Quentin Peel at the Financial Times reports that both manufacturing and services purchasing manager indices showed unexpected strength in the Eurozone.

"Taken in isolation, the indices suggest a real growth rate of gross domestic product in the eurozone of 0.7 per cent in the third quarter – above the 0.5 per cent for the second quarter – but analysts warned against extrapolating the figures for the full quarter."Worth reading in full.

2. US CHIEF OF THE JOINT CHIEFS OF STAFF SAYS HE HAS MOVED FROM BEING CURIOUS TO CONCERNED AT CHINESE NAVAL BUILD UP

Brian Spegele at China Real Time reports that the chairman of the Joint Chiefs of Staff, Adm. Mike Mullen, told troops at a town hall meeting in South Korea Wednesday that

“I have moved from being curious about what [the Chinese] are doing to being concerned about what they are doing.”This has apparently been the position of the chairman for some time now.

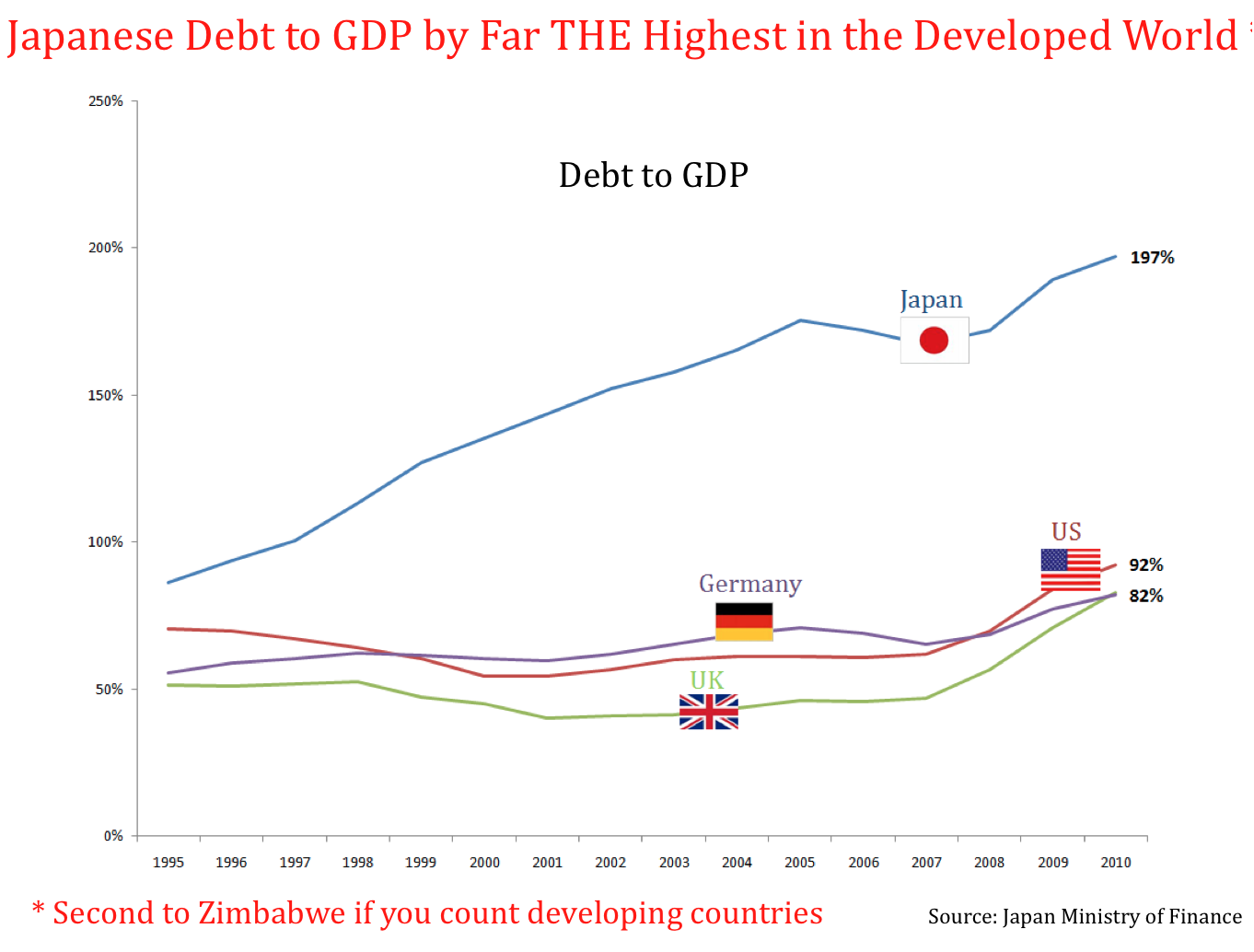

3. IS JAPAN IN DANGER OF FAILING?

Barry Ritholtz at the Big Picture reports on Vitaliy Katsenelson's argument that Japan will be the next big economy to crash.

4. ICJ RULES KOSOVO SECESSION LEGAL

Douglas Muir at A Fistful of Euros reports that the International Court of Justice today ruled that the Kosovo unilateral declaration of independence was legal. What does that mean for Catalonia, Scotland, Abkhazia, etc.?

5. VENEZUELA SEVERS DIPLOMATIC RELATIONS WITH COLOMBIA AGAIN

Christopher Toothaker at the Associated Press reports.

6. ONGC AND PETROVIETNAM TO PURCHASE BP STAKE IN OFFSHORE GAS FIELD

Nidhi Verma at Reuters reports that India's state owned ONGC has reached an agreement in principle with PetroVietnam for a joint purchase of BP's stake in a Vietnamese offshore gas field.

7. SOUTH AFRICA KEEPS BENCHMARK INTEREST RATE AT 6.5%

Nasreen Seria and Franz Wild at Bloomberg report that South Africa's central bank has decided to keep interest rates steady at 6.5%.

"Seven interest rate cuts since December 2008 and inflation at its slowest pace in four years have helped to spur consumer spending and growth in Africa’s biggest economy. [Central Bank Governor Gill] Marcus resisted calls from labor unions and exporters to cut interest rates again today as the World Cup, which ended on July 11, fueled wage demands and pushed up prices of hotel rooms, flights and restaurant bills."8. FORMER SINGAPORE PRIME MINISTER SAYS ENERGY INDEPENDENCE UNATAINABLE

