1. MAYER AND WOOD ARGUE THAT CHINA'S ENTRANCE INTO THE WORLD ECONOMY HAS NOT SIGNIFICANTLY DE-INDUSTRIALIZED REST OF DEVELOPING WORLDJörg Mayer and Adrian Wood at Vox EU argue that China's integration into the world's economy has not had the effect of substantially de-industrializing other developing nations."The biggest possible effect would be for a country which initially produced or exported equal amounts of manufactures and of primary products, where a 15% fall in the ratio would reduce the share of manufactures by 3.5 percentage points.

These estimates are imprecise and subject to error; the true answer may lie outside their range. But there is no plausible modification of the calculations that could make the true answer much larger. This is mainly because, despite its size, China’s opening had only a modest effect on world average endowments. The upper-limit estimates, obtained by simply adding China’s endowments to the rest of the world’s, are a 9% rise (from 0.43 to 0.47) in the share of the global workforce with a complete primary or secondary education, and a 17% fall in the average land/labour ratio, from 2.9 to 2.4 square kilometres of land per 100 workers ... . The average effect on the structure of output and trade in other countries is unlikely to have been larger than these world average endowment changes and was probably smaller.

The significance of the China effect varied widely among developing countries. This is partly because its size varied with the composition of each country’s manufacturing and primary production – how closely its industrial products competed with Chinese exports, and how much demand there was from China for its primary exports (more, say, for copper than for coffee). It is also because there were many other forces acting on sectoral structures--including changes in countries’ own trade policies--whose effects often outweighed those of China."

Worth reading in full.

2. NEPAL HARASSING TIBETAN REFUGEESGopal Sharma at Reuters reports that Nepal is responding to pressure from Beijing by cracking down on Tibetan refugees in the country."Nepali authorities have regularly broken up protests by Tibetan exiles and arrested them for protesting against China's crackdown on demonstrations in Tibet.

The Washington-based [International Campaign for Tibet] said Tibetan refugees were 'increasingly demoralized' as Nepal 'relinquishes its historic and sovereign interests in response to incentivized political pressure from Beijing and its sympathizers.'

ICT said 'pre-emptive arrests of Tibetans, ID checks and house searches' by authorities were contributing to a 'widespread sense of fear and insecurity' among the exiles.

'Nepal's political leadership is betting that the internal benefits of assuaging China in the cause of oppressing Tibetans will be greater... than the traditional legal and historical concepts,' Mary Beth Markey, Vice President at ICT said."

3. INDIA TO ANNOUNCE SOLAR POWER TARGETS OF 1/8TH TOTAL ELECTRICITY DEMAND, CENTRAL BANK LEAVES INTEREST RATE UNCHANGED ON INFLATION CONCERNSKrittivas Mukherjee and David Fogarty at Reuters reports that India will announce its targets for solar power generation in September. The plan promises to

"boost output from near zero to 20 gigawatts (GW) by 2020 as it firms up its national plan to fight global warming, draft documents show.

The target, which would help India close the gap on solar front-runners like China, is part of an ambitious $19 billion, 30-year scheme that could could increase India's leverage in international talks for a new UN climate pact in December, one of several measures meant to help cut emissions.

If fully implemented, solar power would be equivalent to one-eighth of India's current installed power base, helping the world's fourth-largest emitter of planet-warming greenhouse gas emissions limit its heavy reliance on dirty coal and assuaging the nagging power deficit that has crimped its growth.

The 'National Solar Mission', yet to be formally adopted by Prime Minister Manmohan Singh's special panel on climate, envisages the creation of a statutory solar authority that would make it mandatory for states to buy some solar power, according to a draft of the plan, which provided detailed proposals for the first time, obtained by Reuters ... ."

Meanwhile,

Cherian Thomas at Bloomberg reports that India's central bank decided today to leave its benchmark interest rate unchanged at 3.25%."The central bank raised its inflation forecast for the year to March 31 to 'around 5%' from an April estimate of 4%, citing 'elevated' food and commodity prices."

4. EU TO TRAIN SOMALI SECURITY FORCES TO POLICE PIRACYBBC News reports that the EU has announced plans to train Somali security forces to tackle the piracy plaguing their coasts."It will send a planning team to the region next month. The training will take place in neighboring Djibouti, which has French and US military bases."

(h/t

Joshua Keating at FP's Morning Brief.)

5. IMF AND LATVIA REACH ACCORD, MAY OPEN UP NEW FUNDINGAaron Eglitis and Timothy R Homan at Bloomberg report that the IMF and Latvia have reached an accord paving the way for the country to receive its first financial assistance from the organization since December."The review may unlock about 195 million euros ($285 million), which the IMF withheld in March after the Baltic country failed to commit to budget cuts, the fund said in an e- mailed statement.

