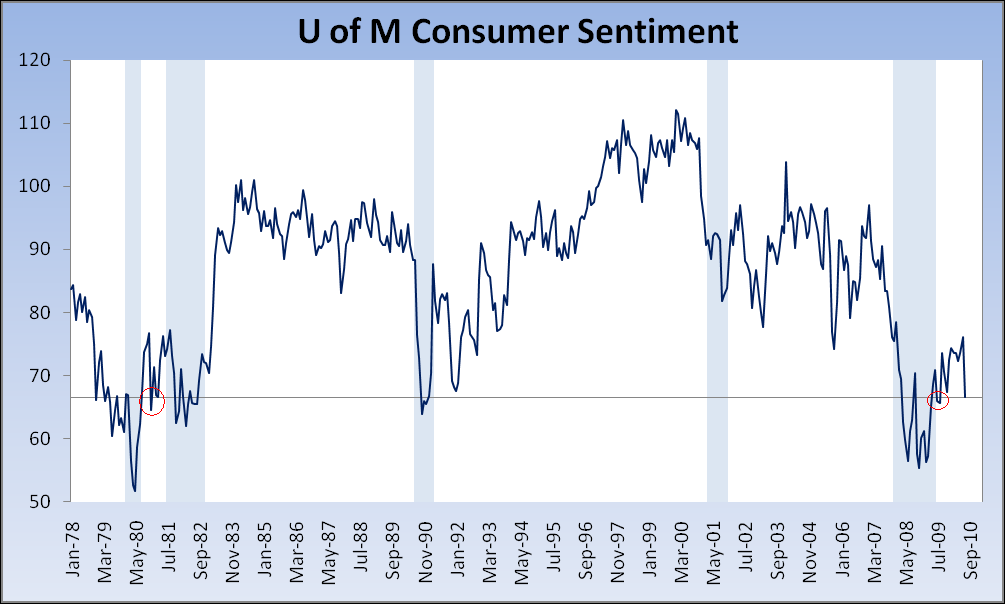

Marcin Grajewski at Reuters reports that consumer sentiment in Europe has hit a 28 month high.

"The European Commission said its economic sentiment indicator for the 16-nation currency area rose to 101.3 in July, a 28-month high, from an upwardly revised 99.0 in June."2. GERMAN UNEMPLOYMENT FALLS FOR 13TH STRAIGHT MONTH

Rainer Buergin and Christian Vits at Bloomberg report that unemployment in Germany fell for the 13th straight month by a seasonally adjusted 20,000 to 3.21 million.

3. BANKS TO PREPARE FOR EUROZONE EXIT SCENARIOS

Eurointelligence reports that banks in Europe are preparing scenarios for eurozone states exiting the euro.

"The International Swaps and Derivative Association asked some of its members to form a group to consider what they may need to do if a eurozone state is ejected."4. CZECH GOVERNMENT REFUSES TO SET DATE FOR EURO ADOPTION

Peter Laca and Ladka Bauerova at Bloomberg report that the Czech government has said that it refuses to commit to a date for euro adoption.

"[Prime Minister] Necas, 45, said the country will benefit from a flexible exchange rate as consumer prices converge with those in richer European Union-member states, and rapid euro adoption would risk fueling inflation. The koruna has gained 3.7 percent against the euro this month, the most among more than 170 currencies tracked by Bloomberg, making Czech exports more expensive.5. UK PRODUCTION OF GAS DOWN 14.3%

'The government program will not include any target date or a promise to join the euro area,' Necas said today in an interview at his office in Prague. 'Exports are important, but this country is not only a country of exporters.'"

Platts reports that the UK's production of gas was down 14.3% in 2009 from 2008. "Gross natural gas production has fallen by 45% since its peak in 2000."

6. REGIONAL GROUPING TO DISCUSS COLOMBIA-VENEZUELA RIFT

BBC reports that Unasur, a regional grouping of foreign ministers, is set to discuss the rift between Venezuela and Colombia at its meeting in Quito today.

7. CONOCO WILL SELL ENTIRE STAKE IN LUKOIL

Sheila McNulty at the Financial Times reports that Conoco announced yesterday that it would sell its entire stake in Lukoil.

"Jim Mulva, Conoco chief executive, said the Lukoil investment had been aimed at doing joint deals and these had not happened."8. IMF TO LEND UKRAINE $15.2 BILLION

Kateryna Choursina and Sandrine Rastello at Bloomberg report that Ukraine has secured a $15.2 billion, 2 1/2-year loan from the IMF.

"The Washington-based institution’s board of directors agreed to disburse $1.9 billion immediately, with subsequent payments subject to quarterly reviews.9. INITIAL UNEMPLOYMENT CLAIMS DOWN 11,000

“Ukraine is emerging from a difficult period during which the economy was severely hit by external shocks and exacerbated by domestic vulnerabilities,” John Lipsky, the fund’s first deputy managing director, said in a statement. “Authorities are committed to addressing existing imbalances and putting the economy on a path of durable growth, through important fiscal, energy, and financial sector reforms.” "

Calculated Risk reports that

"In the week ending July 24, the advance figure for seasonally adjusted initial claims was 457,000, a decrease of 11,000 from the previous week's revised figure of 468,000. The 4-week moving average was 452,500, a decrease of 4,500 from the previous week's revised average of 457,000."