"The eurozone economy was forecast to contract by 3.2% in 2009, [Ms. Ter-Minassian, an adviser to IMF managing director Dominique Strauss-Kahn] said, against the earlier forecast of a 2% decline. The US would shrink by 2.6% (1.6%), and Japan 5% (2.6%), making it the worst-hit big economy. The IMF in Washington said the figures cited by Ms Ter-Minassian were 'unofficial' and 'out of date'."In early March the IMF began indicating that a downward revision was under way--see Daily Sources 3/3 #1.

2. Philip P. Pan and Karen DeYoung at the Washington Post report that many Russia analysts believe that Moscow is signaling interest in a deal on Iran.

"In a meeting last week with a bipartisan commission studying US policy toward Russia, President Dmitry Medvedev expressed alarm in 'very graphic language' over Iran's successful test launch of a satellite last month, linking it to Tehran's nuclear program, said Dmitri Simes, director of the commission.The Federation of American Scientists provide the following illustration of Iranian missile capabilities.

'Medvedev said it demonstrated how far-reaching Iran's nuclear ambitions are, and that he was very concerned,' said Simes, who is also president of the Nixon Center in Washington. 'He felt it was a clear challenge to both Russian and American interests and said he would like both countries to work on this challenge together.'"

Satellite launches reportedly use technologies required for the development of ICBMs. In November, Iran claimed it had successfully tested missiles with a range of 1,200 miles, which as you can see from the map does not quite put Moscow in range--and obviously is even further from presenting any potential threat to, say, Warsaw. That said, it plainly makes a lot of sense that Iran's perennial missile tests would have the--likely unintended--effect of ruffling Moscow's feathers, given that a nuclear armed Tehran which could reach Moscow is definitely not in their interests.

"Alexander Pikayev, a top arms control scholar in Moscow, said Russian policy toward Iran will be determined by competing interest groups and political factions. Defense manufacturers and the atomic energy industry oppose tougher sanctions, for example, but the United States could win over the latter by reviving a bilateral pact on civilian nuclear cooperation that was frozen after the Georgian war, he said.Frankly, I doubt this assessment--I think the notion of a nuclear armed Iran with the capability of hitting Moscow will outweigh the economic considerations involved in putting the kibosh on nuclear power cooperation with Iran. Indeed, it is hard to see many places in which Iranian and Russian interests coincide. Perhaps they do in terms of energy pricing, but Iran's potential as an alternative source of gas for European industry is probably a critical item in Moscow's long term thinking. And as the weekend's events proved, Russia still regards oil production coordination with OPEC as being less in its interest than good terms with Europe--and producing at full bore to claim all price increases produced by the cartel. (A policy which Iran appears to follow with respect to the organization's production quotas as well, ironically enough.)

Pikayev said Medvedev may be more likely to support sanctions because a breakthrough in US relations would boost his political stature at home and set him apart from his powerful predecessor, Prime Minister Vladimir Putin. Putin might resist, but his relationship with Iranian President Mahmoud Ahmadinejad is said to be strained and he surprised Russia's foreign policy establishment by endorsing earlier U.N. sanctions, Pikayev said."

3. The Associated Press reports that North Korea yesterday gave the organizations distributing US food aid inside that country till the end of March to leave--rejecting all future food aid.

4. Judy Dempsey at the New York Times yesterday reported that Russia signed two natural gas deals with Hungary yesterday. One deal signed last week has the Budapest and the Hungarian Development Bank to finance the South Stream project on Hungarian soil.

The other deal has Gazprom and MOL establishing a 1.3 billion cubic meters storage facility in Hungary. To make sense of that, here is a map that Jérôme Guillet drew up of Ukraine's gas infrastructure--note the three asterixes to the West, which represent gas storage facilities.