Latvia turned to a group led by the European Commission and the IMF for a 7.5 billion-euro stabilization loan in December after its second-biggest bank needed a state rescue. The IMF announcement followed a 1.2 billion-euro transfer by the European Commission yesterday, helping quell concern about a lats devaluation that may have destabilized currencies across the region."

6. MOUSAVI CALLS FOR NEW STREET PROTESTS NEXT WEEK IN IRANBorzou Daragahi at the LA Times reports that opposition candidate Mir-Hossein Mousavi has called for more street protests during religious festivals next week. 7. KENYA TO BUILD AFRICA'S LARGEST WIND FARMXan Rice at the UK Guardian reports that Kenya plans to build the largest wind farm in Africa."Some 365 giant wind turbines are to be installed in desert around Lake Turkana in northern Kenya – used as a backdrop for the film The Constant Gardener--creating the biggest wind farm on the continent. When complete in 2012, the £533m (~ $758.8 million) project will have a capacity of 300MW, a quarter of Kenya's current installed power and one of the highest proportions of wind energy to be fed in a national grid anywhere in the world."

8. FUEL OIL APPROACHING COST OF CRUDE, HURTS SHIPPING, CHINESE FUEL OIL IMPORTS ROCKET UPWARD (FROM LOW BASE), VIETNAMESE MAIDEN REFINERY TO TAKE SPOT GASOLINE DEMAND OFF MARKET, WALL OF ASIAN PACIFIC REFINING YET TO PLAY OUTChristian Schmollinger and Alaric Nightingale at Bloomberg report that the price of fuel oil--bunker fuel, the bottom of the barrel, which is used to power ships in great part because it is cheap, generally trading at a considerable discount to crude, is approaching the price of light crude and may surpass it."Fuel oil may surpass crude 'for quite some time, six months is possible,' JPMorgan Chase & Co. vice president of energy strategy Vima Jayabalan said in a phone interview from Singapore."

This means that the effect of rising crude prices is having a more pronounced affect upon the cost of shipping than it did during the 2003-2008 run up in the price of crude.

"'It’s really hurting' ship owners, said Parul Bhambri, a Singapore-based analyst at Drewry.

Maersk said May 12 that falling demand for freight hobbled its ability to pass on fuel costs to customers in the first quarter, when its shipping line lost $559 million after taxes, compared with an $80 million profit a year earlier. The shares are down 40% in the past year in Copenhagen trading."

As the price of fuel oil rises, however, many simple refineries, which do not have the equipment to maximize gasoline and diesel output, can become profitable again, which may undergird a recovery in overall crude demand. That said, it still doesn't look like there's much demand for gasoline and diesel out there, which could push down the crack spread and thus the price of crude.

Winnie Lee at Platts reports that Chinese fuel oil imports in June were up 6.26% from May and 45.94% from June 2008 to 13.7 kb/d. It's largest supplier was Venezuela. In that vein,

Irene Tang at Platt's the Barrel blog reports that the commissioning of Vietnam's first refinery at Dung Quat is poised to erase about 30% of the country's product import demand, which will in turn erase its demand for spot gasoline purchases. The wall of new refining capacity in Asia has yet to fully be appreciated,

"China has now joined India in becoming a major swing exporter of gasoline. Apart from greenfield refineries coming onstream in the country, Beijing's decision to adopt a new products pricing formula for the domestic market and the resulting price revisions in tandem with the global benchmarks has encouraged more speculative buying at the wholesale level, causing wide fluctuations in refiner inventories.

This, in turn, has made Chinese gasoline export volumes unpredictable. The latest customs figures show gasoline exports hit a two-year high of 560,000 mt in June, a 273% surge from the corresponding month of last year. The previous high was in April 2007, at 590,000 mt.

The figures point to Chinese 'apparent' gasoline demand in June being just 1.8% higher than the same month a year ago, a contrast with on-year growth rates of 20.2% in May and 13% in April. The anomaly of the June figure, in the backdrop of staggering double-digit growth rates of automobile sales in China and a 7.7% on-year average gasoline demand growth in the first half of the year, can only be explained by wild swings in stock builds and draws."

"The full impact of the start-up of Reliance Industries' new 580,000 b/d refinery in Jamnagar should be apparent as early as August, as the company's older 660,000 b/d refinery is now restarting from a partial shutdown. Monthly gasoline exports from RIL are expected to more than double to well above 600,000 mt."

