"Angel Gurría warned that the ranks of the unemployed in the 30 advanced OECD countries would swell 'by about 25m people, by far the largest and most rapid increase in OECD unemployment in the postwar period.'"(h/t Yves Smith at naked capitalism for this and a few other pieces listed.)

2. Julie MacIntosh, Francesco Guerrera and Bernard Simon at the Financial Times reported that Canadian Prime Minister, Stephen Harper, told the newspaper yesterday that Canadian banks should capitalize on their solid balance sheets to acquire assets in the US and other foreign nations.

"Mr. Harper indicated Canada’s banks could lead an eventual charge toward consolidation, and said he would support such efforts as 'an opportunity for Canada to expand its role in the world financial sector.'3. Rick Carew at Deal Journal gives some details on the financing terms Aluminum Corp. of China [Chinalco] is getting for its proposed $19.5 billion investment in Rio Tinto.

'I’m not going to try running banks, but I hope our banks will see this as an opportunity to build the brand--the country’s brand, their own brand--and to expand their scope and profitability over time,' Mr. Harper said. 'I can assure you that the steps we’re taking in the financial sector will not be designed to promote greater protectionism.'"

"An SEC filing released Monday shows that policy lender China Development Bank is leading a syndicated loan by four Chinese banks offering the cash at 0.90 point more than the sixth-month benchmark London interbank offered rate. With sixth-month Libor rates at just 1.75% these days that means Chinalco, as the Chinese aluminum maker is known, is looking at payments starting at 2.65%.Meanwhile, Bettina Wassener at the New York Times reports that Australian Treasurer approved a bid by Hunan Valin Iron and Steel Group to take as much as 17.55% in iron ore miner Fortescue for $438 million.

That is cheap money compared with the roughly 9.25% coupon Rio is paying Chinalco on $7.2 billion of convertible bonds Rio issued under the deal. In short, Chinalco will pocket the 6.60-point spread between its cost of capital and coupon payments from Rio, though the spread could narrow if Libor rates rise on a global economic recovery. That demonstrates the government’s desire to keep Chinalco afloat despite it being highly indebted and its publicly traded subsidiary barely profitable."

4. Richard K. Green at Richard's Real Estate and Urban Economics Blog drew up a graph of property prices against property rights in Asia:

"The X axis is a measure of property rights by country: property rights are weakest in Vietnam and strongest in Singapore and Hong Kong. Note the correlation. Even though the property rights index is only ordinal, it has a correlation of .78 with the price per square meter of a 120 square meter flat in the national and or financial capital of each country."India is explained, per Prof. Green, by supply constraints. Well-worth a look. (h/t Mark Thoma at Economist's View.)

5. James Hookway at Real Time Economics reports that Vietnam's economy is managing to avoid the worst of the financial crisis. The Asian Development Bank released its forecast for Asian Pacific nations today and forecast that Vietnam's GDP will grow by 4.5% this year.

"There is now a brand new middle class in the country which didn’t exist before and its spending power has kept Vietnam chugging through the downturn. In fact, the ADB’s Hanoi-based economist Bahodir Ganiev told reporters earlier, 'when it comes to Vietnam, we actually should not use the word "downturn" or "recession". It’s just a slowdown.'"6. Reuters reports that Ali Asghar Arshi, executive director for international affairs at National Iranian Oil Co (NIOC), told the newswire that Iran has made no allocation for diesel purchases in its budget starting March 21 on the expectation that increased natural gas production will cover the country's requirements.

"'We will substitute with gas from our network,' Arshi told Reuters. 'Because we now have new production from South Pars... and other fields.'FACTS Global Energy estimates that Iran imported about 550kb/d in 2007.

In the first three months of this year Iran imported as much as 5 million barrels of diesel, or around 55,0000 barrels per day (bpd), traders and analysts said."

