Times discussing how Indian Hindus, who worship the moon, are undisturbed by any theological consequences of the country's unmanned mission to the satellite. Very interesting--the mission appears to have helped the country from falling into the dour mood that prevails in the West. (As the CERN rap proved so dramatically, ambitious scientific programs have more than one kind of utility. If the markets are driven more by psychology than by fundamentals, then they might prove an important part of any economic stimulus plan. Just so, but then why did Bush's Mars Mission fall flat? Perhaps because Bush and co appear to have no faith in science and, well, because you can't just promise the moon? Let's hope that CERN's experiments go through without a hitch come next Summer.)

6. Walter Pincus at the Washington Post reports that in response to a question fielded after a speech at the Carnegie Endowment for International Peace, Secretary of Defense Robert Gates said he would counsel the incoming President to pursue further nuclear missile reductions with Russia. However, he also defended the Administration's call for a next generation of nuclear warhead. In an interview with John Barry of Newsweek this week, Gates responded to the assertion that the US should unilaterally drastically reduce its nuclear arsenal:

"The reality is that there are probably two dozen, perhaps 30, countries out there that would seriously consider their own nuclear deterrent if they couldn't rely on ours."Perhaps, but which ones? Perhaps the US should not cut its number of nuclear weapons significantly below the numbers in Russia, but we should lead the way. 5,000 strategic nuclear weapons is far more than would be required to destroy any offending nation, indeed the earth, many times over. As it stands, there is only one nation which has even a putative capability to launch an attack which would destroy our ability to respond. But such an attack would by its very nature destroy all human life on earth anyway.

7. Matt Rosenberg at the Wall Street Journal reports that the Pakistani Foreign Ministry released a statement today saying that the unauthorized US missile strikes on forces inside Pakistan "were a violation of Pakistan's sovereignty and should be stopped immediately."