As Guillet pointed out in a piece for the European Tribune:

"Storage capacity is important in the gas business, as demand is seasonal (there is more in winter for heating) and can almost triple in Europe between summer and winter. If you can pre-position your gas near the markets when transport capacity becomes strained, you can extract a lot more value from that seasonality. The storage facilities near the Hungarian and Slovak borders were ideal for Soviet exports, but now they are in Ukrainian hands, and thus Russia must have a minimum of technical cooperation from the Ukrainians, who physically control and operate these facilities, not to lose a lot of money in their export markets. More, unavoidable leverage for the Ukrainians."Hungarian Prime Minister Ferenc Gyurcsany's plea for a regional aid package from the EU was turned down last week. He has been a supporter of the Nabucco Pipeline, but questions of sourcing the gas (which would likely have to come from Iran) and project financing continue to bedevil the project.

5. Edward Hugh at Fistful of Euros posts that Poland's Central Statistical Office has released its industrial output data for February showing a 14.3% annual rate of decline in February, following a revised annual rate of decline of 15.3% in January. Output was up 2.7% in February from January however. Hugh provides a helpful graph of industrial production for the last two years:

Hugh points out that industrial production is on the decline across the spectrum of export-oriented Eastern European economies, warning against too much disambiguation between them. Worth reading and mercifully short.

6. Bettina Wassener at the New York Times reports that the World Bank lowered its forecast for Chinese growth in GDP for 2009 to 6.5%. 6.5%, though quite high by global standards just now, is well below the Chinese principle of "bao ba"--or "protect the 8"--below which conventional wisdom holds that Beijing will begin to see significant, read destabilizing, social unrest. Kevin Hamlin at Bloomberg reports that bank sees signs China's economy is stabilizing faster than the rest of the world.

"'The government’s stimulus is working,' said Louis Kuijs, a senior economist at the World Bank in Beijing. 'China’s fundamentals are strong enough to ride out this storm.'"Meanwhile, Andrew Batson at China Journal helpfully translated the complete text of Chinese Ministry of Commerce’s statement announcing its decision to block Coca Cola’s proposed acquisition of China Huiyuan Juice Group Ltd. Key excerpt:

"Through its review, the Ministry of Commerce found that this concentration will have an adverse impact on competition. After the concentration is completed, Coca-Cola could use its market dominance in carbonated soft drinks to limit competition in the market for juice through tying, bundling or other exclusive transactions, resulting in consumers being forced to accept higher prices and reduced variety. At the same time, because brands can restrict entry to the market, it would be hard for the threat of potential competition to remove the restrictive effect on competition. In addition, the concentration will also reduce the room for small and medium-sized juice companies to survive, and will have an adverse effect on the structure of competition in China’s juice market."The notion that dominance in the carbonated drink market could adversely affect competition in the juice market is unlikely to please most corporate headquarters. The fact that the Ministry of Commerce took stock of the market power of brands is interesting given that some have written that the primary value-addition that Western corporations bring to emerging markets is, well, brands. Meanwhile, the Sydney Morning Herald reports that shares in Rio Tinto have taken a beating on fears that the deal with Chinalco taking a 18% stake in the company.

"'[The 8.7% decline in share price] is [due to] the uncertainty surrounding the Chinalco deal, there has been a bit of talk out today that there is a lot of opposition to the deal and this is what's weighing on it,' MF Global senior trader Anthony Anderson said.(h/t Emmanuel at International Political Economy Zone.)

'The FIRB extension and the senate inquiry into foreign investment is adding to the uncertainty.'

The mounting political concern follows a decision by the Foreign Investment Review Board (FIRB) to extend its review to 90 days and initiate a more in-depth examination of the transaction, after the initial 30-day evaluation period closed on Monday.

The transaction, which has been backed by the Rio Tinto board, will also allow Chinalco to appoint two new non-executive board members to the global miners board."

7. Platts reports that Italian major Eni has signed a major cooperation agreement with Pakistan to develop major projects all along the oil and gas product chain.