"Iran had taken advantage of cheaper prices to build inventories earlier this year, storing as much as 2 million barrels of gas oil [diesel] on ships.Blockading or otherwise putting a halt to Iranian imports of petroleum products has been mooted by various policy analysts as a way to put pressure on Iran. Meanwhile, Ali Akbar Javanfekr, the presidential advisor for press affairs to Iranian President Mahmoud Ahmadinejad, has an opinion piece in the Los Angeles Times today which is a response to President Obama's Nowruz greeting. Continuing in the vein of the March 22 speech by Leader of the Revolution Ayatollah Ali Khamenei, it begins by insulting the Democratic Party:

Arshi said Iran had drawn down those inventories and would not continue stockpiling the fuel."

"America's Democratic Party has historically been less honest than its rival Republican Party. I hope President Obama can change this approach and that he will turn out to be the most honest US president of all."He also repeats the message of Khamenei that Iran distrusts the rhetoric of change and will reserve judgment until it sees action--and in fact demands it:

"President Obama has proclaimed a policy of 'change,' and the American people have embraced it. But to remedy its image in the world, the US needs to truly change its past methods.The piece also reiterates the Iranian historical complaint against the US. It further makes the odd claim that Ahmadinejad is loved round the world:

Change is mandatory for the US administration. For as history demonstrates, either you change, or you are forced to change."

"Mr. Obama expressed his country's willingness to see our Islamic Republic take its true position in the international community. This new approach by the United States is appreciated, but we would note that Iran already occupies a distinguished position in the international community. President Ahmadinejad is one of the most beloved dignitaries in the world, and freedom-loving nations in all corners of the Earth love Iran."That said, the piece does indicate the willingness to engage in talks,

"The president expressed a willingness to talk openly with Iran's leaders. This willingness is promising. The Islamic Republic of Iran appreciates friendly behavior that stems from respect and courtesy toward other cultures and nations."and

"Mr. Obama has talked about his commitment to creating constructive diplomatic ties between the US and Iran. He must first begin dressing the deep and old wounds inflicted on the Iranian nation and start to correct the misunderstandings created by the misconduct of previous US administrations in their actions against Iran."Meanwhile, Mark Landler at the New York Times reports that Secretary of State Hillary Clinton confirmed today that Richard C. Holbrooke met in an unplanned meeting on the sidelines of a conference devoted to Afghanistan with Iran’s deputy foreign minister, Mohammad Mehdi Akhondzadeh. Clinton told reporters:

"It was cordial, unplanned, and they agreed to stay in touch. I myself did not have any direct contact with the Iranian delegation."and

"The fact that they came today, that they intervened today, is a promising sign that there will be future cooperation.The piece is worth reading in full. The State Department offered further clarification of the US position today:

The questions of border security, and in particular the transit of narcotics across the border from Afghanistan to Iran is a worry that the Iranians have, which we share."

"MR. DUGUID: I think the Secretary has answered the question that Iranian participation was welcome and that we wanted to make sure that this conference was one that included everyone in the region. Everyone in the region has a role to play to help Afghanistan. We should not look for, at this time, individual and uncoordinated approaches to Afghanistan. We should look for a regionally based and coordinated approach to dealing with the problems in Afghanistan and with Pakistan.It seems to me that Tehran regards cordial relations with the US as difficult to sustain, given the ideological self-justification of the regime. That said, it does seem that they are feeling the pinch of the growing possibility of being caught by a deal with Moscow regarding their nuclear program--and likely some pressure at home for reconciliation. Insofar as that is the case, they appear willing, as in the past, to cooperate on mutual interests quietly and, as much as possible, out of the public eye, but remain wedded to revanchist rhetoric. Meanwhile, President of Russia, Dmitry A. Medvedev, proffered a much more conciliatory tone in a piece published in the Washington Post today.

QUESTION: But Iranian action today in the conference criticized increased – troop increase––US troop increase in Afghanistan and kind of confronting this concept.

MR. DUGUID: The Iranians expressed their opinions. That’s what they were there to do. And we were there listening to what they had to say. We have gone through a 60-day intensive review of our strategy. We have come forth and laid that out for everyone. The conference itself was our first foray into an international fora to explain our policy and to show that this is – these are the reasons why we see this as being the best way forward. You cannot have a solely military solution in Afghanistan and our strategy recognizes that. That is why we are looking for an increase in resources not only on the military side, but on the civilian side, on the side of trainers for economic development, for other institutional-building and capacity-building efforts that we see as necessary."

