"The United States, European countries, Japan and major developing nations are also close to a deal to create an "early warning system" to detect weaknesses in the global financial system before they reach epic proportions, according to diplomatic sources, who spoke on the condition of anonymity because plans were still being worked out."Worth reading in full.

2. Eurointelligence reports that Der Spiegel is running the story today that the Merkel Administration appears to be behind a report authored by a group led by Otmar Issing with a variety of proposals to be put to the G20 summit in Washington, DC, tomorrow. The Issing report calls for the establishment of an EU-wide regulator for large cross-country banks--similar to a proposal by Sarkozy which was recently rejected by Merkel. The report also proposes that all financial organizations of any kind as well as all financial instruments be subject to regulatory scrutiny. "They favour a global credit register, which the report says would be very easy to establish, given that the necessary data are all available at national level." The Issing report also calls for more cooperation between the central banks and private financial institutions globally.

3. Reuters reports that French President Nicolas Sarkozy told a news conference today that he had won Moscow's support for a proposed European Union-Russia security conference, possibly via the OSCE, in the middle of 2009. He urged Russia and the United States to embargo any further developments regarding missile shields or missile deployments until the conference has had a chance to work. In a related story, Alan Cullison at the Wall Street Journal reports that Belarussian President Alexander Lukashenko is in talks with Moscow about hosting Iksander missiles--short range missiles which can carry nuclear payloads--in Belarus. Interestingly, no country of the former Soviet Union has followed Moscow's lead in recognizing the independence of South Ossetia and Abkhazia--including Belarus, the one country most likely to do so.

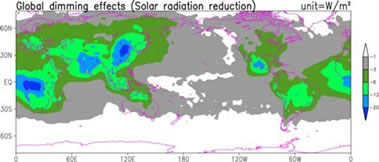

4. Andrew Jacobs at the New York Times reported yesterday that the UN released a report that day suggesting that the pollution caused by the industrialization of Southeast Asia has markedly reduced the amount of sunlight reaching the ground in the region, contributing to weather extremes and reduced harvests.

"The brownish haze, sometimes in a layer more than a mile thick and clearly visible from airplanes, stretches from the Arabian Peninsula to the Yellow Sea. In the spring, it sweeps past North and South Korea and Japan. Sometimes the cloud drifts as far east as California."I am not especially qualified to speak to global warming issues, but this report seems like very serious news to me--it sounds quite similar to the hypothesized causes of the Little Ice Age. The geopolitical consequences of such events are sobering, to say the least.

(image h/t informed comment)

5. Henry Sanderson at the Associated Press reports that Zhang Xiaoqiang, Vice Chairman of China's National Development and Reform Commission, has announced that the country will set as a strategic priority domestic production of 95% of their grain consumption through 2020. China is a net importer of grains and recent volatility in basic food costs has alarmed Beijing. The US is a major grain exporter. The recent decision to allow the transfer of land-use rights in China should be seen as an effort to increase productivity in the agricultural sector on national security grounds. Edward Wong at the New York Times has a story on unrest being caused by factory shut downs in China. Worth reading.

6. Platts reports that Rosneft President Sergei Bogdanchikov has told Russian media that the company plans to build a refinery near the Pacific port of Nakhodka in the second half of 2009. There have been competing reports about the project's possibilities. Some reports has a 400 kb/d refinery. Some had 200 kb/d. Some had a petrochemical project. The refinery would sell products into the Asian market. (Presumably primarily China.)

7. Nadia Rodova at Platts reports that

"Kazakhstan's state-owned KazMunaiGaz and Azerbaijan's state-run Socar have signed an agreement on main principles of establishing the Trans-Caspianto transport Kazakh crude to international markets via the Baku-Tbilisi-Ceyhan pipeline, KazMunaiGaz said Friday.

project

According to an agreement signed by Kazakhstan and Azerbaijan in August 2007, a pipeline will be built to transport crude from Iskene in western Kazakhstan to the Caspian Sea port of Kuryk, from where it will be loaded on tankers for delivery to terminals on the Azeri coast of the Caspian Sea."Project cost estimations have run at about $3 billion. Kazakhstan plans for the system to carry about 1.12 mb/d of its crude at its peak.

8. Grant Smith and Mark Shenk at Bloomberg surveyed a number of oil analysts and found that most thought that OPEC will cut production by 1 million barrels or more in the upcoming extraordinary meeting in Cairo November 29. Ministers from Iran and Algeria have indicated to reporters since the meeting was announced that they thought cuts were necessary. The following table was adapted from Platts and gives the inferred OPEC production quotas established in the October 24 meeting.