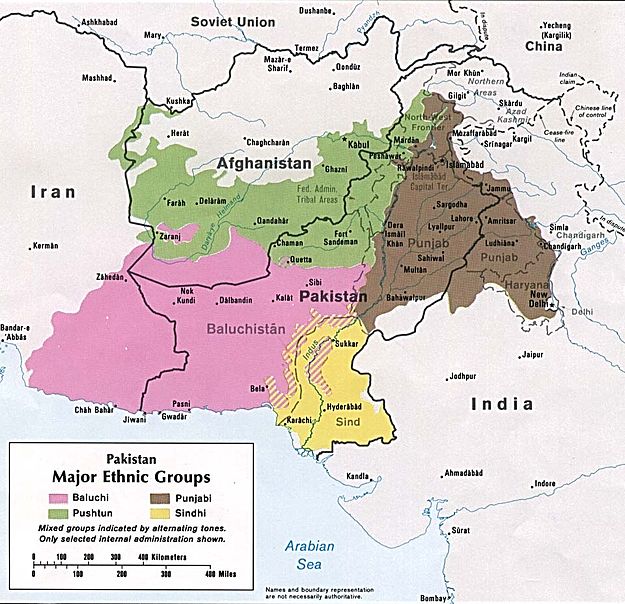

"The agreement also allows Eni to become a strategic partner in developing the oil and gas sector in Pakistan and to enter fields which are currently managed by state-run oil companies."8. David E. Sanger and Eric Schmitt at the New York Times reports that "two of the high-level reports on Pakistan and Afghanistan that have been forwarded to the White House in recent weeks have called for broadening the target area to include a major insurgent sanctuary in and around the city of Quetta."

Baluchistan has separatist tendencies and is in the middle of a small bore separatist struggle, both in Pakistan and Iran.

Note that Baluchis can be found in southern Afghanistan where most of that country's opium production--and violence--is concentrated.

9. Galrahn at Information Dissemination notes that due to the Obama Administration's review of all military ties, GE has been asked to freeze work on turbines it was to provide the Indian navy for three Shivalik-class stealth frigates. Though I strongly disagree with the way Galrahn frames the story, I think it is an important data point. Clearly the US is likely to approve continued sales of engines to the Indian Navy.

10. Maher Chmaytelli and Juan Pablo Spinetto at Bloomberg report that Shokri Ghanem, chairman of Libya’s state-run National Oil Corp., told journalists today in Vienna that Libya will exercise its right to buy Calgary-based Verenex Energy Inc., which would effectively block CNPC's bid for the E&P company.

"Verenex has assets in Libya that are worth 'hundreds of millions' of dollars, Ghanem said in an interview with Bloomberg on March 16."It is an interesting signal given China's Africa Policy announced in 2006 and Ghaddafi's recent selection as chair of the African Union--see Daily Sources 2/3 #9.

11. Justin Stares at Lloyd's List reports that the Bangladeshi High Court ordered the closure of all ship breaking yards operating without environmental clearance.

"Industry sources said they were 'staggered' by the ruling, which if confirmed will close down one of the world’s largest breaking industries just as scrapping activity peaks.It is a decision bound to amplify the effects of the financial crisis, economically-speaking ... it seems that probity only comes when it will hurt the most, ironically. Note the significance of the courts in the Muslim-majority nation. Well-worth reading in full.

'None of the 36 shipbreaking yards in Chittagong currently have an environmental clearance,' said the NGO Platform on Shipbreaking. 'The decision therefore effectively shuts down an industry that has been highly criticized by environmentalists and human rights activists for many years for operating with complete disregard for the law, human health and the environment.'

The scrapping industry, which claims to employ 250,000 either directly or indirectly in Bangladesh, is expected to appeal.

The court was ruling on a petition filed by the Bangladesh Environmental Lawyers Association. Judges ordered that no ship on the Greenpeace 'dangerous ships list' be allowed into the country, according to reports by the platform and local media."

12. Nasreen Seria at Bloomberg reports that the South African Reserve Bank's Monetary Policy Committee will meet next week and accelerate its schedule to monthly meetings for the rest of the year from planned meetings every two months.