"Unfortunately, relations soured because of the previous US administration's plans--specifically, deployment of the US global missile defense system in Eastern Europe, efforts to push NATO's borders eastward and refusal to ratify the Treaty on Conventional Armed Forces in Europe. All of these positions undermined Russia's interests and, if implemented, would inevitably require a response on our part.Medvedev also asserts:

I believe that removing such obstacles to good relations would be beneficial to our countries--essentially removing 'toxic assets' to make good a negative balance sheet--and beneficial to the world.

This will require joint efforts. The exchange of letters between myself and President Obama this year showed mutual readiness to build mature bilateral relations in a pragmatic and businesslike manner. For that we have a 'road map'--the Strategic Framework Declaration our countries signed in Sochi in 2008. It is essential that the positive ideas in that declaration be brought to life. We are ready for that.

Possible areas of cooperation abound."

"Neither Russia nor the United States can tolerate drift and indifference in our relations. I spoke in Washington last November about the need to put an end to the crisis of confidence. To begin with, we should agree that overcoming our common negative legacy is possible only by ensuring equality and mutual benefit and by taking into account our mutual interests. I am ready for such work with President Obama on the basis of these principles, and I hope to begin as early as tomorrow at our first meeting in London before the Group of 20 summit. "Well worth reading in full. Further, Abdullah Gül, the President of Turkey, has a piece in the Wall Street Journal which argues for stronger efforts to establish law and order in Afghanistan.

"But more troops and more money alone will not be enough. The Afghan government needs military force to operate from a position of strength. But real improvement requires embracing every Afghan ready to work through peaceful means for the good of their country.Also well worth reading in full.

Political, diplomatic, economic, and social efforts must be increased and focused on consolidating national unity to bring about tangible improvement to people's lives. To have peace, we must win over the people.

There is a role here for the international community in enabling Afghan officials working to meet the basic needs of their people. Health care and education must both be top priorities. The country's civil service needs work. Its judiciary and police forces need to be strengthened. The people must come to believe that change is underway that will create a sense of normalcy for them."

7. Munir Ahmad at the Associated Press reports that the newly reconstituted Supreme Court in Pakistan restored the province of Punjab to the main opposition party, under Shahbaz Sharif, the brother of the head of Pakistan Muslim League (N) Nawaz Sharif.

8. Edward Hugh at Fistful of Euros reports that the EU Economic Sentiment Indicator for the EU27 fell by 0.6 points to 60.3 and for the eurozone fell by 0.7 points to 64.6. The post looks at economic sentiment in most of the major economies in the region as well as Eastern Europe. However, "economic sentiment recovered slightly in the Netherlands (1.3) and (amazingly) in Spain (0.8)." Worth a look.

9. Brian Murphy at the Associated Press reports that Venezuelan President Hugo Chávez, upon setting foot in Qatar, proposed a "petro-currency" as an alternative to the dollar, to be backed by the oil producing nations.

"The idea never reached the full agenda of a summit of leaders from South America and the Arab League--and has little hope of gaining any momentum among the US allies in the Middle East."Meanwhile, Daniel Cancel at Bloomberg reports that Venezuela, according to a resolution published today in the Official Gazette, will sell 2.68 billion bolivars ($1.2 billion) of bonds in the local market as part of an effort to fund the budget. The bonds will be sold in two tranches, will have a fixed coupon and mature between 2010 and 2016.

10. David M. Herszenhorn and Clifford Krauss at the New York Times report that a bill in the House, sponsored by Representative Betty Sutton of Ohio, seeks to give those trading in a new car for a fuel efficient model a $4,000 voucher if the car gets at least 27 miles per gallon and is assembled in the US. Cars assembled outside the US would qualify if they got at least 30 miles per gallon. Cars assembled inside the US getting 30 miles per gallon would receive a voucher for $5,000.