9. NIGERIAN REBELS IN SOUTH TARGET OIL MINISTER'S COMPANY, NORTHERN ISLAMISTS CONTINUE UNRESTPlatts reports that the Nigerian Joint Revolutionary Council has issued a warning to UK-based independent producer Afren Resources to stop operating in the Niger Delta or risk attacks on its equipment and personnel."The Joint Revolutionary Council, which styles itself as a coalition of militant groups based in southern Rivers and Bayelsa states, said in a statement that its ultimatum to Afren was aimed at expressing the group's opposition to the policies of Nigeria's Oil Minister Rilwanu Lukman--policies the group sees as skewed against the Niger Delta region in the country's south.

Lukman was a co-founder of Afren and stepped down from his position as chairman of the company's board of directors once he was appointed oil minister for Nigeria in late 2008. His shares in the company were to be held in a blind trust, the company said in a statement at the time."

Lukman wants to site an oil university in his home state in the north--Kaduna. Meanwhile,

Ibrahim Mshelizza at Reuters reports on the increasing Islamist inspired unrest in northern Nigeria."The violence was triggered when some members of the group called Boko Haram, which wants a wider adoption of Islamic sharia law across Africa's most populous nation, were arrested Sunday in Bauchi state.

Unrest spread to the northern states of Kano, Yobe and Borno, whose capital Maiduguri is home to the group's leader, Mohammed Yusuf, and has seen the worst violence.

'The situation has been contained in Bauchi and Yobe. The bad situation we have now is in Borno where the leader of the group is residing ... We are going to launch an operation, a main operation to flush them out,' [Nigerian President Umaru] Yar'Adua told reporters after meeting security chiefs and state governors."

10. PRESSURE TO CHANGE DRUG WAR STRATEGY BUILDING IN MEXICO, MEXICAN CRUDE PRODUCTION WAY DOWNWilliam Booth and Steve Fainaru at the Washington Post report on the growing pressure on Mexican President to change Mexico's "surge" strategy in dealing with its drug cartels."Dan Lund, president of the MUND Group polling organization, said public support for Calderón's strategy appears to be weakest in the places where the federal government needs it most. 'In a series of national surveys, polls consistently have found a reasonable but cautious level of support for using the military in the front lines against the cartels,' he said. 'But in all the states where the military is actually deployed, the support goes down, sometimes dramatically.'

The situation has been exacerbated by the global economic crisis, which has cast millions of Mexicans into poverty. José Luis Piñeyro, a Mexican military analyst who maintains close ties with the armed forces, said rising unemployment and poverty 'is creating what I call an "army in reserve,"' for the traffickers.

In Michoacan, La Familia has used the media to try to align itself with the disenfranchised. After the recent attacks, one of its leaders, Servando Gómez, called a local television station and told viewers: 'I want to say to all Michoacanans, we love them and respect them.'"

Meanwhile, there was plenty of stories on the decline in Mexican production last week.

John Kingston at the Barrel notes:

"But here's the more stunning figure: what's happened in two years. In July 2007, Pemex reported crude output of 3.165 million b/d. That's a 20.4% decline in 23 months."

11. VATICAN AIMS AT FREE MARKETEERS, SAYING MARKETS WITHOUT ETHICS DESTROY WEALTH AND CREATE POVERTYFlavia Krause-Jackson at Bloomberg reports that the Vatican has attacked free markets, saying that they have legitimized greed. On June 7, the pope published an encyclical which examined the financial crisis and means out of it, saying that once profit becomes the exclusive goal of business, it destroys wealth and creates poverty.

"Last November, Italian Finance Minister Giulio Tremonti said the pope had pronounced a 'prophecy' in a paper Benedict wrote when he was a cardinal.

In 1985, then-Cardinal Joseph Ratzinger presented a paper titled 'Market Economy and Ethics' at a Rome event on the Catholic Church and the economy. He said a decline in ethics 'can actually cause the laws of the market to collapse.'"

I think it is plain that markets cannot sustain themselves without a modicum of trust, engendered by ethics held in common.

12. CFTC MAY OR MAY NOT REVISE LAST YEAR'S REPORT EXONERATING SPECULATION IN PRICE VOLATILITY, LONDON'S FSA EXONERATES SPECULATORSIanthe Jeanne Dugan and Alistair MacDonald at the Wall Street Journal report that the CFTC "plans to issue a report next month suggesting speculators played a significant role in driving wild swings in oil prices--a reversal of an earlier CFTC position that augurs intensifying scrutiny on investors."