"Global economic conditions 'are getting worse' and the 'changed' environment requires the MPC to meet more regularly, Governor Tito Mboweni said in a phone interview from Pretoria today."13. Victor L. Simpson at the Associated Press reports that in Cameroon Pope Benedict XVI reiterated yesterday that condoms were not an answer to the fight on AIDS--"You can't resolve it with the distribution of condoms. ... On the contrary, it increases the problem." I would note that Africa is one region where Catholicism--and more conservative Catholicism--is growing quickly. However, perhaps the one really impressive and compellingly moral US foreign policy triumph under the Bush Administration was the huge increase in aid to Africa in terms of the fight on AIDS, including condoms and retro-viral drugs. The people in Africa are well aware of how these aid programs have reduced the mortality rate in the continent. The notion that condoms are against life and a concession to death, and thus amoral, as opposed to a way to protect life and thus moral, will not, I believe, make much sense to them. Pope Benedict XVI appears to have a tin ear when it comes to husbanding the moral authority of the Church.

14. The Port of Long Beach recently posted its numbers for February, showing a 40% decline in container traffic from February 2008:

So far in 2009 the port has recorded a 20.2% decline in traffic. The Port of Marseilles, France, also recently posted its report for February, showing a 21% annual decline in total traffic. It registered a 16% decline from the traffic seen in January:

Hydrocarbons account for about 74% of Marseilles' traffic and it lost about 12% in volume from the year before. The grim trade data continue their march.

15. Bob Willis at Bloomberg reports that the consumer price index rose by 0.4% in February from January. Excluding fuel and food, prices climbed by 0.2% from the month prior. On an annual basis, the consumer price index rose by 0.2%, up from the 0% annual rate seen in January. Excluding fuel and food, prices climbed by an annual rate of 1.8% in February, up from a 1.7% annual rate of increase seen in January.

"Energy expenses increased 3.3%, led by an 8.3% increase in gasoline prices. Still, the fuel’s cost is down 36% from a year earlier.16. The Federal Open Market Committee met today and decided to keep the federal funds rate unchanged at 0-.25%. Excerpt from its press release:

Food prices, which account for about a fifth of the CPI, fell 0.1%, the first drop since April 2006."

"To provide greater support to mortgage lending and housing markets, the Committee decided today to increase the size of the Federal Reserve’s balance sheet further by purchasing up to an additional $750 billion of agency mortgage-backed securities, bringing its total purchases of these securities to up to $1.25 trillion this year, and to increase its purchases of agency debt this year by up to $100 billion to a total of up to $200 billion. Moreover, to help improve conditions in private credit markets, the Committee decided to purchase up to $300 billion of longer-term Treasury securities over the next six months."This follows the latest Treasury International Capital data which shows, courtesy of Brad Setser at Follow the Money, that foreign purchases of long term treasuries have collapsed:

Foreign government demand for US agency debt fell off a cliff late last year and purchases were even banned by Moscow just the other week. Meanwhile, Jon Hilsenrath at Real Time Economics reports that the Fed's quarterly survey of banks shows that during the week of February 2-6, banks extended $85.6 billion in credit to businesses, an increase of 13% from the first quarter of 2008--per JP Morgan Chase economist Michael Feroli:

17. The EIA reported that crude oil stocks built by 2 million barrels in the week ended March 13 to 353.3 million barrels, well above the historical average for this time of year, but still below the most recent peak of 354 million barrels seen on June 29, 2007. According to a survey by Bloomberg, analysts had expected a 1.5 million barrel build. Gasoline stocks grew by 3.2 million barrels, are near the top of the historical average. Analysts had expected a 1.5 million barrel draw. Distillates stocks grew by 100,000 barrels, are well above the five year historical average range as well as counter-cyclical, and versus analyst expectations of a 1 million barrel build. Taken in isolation, the data would be bearish on the price of crude.

1 comment:

Interesting.. as always.

http://en.wikipedia.org/wiki/SS_France_(1961)#Second_decommissioning

Post a Comment