Peter Maloney at Platts reports that the former Prime Minister of Singapore answered the question of whether the city state could become energy independent firmly in the negative.

"He was also refreshingly direct about the prospect of renewable energy making a significant dent in Singapore's energy mix. Wind power is out, he said. The island does not have winds that are strong or consistent enough. And solar power is too expensive.9. PERU TO PURCHASE RECORD NUMBER OF DOLLARS TO STAVE OFF SOL'S APPRECIATION

Lee noted that China has a huge share of the market for photovoltaic equipment, but the Chinese charge too much. If they want to lower prices, then Singapore might be interested, he said. Until then the island nation is looking to diversify its energy sources in other ways.

Right now, about 80% of the country's electricity is generated by natural gas, most of it from Indonesia. So Singapore is building an LNG regasification terminal to import LNG from Qatar."

John Quigley at Bloomberg reports that Peru may purchase a record number of dollars to prevent the sol from appreciating on investment in the country.

"Foreign investors are moving capital into the country as policy makers lift borrowing costs to prevent the $129 billion economy from overheating. The central bank will probably raise reserve requirements again, following an increase on July 18, Segura said. The Finance Ministry said this week it will coordinate dollar purchases with the central bank to slow gains in the currency."10. INITIAL JOBLESS CLAIMS RISE TO 464K

Peter Boockvar at the Big Picture reports that initial jobless claims totaled 464k, 19k above expectations and up from a revised 427k last week.

11. RAILFAX WEEKLY DATA--LOOKS LIKE GROWTH IS MODERATING

Atlantic Systems Inc.'s weekly railfax showed that year to date rail carriage of coal was down 1.4%. That should mean for no recovery in industrial production in the US.

Their graph of total North American carloads of waste and scrap material in four week rolling averages:

No comments:

Post a Comment