Eric Watkins at the Oil & Gas Journal reports that the EIA released its estimate the OPEC's production was down in October, to wit:

"EIA's estimated figures for OPEC members in October 2008 includes one member with higher production, namely Angola with 1.91 million b/d, up 130,000 b/d. Holding steady production levels are Algeria with 1.44 million b/d; Ecuador, 510,000 b/d; Iran, 3.9 million b/d; Iraq, 2.32 million b/d; Kuwait, 2.6 million b/d; Libya, 1.75 million b/d; UAE, 2.6 million b/d. Down in production are Saudi Arabia, 9.3 million b/d, down 100,000 b/d; Venezuela, 2.38 million b/d, down 10,000 b/d; Nigeria, 1.96 million b/d, down 20,000 b/d; Indonesia, 850,000 b/d, down 10,000 b/d; and Qatar, 800,000 b/d, down 70,000 b/d."Indonesia has since left OPEC.

9. Reuters reports that Jammu-Kashmir will hold a multi-phase, month and a half long, referendum on New Delhi's right to rule the region starting Monday. In the run up to the election, New Delhi has jailed much of the separatist leadership. Still, they believe that a strong turn-out will provide them with the mandate to rule, given calls for boycotts by the opposition. What's different appears to be that this time separatists have rejected violence as means of enforcing a voter boycott.

10. Takeo Kumagai at Platts reports that International Energy Agency Executive Director Nobuo Tanaka said today that $60/b is sufficient for Middle Eastern oil producing nations to make a return on new oil production investments. This is significant all net additional oil capacity has come from OPEC in the last five years, and most of that from the Middle East. It is also significant because refiners should be able to produce gasoline profitably at $60/b without the price raising to about $4/gallon, which appears to be about the point where real demand destruction sets in.

11. John Kingston at the Platts' blog The Barrel reports that according to Philip Verleger steep contangos such as the one we are currently experiencing generally mean that we are out of storage. "'One can find very few instances where forward curves have been in such steep contango in the last 22 years,' he wrote." However, as the EIA This Week in Petroleum reports suggest,

"a speaker at a meeting of the Energy Forum in New York earlier this week said he believes that tanks are not full, and the credit crunch is the reason for that; there aren't enough players who want to tie up cash to take advantage of a one-year or even four-year spread, no matter how appealing it may look. That's why it appears that tanks still have room to hold more oil."Kingston believes that this may well mean that stocks of crude will build over the whole of the fourth quarter world wide, when ordinarily the world draws them down to meet the building heating demands of winter.

12. Sustainable Business News reports that construction of the National Ignition Facility at Lawrence Livermore National Laboratory is set to be completed this coming summer. "The lab's first ignition attempt is set for 2010, with a goal of reaching nuclear fusion in 2011." Nuclear fusion would solve most of the nuclear waste and fuel problems of nuclear power generation. As the article states, it would be a silver bullet.

13. Cordell Eddings and Sandra Hernandez at Bloomberg report that an auction of US bonds yesterday did not go as well as expected. Yields for all long-term bonds rose significantly, while the yield on the one month bill was 0.05%, near the record low. In a related story, Germany's 10 year bond auction flopped.

14. Matthew Saltmarsh at the New York Times reports that the European Union's statistical agency published data today establishing that the Euro zone has entered a recession. GDP for the region as a whole contracted by 0.2% in the third quarter from the second. Of its members, Germany and Italy experienced the largest delines, with 0.5% GDP contractions in both. "Compared with the same quarter a year earlier, G.D.P. grew 0.7 percent in the 15-member euro zone and 0.8 percent for the 27 countries of the European Union."

15. Shobhana Chandra at Bloomberg reports that the Commerce Department published its report on retail sales today which showed that they dropped in October by 2.8%--the most recorded since the Department started keeping track in 1992. Justin Fox at the Curious Capitalist points out that if you take out retail gasoline and diesel sales from the picture, you get a 1.5% decline. That suggests that nearly half of the decline seen in retails sales is simply coming from the fall in the price of oil, and thus gasoline. Car sales account for more than a third of the decline or 1%, confirming all the horrible news about the automobile sector recently. Daniel Gross in Slate pointed out yesterday that were the big three to stop production completely next year that over 3 million jobs would be lost. Even were they to continue, the general consensus appears to be that all three need to shed capacity by 40%! (Anyone who knows me knows my opinion of the general consensus, but still, wow!)

16. Andrew Taylor at the Financial Times reports that yesterday British officials announced that UK unemployment had risen to 1.82 million, the most seen since 1997. "City economists forecast a total of 2.7m by 2010, the last date Labour could hold a general election." In a related story, James Thompson at the UK Independent reports that data released by Rightmove, an online UK realtor, suggest that the housing market there is much worse than the traditional data sources would suggest. While large mortgage lenders are reporting a 15% decline from peak housing prices, Rightmove is seeing a 20-25% decline. Their data suggests that 15% of their real estate agent members have been forced out of business in the last two quarters. (h/t Yves Smith nakedcapitalism)

No comments:

Post a Comment