"Officials said the program could cost $2 billion or more depending on how long it operated. Ms. Sutton said the most important thing was to get the program started quickly. 'The urgency for its initiation is extraordinary,' she said."The Senate version is slightly less generous. The Obama Administration indicted that it supported an effort along these lines on Monday.

11. Mark Pittman and Bob Ivry at Bloomberg report that the US Government and Federal Reserve have "spent, lent, or committed" $12.8 trillion, close to 2008 GDP.

"New pledges from the Fed, the Treasury Department and the Federal Deposit Insurance Corp. include $1 trillion for the Public-Private Investment Program, designed to help investors buy distressed loans and other assets from U.S. banks. The money works out to $42,105 for every man, woman and child in the U.S. and 14 times the $899.8 billion of currency in circulation. The nation’s gross domestic product was $14.2 trillion in 2008.'The piece includes a useful balance sheet of commitments and expenditures. Worth a look.

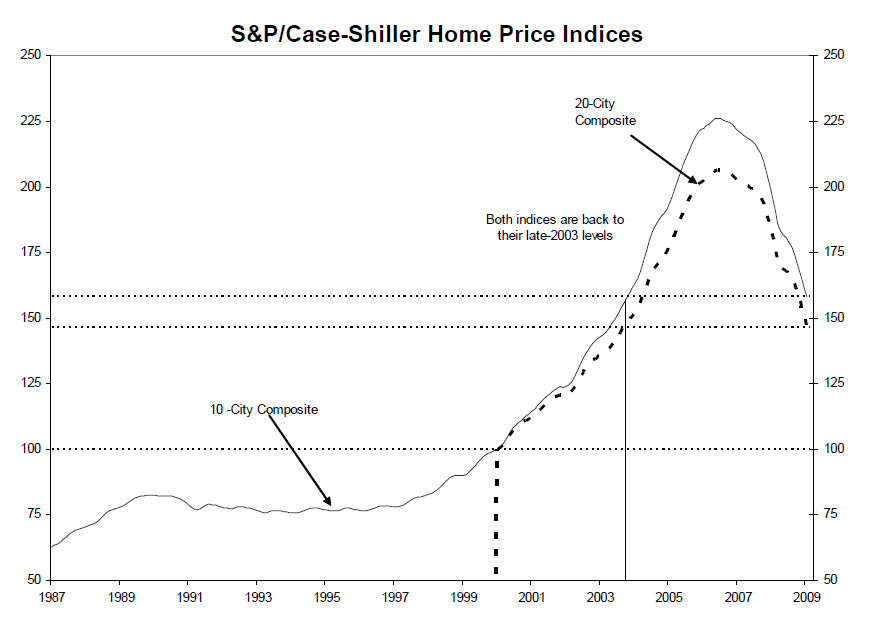

12. Barry Ritholtz at the Big Picture reports that Standard & Poor's Case Shiller 20 city Home Price Index fell at an annual rate of 18.97% in January. Prices have fallen to late 2003 levels as per an S&P graph:

Worth a look. The full S&P Case-Shiller US National Home Price Index can be found here.

13. Simon Johnson at Baseline Scenario notes that CDS spreads are the highs last seen in early February.

14. Jeanne Meserve and Mike M. Ahlers at CNN report that the Federal Aviation Administration released its forecast today which sees the number of travelers using US airlines will fall 7.8% in 2009, the steepest decline seen since the period following 9/11.

"The short-term forecast is downbeat for virtually every segment of the aviation business, the Federal Aviation Administration predicted. Major airlines are expected to bear the brunt of the decline, with a projected 8.8% drop that would return them to passenger levels last seen in 1995.Private industry analysts disagree with long-term analysis of the FAA that passenger levels will rebound in 2010.

Regional airlines will see business drop 4.5%, taking them back to volumes they had four or five years ago, while air cargo is expected to slide 2.8%."

15. Amartya Sen, in the New York Review of Books, has a piece which points out that historically "capitalism" can only exist in a framework of trust and rule of law--the tradition of keeping one's contracts, of course, obviating the need of recourse to the courts too often. Long, but should you have the time, worth reading. (h/t Justin Fox at The Curious Capitalist.)