Elena Moya at the Guardian UK reports that European governments are freezing Goldman Sachs out of debt offerings. An observer in France says that there would be rioting in the streets if Paris chose Goldman to lead a bond sale. Worth reading in full.

PRIVATE EQUITY INVESTMENT IN INDIA GROWING RAPIDLY

James Lamont at beyondbrics reports that India's private equity market is predicted to reach $17 billion this year.

"New investments will originate from the US where investors seek to participate in India and China’s high growth profiles. Average deal size among private equity investments this year is already between $50m and $200m, up from an average of $21m last year."CLINTON ANNOUNCES NEW AID PROJECTS FOR PAKISTAN

BBC News reports that US Secretary of State Hillary Clinton announced a number of new aid projects for Pakistan worth $500 million. The projects include the building of two new hydroelectric dams. The aid money comes from a five year $7.5 billion aid package agreed to by Congress last year.

HUNGARY SUSPENDS BUDGETARY REVIEW BY IMF AND EU

Judy Dempsey at the New York Times reports that Hungary's government has stated that it will not pursue further austerity measures despite pressure from international creditors. The IMF and EU suspended a budgetary review of Hungary over the weekend.

MOODY'S DOWNGRADES IRISH DEBT

Matthew Saltmarsh at the New York Times reports that Ireland's debt has been downgraded by Moody's to Aa2 from Aa1. It's outlook has been changed from stable to negative. Not sure why anyone would pay any attention to the ratings agencies after this last bugaboo, but there you have it. The rating is still well above junk.

IRANIAN REVOLUTIONARY GUARD PULLS OUT OF PHASES 15 AND 16 OF SOUTH PARS

Aresu Eqbali at Platts reports that due to sanctions, the Iranian Revolutionary Guard has pulled out of phases 15 and 16 of the South Pars project.

"The IRGC and its affiliates have grown into an economic power in Iran, largely as a result of a succession of UN sanctions imposed by the international community over suspicions that Tehran is secretly developing nuclear weapons, a charge the Iranians deny.BOEING SELLS 30 777S TO DUBAI

The involvement of IRGC or its subsidiaries would make it difficult to source parts and equipment from foreign companies, which run the risk of being in breach of the sanctions should they have to deal with Khatam al-Anbiya or any other banned entity."

Christopher Drew at the New York Times reports that the Dubai-based Emirates Airlines has put in a purchase order to Boeing for 30 777s. Airbus has sold 131 commercial airplanes this year; Boeing has sold 177.

WATER START UP SEEKS MARKETS IN INDIA, SAUDI ARABIA, CYPRUS AND IRAQ

John Collins Rudolf reports that a start up company in Texas plans to ship fresh water from Sitka, Alaska, to markets in India, Saudi Arabia, Iraq, and Cyprus. The company has no contracts yet, but has signed a deal with Sitka.

MOZAMBIQUE SOURCE OF COKING COAL FOR CHINA, INDIA, AND SOUTH AFRICA

Frontier Markets reports that interest is growing in Mozambique from China, India, and South Africa due to its reserves of coking coal for use in their steel plants.

BUILDER CONFIDENCE IN NEWLY BUILT, SINGLE FAMILY HOMES DECLINES ACCORDING TO HMI

Free exchange opines that the outlook for housing will be grim for the foreseeable future.

TWO AND HALF MILLION UNEMPLOYED LOSE ACCESS TO UNEMPLOYMENT BENEFITS

Phil Izzo at Real Time Economics reports that 2,502,000 jobless Americans have lost access to unemployment benefits since June 2.

"The Senate is expected next week to vote to extend unemployment benefits, but the delay has caused a lapse in benefits for some 2.5 million of the nation’s jobless."Meanwhile, Tom Barkley at Real Time Economics reports that the National Association for Business Economics survey of 84 companies found that they were back in hiring mode. Meanwhile, Free Exchange reproduces a Brookings graph which plots the length of time it will take for jobs to reach the height seen prior to the recession with how many jobs need to be created.

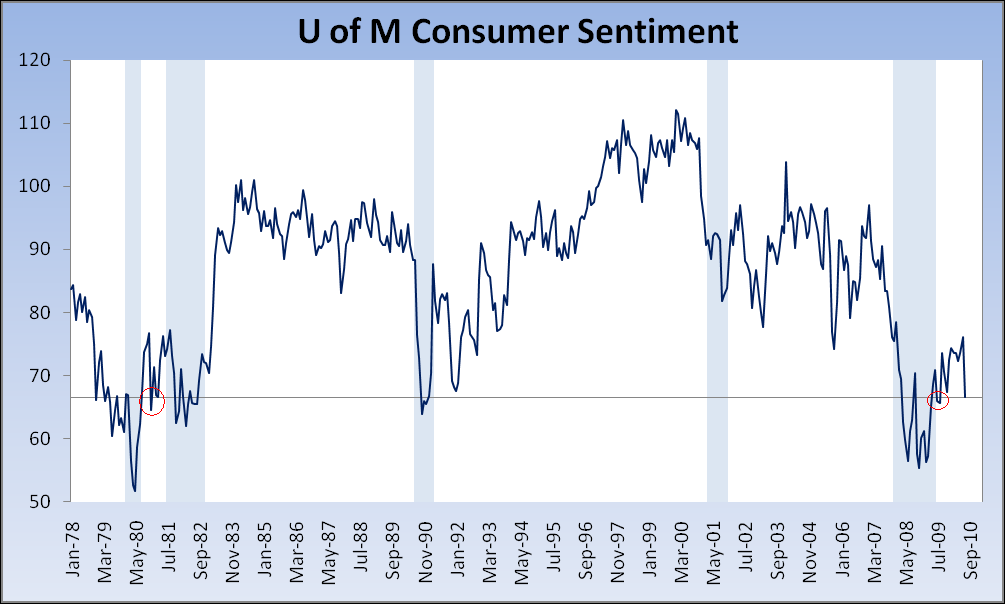

Invictus at the Big Picture reproduces a graph from the University of Michigan's Consumer Sentiment Survey and notes that the reading looks a lot like the last time we had a double dip recession.

THE CLEVELAND FED REPORTS THAT THE PUBLIC EXPECTS INFLATION TO STAY BELOW 2% OVER THE NEXT DECADE

"The Cleveland Fed’s estimate of inflation expectations is based on a model that combines information from a number of sources to address the shortcomings of other, commonly used measures, such as the "break-even" rate derived from Treasury inflation protected securities (TIPS) or survey-based estimates."

No comments:

Post a Comment