However, I understand that the Chair of the CFTC indicated today that the story in the WSJ that the report will be redone and altered are premature and inaccurate. From the WSJ story,

"In the US, the CFTC begins public hearings Tuesday to determine whether to limit speculative investments in commodities. Congress also is weighing whether to give the CFTC the authority, under a broader proposal to revamp financial regulation, to regulate commodities investments that occur off traditional exchanges. Byron Dorgan, a North Dakota Democrat, has called on the CFTC to curb 'oil speculators looking for a quick buck at the expense of American consumers.'"

I suspect that the direction of these accusations is misdirected, given that commercials may choose to purchase futures to profit on price just as much as to hedge their obligations.

+7+21+09.jpg)

Positions net long and short for the week ended July 21 only comprised 1% of the market. Note that from 2008 open interest--or the total number of contracts--has been steadily falling for both futures and options--though the trend for options was up through February.

If you include options, the number of positions held by traders net long or short represent 3.17% of the market--not an especially large share. Meanwhile,

Alistair MacDonald and Carolyn Cui at the Wall Street Journal report that the Financial Services Authority in London has found no evidence that speculators are behind the wild swings in oil price seen from 2008."One person familiar with the matter said the FSA had seen no evidence to suggest that speculators are driving up the price of oil.

'More than they ever were before, [investors] are looking to the global economic climate and nobody is sure on that, and that is perhaps driving the volatility,' he said.

Given that view, the FSA doesn't believe that limiting the size of trading positions would be 'beneficial' for the market, said a person familiar with the matter. Still, the FSA acknowledges it doesn't have a 'full explanation' as to why the market has moved the way it has, said a person familiar with the matter.

The FSA's conclusion contradicts British Prime Minister Gordon Brown, who has linked the recent rises in oil to speculation.

...

Politicians around the world are worried about the effect of rising oil prices on the recovery potential of their recession-hit economies. World leaders from French President Nicolas Sarkozy to the leaders of Asia's biggest oil-consuming nations have tied these rises to oil speculators."

"Speculation," of course, is sufficiently vague to represent a politically useful bogeyman, and it seems likely that someone will call financial protectionism. That said, I do think it is in the global economic interest to make the cost of energy--and in particular transportation fuels--more stable and predictable, I just don't think that attacking "speculation" is a particularly productive way of doing so.

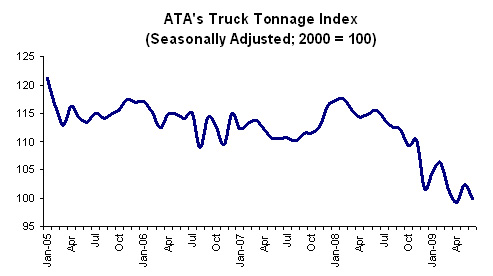

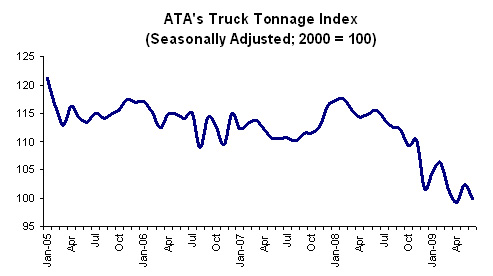

13. TRUCKING VOLUMES IN US DOWN 13.6% IN JUNE YOYThe American Truckers Association yesterday announced that their "advance seasonally adjusted (SA) For-Hire Truck Tonnage Index fell 2.4% in June. In May, SA tonnage jumped 3.2%. June’s decrease, which lowered the SA index to 99.8 (2000=100), wasn’t large enough to completely offset the robust gain in the previous month."

Over June 2008, tonnage fell 13.6%, which exceeded the year over year drop of 11%.

The ATA release warns:

"The sample includes an array of trucking companies, ranging from small fleets to multi-billion dollar carriers. When a company in the sample fails, we include its final month of operation and zero it out for the following month, with the assumption that the remaining carriers pick up that freight. As a result, it is close to a net wash and does not end up in a false increase. Nevertheless, some carriers are picking up freight from failures, and it may have boosted the index. Due to our correction mentioned above, however, it should be limited."

(h/t

Barry Ritholtz at the Big Picture.)