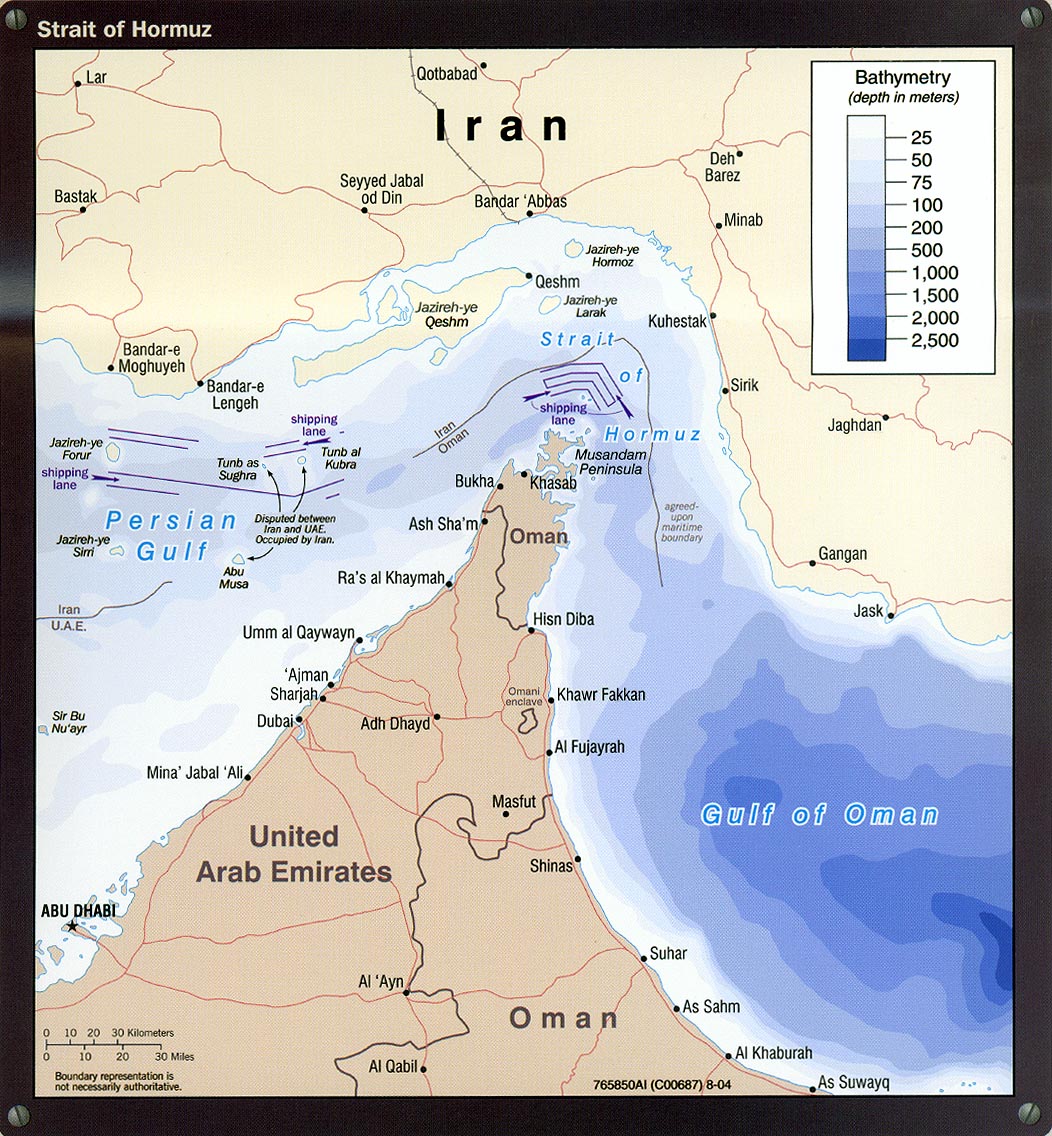

8. Nazila Fatih at the New York Times reports that Iran has opened a new naval base near the Gulf of Oman which could be used to block the passage of ships through the Hormuz Strait--the strait with the largest percentage of oil shipments worldwide. The naval base is in the port city of Jask, which you can see on the map linked below. The move is of a gadfly.

9. If you thought the Somali pirate problem a tempest in a teapot, you were wrong. David Osler at Lloyd's List reports that the UK is considering revising their law of the sea to provide British warships with the right, under severely circumscribed situations, to search and detain ships flying another country's flag. The new law will need to be ratified by 12 nations before it comes into force. The British hope to pass it by the end of next year; so far five other nations have ratified 2005 Protocol to the Convention for the Suppression of Unlawful Acts Against the Safety of Maritime Navigation. "[If passed, the legislation] will effectively replace the Piracy Act 1837 as the main framework for the Royal Navy’s fight against piracy." The legislation is "vying for a spot in this year’s Queen’s Speech."

10. Jeb Blount at Bloomberg reports that a consortium of British, Spanish, Brazilian and Persian Gulf investors have announced they will build a refinery near Aracaju, in northeast Brazil. U.K.-based South Atlantic Refining Co. has received approval to build the refinery from Brazilian regulatory authorities and, as such, will be the first foreign country to build a refinery there. The company's operations director told Blount that the refinery will have a capacity of 200 kb/d and will be able to process heavy and light crudes into low-sulfur diesel, lubricants and naphtha at a cost of about $3 billion. Brazil is a more attractive destination for a greenfield refinery than, say, China because Brazil's product prices float freely on the market and the feedstock is nearby. 80% of the refined product is slated for export. This refinery is being built into what analysts expect will be a huge refining capacity glut starting from 2011 or so (and heralded by the 600 kb/d Jamnagar refinery.)

11. Vladimir Soldatkin at Reuters reports that Lukoil Vice President Leonid Fedun surprised an oil industry conference today by saying that Russia's future hinges on close cooperation with OPEC and that the country should cut prices in support of the October 24 move.

12. Diana Elias of the Associated Press reports that the the Kuwaiti Parliament passed a law fully guaranteeing all bank deposits in Kuwait as well as foreign bank operations there.