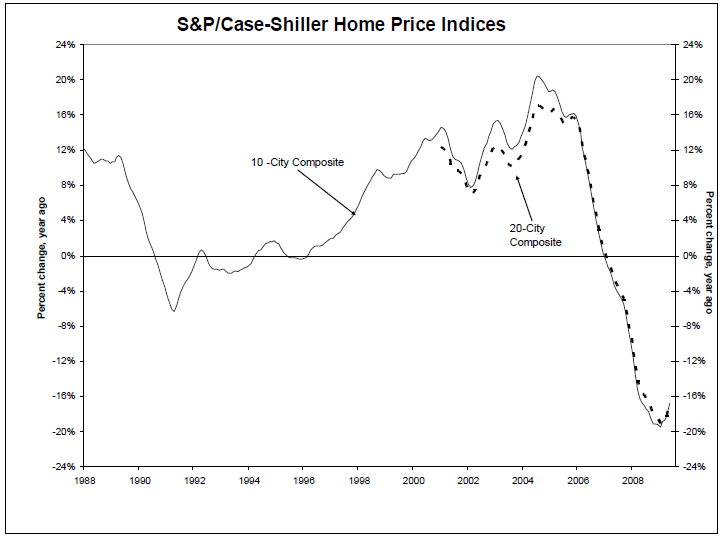

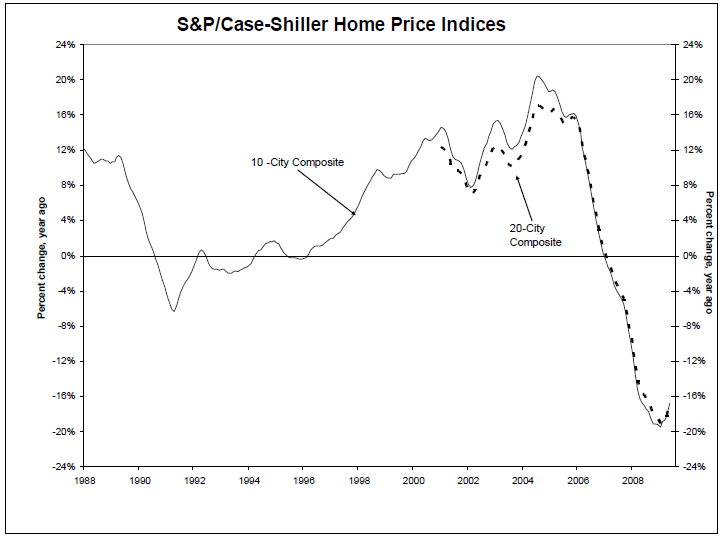

14. HOME PRICE DECLINE SLOWING, CALIFORNIA FORECLOSURES DOUBLE NEW HOME SALES IN JUNEBarry Ritholtz reports that home price declines are "slowly abating." Here is his graph:

Jake at Econopic picked up on the Big Picture's quote of the day of Mark M Hanson which notes that California foreclosures are more than double the national new home sales for June.

Jake at Econopic picked up on the Big Picture's quote of the day of Mark M Hanson which notes that California foreclosures are more than double the national new home sales for June. His graph:

15. EPA MAY GIVE ALGAE BIG BOOSTRussell Gold at Environmental Capital notes that Blair Carter at the Renewable + Law Blog reports that "that the Environmental Protection Agency will count algae as an advanced biofuel under Renewable Fuel Standard rules being developed."

15. EPA MAY GIVE ALGAE BIG BOOSTRussell Gold at Environmental Capital notes that Blair Carter at the Renewable + Law Blog reports that "that the Environmental Protection Agency will count algae as an advanced biofuel under Renewable Fuel Standard rules being developed.""Why do EPA’s steps towards including algae matter? Because when Congress created its mandate to blend advanced biofuel into the fuel pool, it created a big market for these fuels. By 2012, the law mandates that two billion gallons of these advanced biofuels be blended, a figure that rises by tenfold by 2022. It’s all in Section 202 of the Energy Independence and Security Act of 2007.

... For algae to be included, the law says it needs to have no more than 50% of the 'lifecycle greenhouse gas emissions' of gasoline and diesel. This could be tricky, says David Woodburn, an alternative energy analyst with ThinkEquity. 'The hard part for me is understanding how the EPA plans to calculate the GHG emissions of algae fuels, based on the variety of feedstocks (sugar, CO2, other), processes (open ponds, photobioreactors), and algae varieties being explored--especially before November,' he says, noting when the rules are supposed to be finished."

Blair Carter's post can be found

here.

16. TEXAS DROUGHT GETS WORSETom Benning at the Wall Street Jounral reports on the drought in Texas."Nearly 80 of Texas' 254 counties are in 'extreme' or 'exceptional' drought, the worst possible levels on the US Department of Agriculture's index. Though other states are experiencing drought, no counties in the continental U.S. outside Texas currently register worse than 'severe.' In late April, the USDA designated 70 Texas counties as primary natural-disaster areas because of drought, above-normal temperatures and associated wildfires."

The Journal carries

an interactive graphic:

+7+21+09.jpg)