13. Carola Hoyos and Javier Blas at the Financial Times report that the as-of-yet unpublished Paris-based IEA World Energy Outlook forecasts a natural crude oil output decline of 9.1%. If all "necessary" investments were made in boosting output worldwide, the natural decline rate would fall to 6.4%.

"The IEA ... forecasts that China, India and other developing countries’ demand will require investments of $360bn each year until 2030."I'm unclear on what that means, exactly, given the currency situation just now, perhaps it means that about 0.6% of global GDP (of $54 trillion) will need to be spent on new production in order to establish a natural decline rate of 6.4%. Gregor MacDonald provides a good discussion of the matter (in language somewhat a la Nouriel Roubini). This kind of news should push up prices as it essentially means that new supply will not be commensurate to new demand. And so far today front month futures prices for light sweet crude have gone up, though whether that is in response to currency news, yesterday's stock market bounce, or some other factor is totally unclear. Joe Brock at Reuters yesterday reported that BP's chief economist, Christof Ruhl, told the Oil & Money conference in London

"We should expect oil price volatility and low oil prices for 12-18 months until economic recovery helps prices to rise."However, he does not think that prices will be sustainable at levels seen five or six years ago because of strong demand additions from the emerging market nations.

14. I think it is probably significant that the US Treasury Inflation Protected Securities (TIPS) now yield as much as regular Treasuries, as noted at Jesse's Cafe Americain. TIPS are basically bonds which guarantee that the principle will be adjusted for inflation when they return. So, no matter what the actual inflation rate is over the life of the instrument, you will receive the principle invested, plus whatever the rate of inflation was over that course of time, plus whatever the yield is. Is this a sign that the market expects deflation? Maybe. Eric Dash at the New York Times reports that credit card companies are in the process of cutting back lending sharply. Since America is a consumer society, a sharp cut back in credit card debt should, as I understand it, mean a deep drop in money supply ... deflation. If the banks try to blow out their riskier customers--which, ironically in the most un-businesslike fashion they are likely to do--you will see defaults go up, which will lead to rates going up on less risky customers and so on ... until the Congress is called in to legislate the matter.

On the other hand, Jesse's Cafe Americain also warned on the same day that the US will be forced to selectively default and devalue its debt.

"Once the deleveraging of the markets subsides, the dollar and Treasuries will drop, perhaps with some momentum, as the rest of the world realizes that the US has no choice but to default. This can be resolved in several ways, including continued subsidies from foreign sources in the form of virtual debt forgiveness, devaluation of the dollar, raising of taxes, and higher interest rates on debt.That argues that we will see inflation, does it not? So far today the dollar has taken a pounding, as per Ye Xie and Daniel Kruger at Bloomberg. My expertise is too far removed from this to give a strong opinion one way or another. Nonetheless, it will be critical, I think, to predicting possible realignments in international affairs going forward.

The problem now is that the US has breached the point where it can service its debt out of real cash flows, and turning this around will require a severe devaluation of the US dollar.

...

This is the fundamental situation. Everything else is speculation and commentary."

For example, today RIA Novosti reported yesterday that Prime Minister Putin suggested in talks with Chinese Prime Minister Wen Jiabao that Russia and China switch over to national currency payments in their bilateral trade arrangements.

15. Li Yanping and Wang Ying at Bloomberg report that the People's Bank of China cut the benchmark one year lending rate from 6.93% to 6.66%, effective tomorrow. This is the third time the PBoC has cut interest rates in two months.

16. Sharon Otterman at the New York Times reports that the DOW climbed 889.35, or 10.8%, to 9,065.12 in late trading on Tuesday. Otterman's piece says it was due to rate cuts and the freeexchange blog has a snarky take on the major financial press's takes here which I admit made me chuckle.

17. Timothy R. Homan at Bloomberg reports that orders for US durable goods (excluding transportation equipment) in September fell 1.1%. Michael Grymbaum at the New York Times reports that orders for US durable goods (including transportation equipment) in September grew 0.8% from August. "Orders for August were revised lower, to minus 5.5 percent, the Commerce Department said Wednesday."

No comments:

Post a Comment